Good but not outstanding: NVIDIA stock declines following the report release

As NVIDIA Corp (NASDAQ: NVDA) is at the forefront of AI technology development, investors assess its performance to gauge the overall AI sector. On 28 August, NVIDIA released the Q2 2024 report, which showed stronger-than-expected results. This suggests that the AI boom is not over, and the company’s stock has growth potential. This article provides a fundamental analysis of NVIDIA’s report and technical analysis of NVIDIA’s stock based on NVIDIA’s stock forecast; it also outlines the company’s business model and its role in the US stock market.

NVIDIA Corp’s business model

NVIDIA is primarily known for its GPUs but has recently added the AI segment to its portfolio, where the company dominates the market with high-performance chips used for AI technology development. Revenues from this segment are shown under the Data Centre section. NVIDIA’s business model focuses on several key areas:

- GPUs – the company supplies the gaming industry with microchips for gaming PCs, consoles, and other devices, ensuring high-performance data processing in computer games. Revenues in this segment mainly come from the GeForce lineup

- Professional visualisation – this area includes GPU sales for professionals involved in 3D graphics, CAD, animation, video editing, and other tasks that require high computing power

- Data centres – these are one of the fastest-growing segments. The company develops GPUs and other hardware solutions for data centres, which are used in artificial intelligence (AI), deep learning, cloud computing, and big data technologies

- Automotive segment – the company is actively involved in the automotive sector by developing self-driving platforms and advanced driver-assistance systems (ADAS)

- OEM and others – this category includes earnings from technology licensing and sales of electronic components and solutions for the OEM industry, including the production of laptops and other gadgets

NVIDIA diversifies its operations, covering various segments from gaming to data centres and automotive components. Unlike McDonald's, NVIDIA operates exclusively in the computing sector without venturing into other business segments beyond the high-tech industry. The company publishes statistics on the gaming, data centres, professional visualisation, and automotive segments in its quarterly reports, while other indicators are included in the Other Revenues section.

NVIDIA Corp’s role in the US stock market

NVIDIA’s capitalisation increased from 90 billion USD to 3.1 trillion over the past five years, with the company’s share in the S&P 500 and the NASDAQ 100 also growing. In August 2024, its stock had a 6.2% share in the S&P 500 index and a 7.9% share in the NASDAQ 100, making it one of the top three largest companies by weight in the indices and falling behind only Microsoft Corporation (NASDAQ: MSFT) and Apple Inc. (NASDAQ: AAPL). As a result, NVIDIA's stock price movements affect the overall situation in stock indices. Panic-stricken sell-offs of NVIDIA shares may lead to a collapse of stock index quotes, while further demand for the stock will drive up the indices.

NVIDIA is also a gauge of the development of the AI industry. According to Mizuho Securities estimates, it controls from 70 to 95% of the AI chip market. Failure to meet forecasts will indicate challenges that companies face in monetising AI. This will, in turn, lead to sell-offs of tech stocks, especially Meta Platforms Inc (NASDAQ: META), which has significantly increased its investments in this segment. As a result, the investment community entirely focused on the NVIDIA report, and the company not only met investor expectations but also surpassed them.

NVIDIA Corp Q2 2024 report

On 28 August, NVIDIA released its Q2 2024 earnings report (available on NVIDIA’s website under the title “Q2 Fiscal 2025”). Below are the key figures compared to the same period last year:

- Revenue – 30.04 billion USD (+122%)

- Net income – 16.95 billion USD (+152%)

- Earnings per share (EPS) – 0.68 USD (+152%)

- Operating profit – 19.94 billion USD (+156%)

- Operating margin – 66.36% (+879 basis points)

Revenue by segment:

- Data centres – 26.27 billion USD (+154%)

- Gaming – 2.88 billion USD (+16%)

- Professional visualisation – 454 million USD (+20%)

- Automotive – 346 million USD (+37%)

- OEM and others – 88 million USD (+33%)

NVIDIA returned 15.40 billion USD to its shareholders through share repurchases and dividends. As of the end of Q2 2024, the company had 7.50 billion USD remaining for share repurchases. On 26 August 2024, the Board of Directors approved an additional 50.00 billion USD in share repurchase authorisation with no expiration date.

Although the Q2 2024 results exceeded expert forecasts, NVIDIA shares fell immediately after the data release. Investors needed to be more impressed with revenue and income growth as financial indicators rose from 200% to 700% last quarter. Maintaining such rates for an extended period is clearly impossible, but investor expectations remain high.

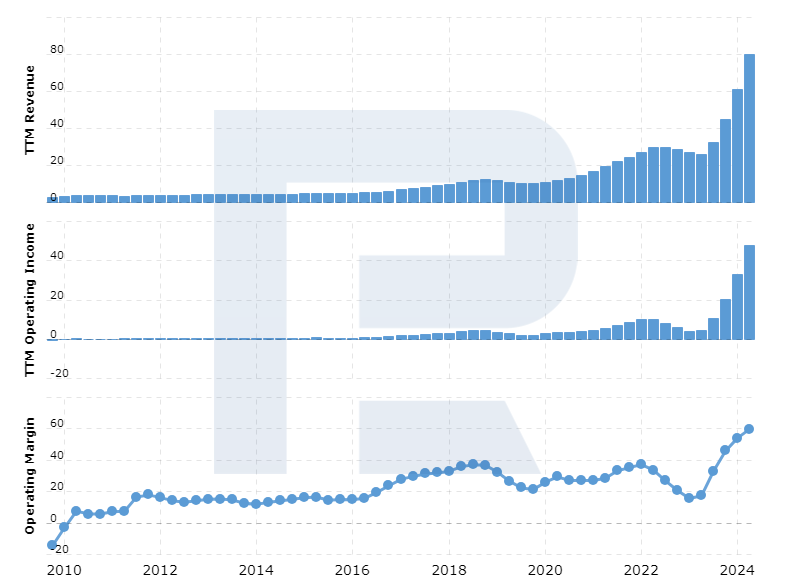

A fundamental analysis of NVIDIA’s report shows that revenue has increased across all business segments. The data centre segment, which focuses on developing AI technologies, remains the leader. The company’s operating margin chart below illustrates how much AI has affected NVIDIA’s performance.

NVIDIA Corp’s operating margin

OpenAI announced ChatGPT on 30 November 2022, and as early as Q1 2023, NVIDIA reported an increase in operating margin. It then grew at a rapid pace, unseen even during the cryptocurrency mining boom. In fact, this indicates the company has been raising product prices without a decline in demand, allowing it to generate a profit of more than 50 cents on every dollar invested.

NVIDIA Corp management’s comments on the Q2 2024 report

Following the release of NVIDIA’s Q2 2024 financial report, the company’s management commented on the current results and the outlook.

NVIDIA’s CEO, Jensen Huang, noted significant growth in demand for AI chips, particularly in data centres. This segment’s revenue reached record levels, driven by active purchases by cloud providers and tech giants, including Alphabet Inc (NASDAQ: GOOG), Amazon.com Inc. (NASDAQ: AMZN), and Microsoft (NASDAQ: MSFT), which have significantly increased their investments in AI infrastructure.

Huang also mentioned that the Blackwell platform, which is expected to launch in the coming months, will be a game-changer for the industry. He emphasised that demand for this product is already outstripping supply, a trend likely to persist into next year. NVIDIA’s CEO expressed confidence that Blackwell will become the most successful product in the company’s history.

At the same time, it was also noted that current sales of Blackwell’s predecessor – the Hopper platform – remain strong as many clients are unwilling to wait for new chips and prefer to invest in already available solutions.

NVIDIA Corp 2024 forecast

NVIDIA presented a positive outlook for Q3 2024, anticipating further performance growth. The company expects revenues of approximately 32.50 billion USD, plus or minus 2%, which implies steady demand for its products, particularly in the data centre segment. The gross margin is expected to be in the range of 75%, plus or minus 50 basis points.

Management emphasised that demand for NVIDIA products remains robust, particularly for the Hopper and soon-to-be-launched Blackwell platforms. However, the company is addressing supply issues as production ramps up.

Antitrust case against NVIDIA Corp

On 3 September 2024, it was revealed that the US Department of Justice had initiated two antitrust investigations into NVIDIA. The first concerns the company’s acquisition of the Israeli startup Run in April 2024. Run develops technologies for optimising GPU algorithms. The second part of the investigation focuses on NVIDIA’s potential anti-competitive actions regarding its dominant position in the AI market.

The accusations primarily concern NVIDIA pressuring clients not to buy competitors’ products, such as AMD, and threats to raise prices on other NVIDIA products if clients decide to team up with competitors. The company denies these accusations, stating it competes honestly due to its investments and innovations.

This development may have a significantly negative long-term impact on NVIDIA’s stock price. Following the news release, the company’s shares fell by 9.5%.

Technical analysis of NVIDIA Corp’s stock

Despite excellent Q2 2024 results and a positive outlook for the next quarter, NVIDIA’s stock price declined after releasing the report. The company’s revenue growth does not always correlate with changes in its share value.

NVDA technical analysis shows that volatility in this stock increased significantly in 2024. Previously, the quotes traded within ranges of about 10 USD, whereas now, the range of fluctuations has reached 45 USD. High volatility often signals a trend reversal or a deep correction. The quotes are currently testing the crucial 117 USD support level. Depending on whether this level will be breached, two scenarios can be considered.

An optimistic NVIDIA stock forecast suggests a rebound from the 117 USD support level, with the price rising to an all-time high of 140 USD.

A negative scenario suggests a breakout below this support level, potentially pushing the price to 95 USD. Given the 50.00 billion USD share repurchase program, the company will likely hold the stock price at this level, with the possibility of the price rising back to 117 USD.

Technical analysis of NVIDIA Corp’s stock

Summary

The Q2 2024 report indicates continued revenue growth for NVIDIA but at a slower pace, signalling gradual saturation of the AI chip market. NVIDIA’s revenue growth may become more measured in the future. This does not suggest a decrease in revenues, especially as sales of the new AI Blackwell platform, a product for which the company has high expectations, are set to begin in Q4 2024.

The Board of Directors’ decision to launch a 50.00 billion USD stock buyback plan significantly impacts the company’s shares. The buyback directly influences the stock price, either preventing significant declines or driving growth, as NVIDIA will be a major buyer in the market.

Reports of tech companies cutting AI spending could be a warning signal for NVIDIA. As a result, there will be less of a need to wait for NVIDIA’s report to assess the industry’s condition. In the future, investors will focus on reports from companies such as Amazon, Google, Meta, and Microsoft, particularly their spending plans for the coming quarters. These reports could significantly impact NVIDIA’s stock price.

Unfortunately, the US Department of Justice has also contributed to negative sentiment, increasing the risks of investing in NVIDIA stock. Investors tend to be proactive, and some may offload the company’s shares during the investigation, putting pressure on the stock price. In this situation, NVIDIA will likely attempt to prevent a price decline by buying back shares to create additional demand for the stock.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.