FedEx’s revenue decline: what it signals and how it affects the company’s stock

The Q3 fiscal year 2025 report fell short of expectations, leading to a downward adjustment of the fiscal year 2025 outlook. FedEx stock is falling.

The FedEx Q3 fiscal 2025 earnings report revealed weaker-than-expected results. The company attributed this to a decline in transportation volumes and economic uncertainty despite its cost-cutting efforts through the DRIVE program. Investors reacted negatively to the report, pushing FedEx stock lower amid concerns about the company’s ability to return to growth in the short term.

This article examines FedEx Corporation, outlines its revenue streams, reviews the Q2 fiscal year 2025 performance, and analyses expectations for fiscal year 2025. In addition, it provides a technical analysis of FDX stock, forming the basis for the FedEx stock forecast for 2025.

About FedEx Corporation

FedEx Corporation is an American logistics company founded in 1971 by Frederick Smith. The company provides global express delivery, freight transportation, logistics, and e-commerce services. In 1978, it went public through an IPO on the NYSE, where its stock trades under the ticker FDX.

FedEx holds a leading position in the global logistics and delivery market, though its market share varies by region and delivery segment. Major competitors include Amazon Logistics, DHL, and United Parcel Service, Inc. (NYSE: UPS).

FedEx Corporation’s business model

FedEx’s business model is centred around providing logistics and transportation services, primarily express delivery and freight transportation. The company generates revenue from various business segments, each catering to different client categories: individuals, small and medium-sized enterprises, and large corporations. The main sources of the company’s income are as follows:

- FedEx Express: one of the key segments responsible for the fast delivery of parcels and documents worldwide. Revenue is generated through tariffs based on weight, distance, and delivery speed

- FedEx Ground: ground delivery of freight and parcels, which is typically slower but more cost-effective than air transportation. This segment is popular among small and medium-sized enterprises, as well as in the e-commerce sector

- FedEx Freight: this segment transports freight across the US and international routes, focusing on large and heavy cargo.

- FedEx Services: provides logistics and business solutions, including supply chain management, IT services, and e-commerce support for corporations

- FedEx Office: offers retail and business services, including document printing, mailbox rentals, and package handling and shipping at service points

The company reports on two segments – FedEx Express and FedEx Freight – with other divisions categorised under ‘Other Income’.

FedEx Corporation Q1 FY 2025 report

On 19 September 2024, FedEx posted disappointing results for the Q1 fiscal year 2025, which ended on 31 August 2024. Below are the key figures compared to last year’s corresponding period:

- Revenue: 21.60 billion USD (-0.5%)

- Net income: 890 million USD (-26.0%)

- Earnings per share: 3.60 USD (-21.0%)

- Operating margin: 5.60% (-170 basis points)

Revenue by segment:

- FedEx Express: 18.30 billion USD (-1.0%)

- FedEx Freight: 2.32 billion USD (-2.0%)

- Other and eliminations: 945 million USD (+9.0%)

A fundamental analysis of FedEx’s report shows no revenue growth amid rising expenses. Transportation costs rose by 5% to 5.27 billion USD, and business optimisation costs increased by 22% to 128 million USD. As a result, net income declined from 1.16 billion to 0.89 billion USD. Analysts’ forecasts were not met: revenue was expected to be 360 million USD higher (21.96 billion USD), and earnings per share were projected at 4.86 USD, above the actual 3.60 USD. Following the report’s release, FedEx stock plunged by over 15%.

If the logistics company shows no revenue growth, this may indicate a slowdown in the US economy. Additional pressure came from a 0.50% Federal Reserve interest rate cut, which may suggest the peak of economic growth.

FedEx’s outlook for the fiscal year 2025 was cautious, with revenue expected to rise moderately and the EPS forecast lowered from 18.25-20.25 USD to 17.90-18.90 USD.

FedEx CEO Rajesh Subramaniam noted that the weak results were due to reduced demand for express deliveries, higher operating costs, and a downturn in industrial production. Despite cautious optimism about the second half of 2024, the company maintained a moderate outlook due to economic uncertainty.

FedEx Corporation Q2 FY 2025 report

On 19 December 2024, FedEx posted disappointing results for the Q2 fiscal year 2025, discouraging investors again. Below are the main highlights:

- Revenue: 22.00 billion USD (-1.0%)

- Net income: 0.99 billion USD (-1.9%)

- Earnings per share: 4.05 USD (+1.5%)

- Operating margin: 6.30% (-10 basis points)

Revenue by segment:

- FedEx Express: 18.84 billion USD (+0.3%)

- FedEx Freight: 2.18 billion USD (-11.2%)

- Other and eliminations: 949 million USD (+0.9%)

FedEx’s management, commenting on the 1% revenue decline, attributed it to a challenging economic environment, particularly the weakness in the US industrial economy and the expiration of its air freight contract with the US Postal Service (USPS), which ended on 29 September 2024 and had previously generated approximately 2 billion USD in annual revenue. However, there were also positive developments, including a 9% increase in international export parcel volume and cost-saving benefits from the DRIVE program, which resulted in savings of 540 million USD in the last quarter.

The company also highlighted the completion of a one billion USD share buyback and announced plans to spin off FedEx Freight into a separate publicly traded company within the next 18 months to increase stockholder value.

For Q3 of the fiscal year 2025, management expects positive effects from increased DRIVE savings and higher revenue due to the Cyber Week event dedicated to cybersecurity, digital technology, and the IT industry. However, these benefits may be offset by the loss of the USPS contract.

The fiscal 2025 outlook expects revenue to remain approximately the same as last year. The EPS forecast has been adjusted to a range between 19.00 USD and 20.00 USD, down from 20.00 USD to 21.00 USD.

FedEx Corporation Q3 FY 2025 report

On 20 March 2025, FedEx reported disappointing results for Q3 of the fiscal year 2025, discouraging investors again. Below are the key figures:

- Revenue: 22.20 billion USD (+0.9%)

- Net income: 1.09 billion USD (+12.3%)

- Earnings per share: 4.51 USD (+16.8%)

- Operating margin: 6.80% (+600 basis points)

Revenue by segment:

- FedEx Express: 19.81 billion USD (+2.7%)

- FedEx Freight: 2.08 billion USD (+27.2%)

- Other and eliminations: 890 million USD (+3.3%)

In his commentary on the report, Rajesh Subramaniam highlighted revenue growth in Q3 compared to the corresponding period last year, marking the first such increase in the fiscal year 2025. He emphasised that FedEx improved profitability despite a particularly challenging operating environment, which included a busy festive season and severe weather conditions. Management also highlighted the success of the DRIVE program, which helped save 600 million USD in costs for the quarter, contributing to a 12% increase in adjusted operating income, which rose to 1.8 billion USD from the previous year.

FedEx’s management expressed cautious optimism for its Q4 fiscal year 2025 outlook. The company is expected to continue its revenue quality strategy and further increase cost reductions from the DRIVE program. Specifically, the company projects ending Q4 of the fiscal year 2025 with annual cost reductions exceeding 2.2 billion USD, aligning with its target for the full fiscal year 2025.

However, management also expects challenges in the FedEx Freight segment to persist, though these should ease somewhat compared to previous quarters. Revenue in the FedEx Express segment is forecast to remain nearly unchanged, while the FedEx Freight segment is projected to see a decline in revenue compared to last year.

FedEx revised its full fiscal year 2025 forecast downward, expecting EPS to range from 18.00 USD to 18.60 USD, down from 19.00-20.00 USD. This reflects ongoing economic challenges and uncertainty regarding global trade policies under the Donald Trump administration.

Expert forecasts for FedEx Corporation stock

- Barchart: 18 out of 29 analysts rated FedEx stock as a Strong Buy, one as a Moderate Buy, eight as a Hold, and two as a Strong Sell. The high price target is 370 USD, while the low one is 200 USD

- MarketBeat: 18 out of 28 specialists assigned a Buy rating to the shares, while eight gave a Hold recommendation, and two rated it as a Sell. The high price target is 354 USD, while the low one is 200 USD

- TipRanks: 13 out of 19 respondents gave a Buy rating to the stock, four recommended it as a Hold, and two rated it as a Sell. The high price target is 365 USD, while the low one is 200 USD

- Stock Analysis: out of 24 experts, eight rated the shares as a Strong Buy, seven as a Buy, six as a Hold, two as a Sell, and one as a Strong Sell. The high price target is 354 USD, while the low one is 200 USD

FedEx Corporation stock price forecast for 2025

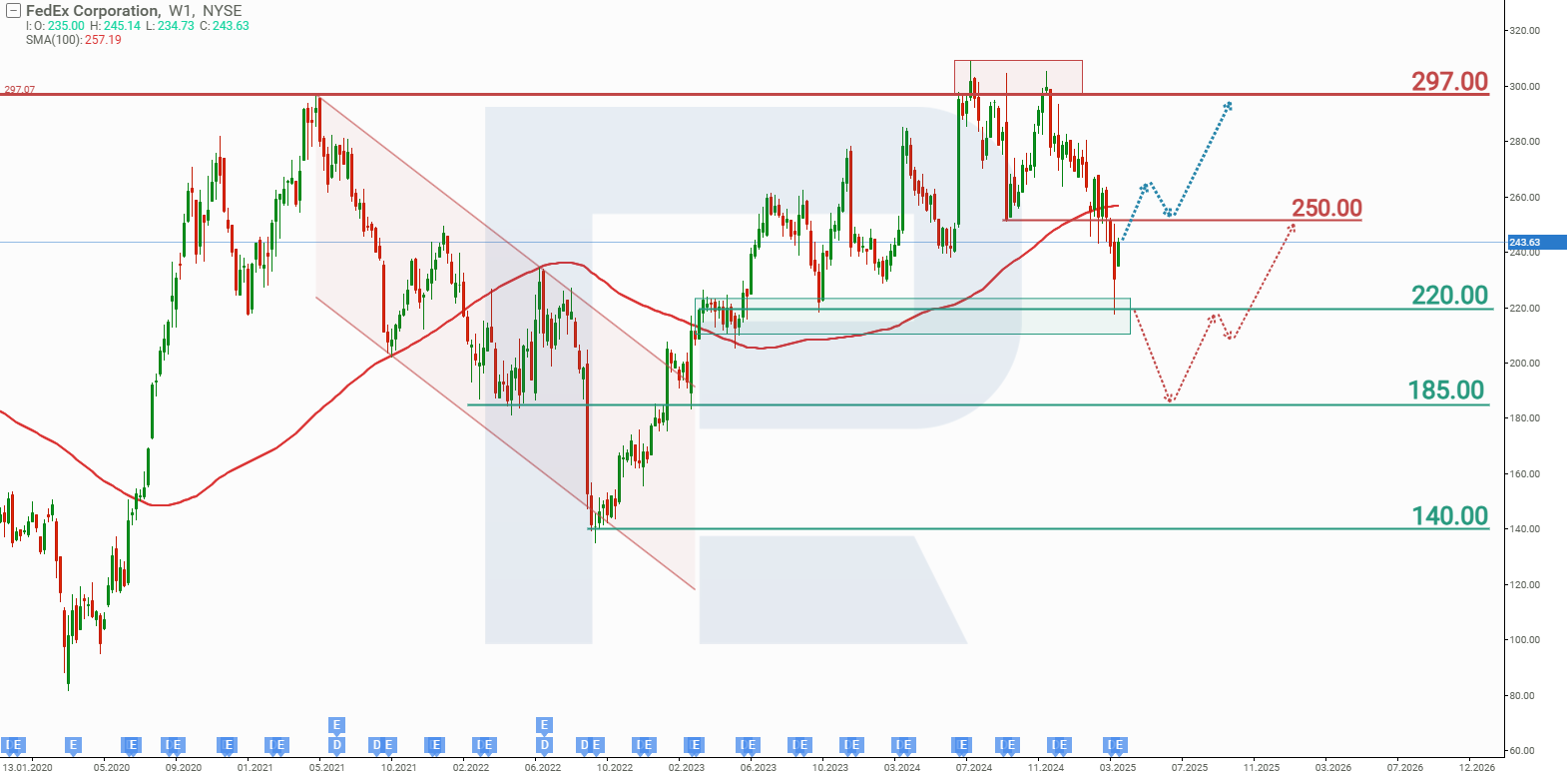

In May 2021, FedEx stock reached a high of 297 USD before dropping to 140 USD. In 2024, the shares revisited the 297 USD resistance level and made three unsuccessful attempts to break above it. As a result, the stock price again dropped, reaching 220 USD. Based on FedEx’s stock performance, potential price movements in 2025 are as follows:

The primary FedEx stock forecast suggests a breakout above the 250 USD resistance level, followed by an increase to 297 USD. This time, the price may surpass the resistance level and continue its upward momentum. The average price forecast of experts, at 360 USD, serves as an upside target.

The alternative FedEx stock forecast anticipates a breakout below the 220 USD support level, followed by a decline to 185 USD. If this scenario materialises, it will signal ongoing challenges for the company that it may not be able to solve quickly.

FedEx Corporation stock analysis and forecast for 2025Risks of investing in FedEx Corp stock

When investing in FedEx, it is essential to consider the risks the company may face. Below are the key factors that could negatively impact FedEx’s revenue:

- Economic sensitivity: FedEx’s financial performance is closely tied to the global economy. Economic downturns may lead to reduced demand for shipping services as businesses and consumers cut back on spending

- Intense competition: the logistics sector is highly competitive. FedEx faces significant pressure from major players such as UPS (NYSE: UPS) and DHL, as well as emerging competitors like Amazon (NASDAQ: AMZN), which is developing its own logistics network

- Fuel price volatility: as a logistics company, FedEx is heavily dependent on fuel prices. While fuel surcharges help offset costs, continuous price increases can raise shipment costs and lead to customer dissatisfaction due to higher tariffs, ultimately impacting revenue

- Dependence on the US market: a substantial portion of FedEx’s revenue is derived from the US. Economic challenges or market saturation within the US may limit growth opportunities and reduce overall revenue

Summary

FedEx’s Q3 fiscal year 2025 results reflect a company navigating a challenging environment, balancing operational improvements with persisting economic challenges. While FedEx has made progress in cutting costs and improving efficiency, the overall downturn in the manufacturing industry and ongoing uncertainty around demand continue to place significant pressure on the company, forcing it to lower its fiscal 2025 outlook.

Nevertheless, there is potential for growth. FedEx has a solid foundation – the DRIVE program, which helps eliminate inefficiencies – and its strong e-commerce position provides a key advantage in a world where online shopping shows no signs of slowing down. If FedEx can perfect its operational improvements, capitalise on digital delivery trends, and experience some relief from macroeconomic uncertainty, it may resume growth by late 2025 or early fiscal 2026.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.