The decline in McDonald's profits fails to scare investors. The stock nears an all-time high

Despite the boycott of McDonald's Corp (NYSE: MCD) in the Middle East, a decrease in net income, and reserved expectations for Q3 2024, the company's stock price is approaching an all-time high. McDonald's business model once again proves its effectiveness. This article covers the company's revenue streams, its growth potential, and a technical analysis of MCD's shares, on which McDonald's stock forecast is based.

McDonald's Corp's business model

McDonald's business model is unique, combining elements of the conventional restaurant business with franchising and real estate management. McDonald's main revenue streams are divided into four key categories:

- Franchising – many restaurants under the McDonald's brand operate through franchising, where the company grants its partners the right to use the brand, recipes, quality standards, and other corporate norms in their business. Revenue in this segment consists of an initial payment the franchisee makes to open a restaurant under the McDonald's brand and a percentage of sales

- Company-owned restaurant operations – revenue in this business comes directly from sales of products and services, with the company covering all expenses related to the operation of these divisions

- Real estate revenue – the company owns numerous properties used for operating restaurants. As the landowner or leaseholder, it earns income from leasing or subleasing the land to its franchisees. In some cases, McDonald's only owns the land, while partners build and own the buildings. This strategy enables the company to generate stable and long-term income independent of the success of specific restaurants

- Deliveries and logistics – the company often controls the entire supply and procurement chain of its franchisees, creating additional income from markups on products and ingredients

This business model allows the company to sustain long-term growth and diversify revenue streams. In its quarterly earnings report, McDonald's publishes data on revenues from franchised and company-operated restaurants separately, while income from other segments is recorded in the Other Revenues section.

McDonald's Corp's Q2 2024 report

McDonald's released its Q2 2024 financial data on 29 July 2024. Below are the Q2 results compared to the corresponding period in 2023:

- Revenue – 6.49 billion USD (0%)

- Net income – 2.02 billion USD (-12%)

- Earnings per share – 2.8 USD (-5%)

- Operating margin – 45.0% (-270 basis points)

- Revenues from franchised restaurants – 3.94 billion USD (0%)

Franchised restaurant occupancy expenses – 629 million USD (+2%) - Revenues from company-owned restaurants – 2.46 billion USD (-1%)

Company-owned restaurant expenses – 2.07 billion USD (-1%) - Other revenues – 89 million USD (+16%)

McDonald's fundamental analysis shows that franchisees remain the company's primary revenue stream. For comparison, expenses in the franchising segment account for 16% of revenue, while company-owned restaurant costs reach 83% of cash inflows. This means it is more profitable for McDonald's to develop its business through franchising rather than opening and running restaurants. Although McDonald's did not exceed last year's figures, a 45% operating margin indicates its flexibility in financial management.

McDonald's Corp management's comments on the report

In the Q2 2024 report comments, McDonald's management outlined several difficulties faced by the company. The main challenge was a significant slowdown in the fast-food sector's growth in major markets such as Australia, Germany, Canada, and the US. This was due to lower consumer activity and inflationary pressures, which increased the company's expenses by 20-40%, resulting in higher menu prices. Additionally, military actions in the Middle East negatively affected sales in countries with predominantly Muslim populations. China also saw sluggish demand, but opening new restaurants offset this.

McDonald's Corp Q3 2024 and full-year forecast

McDonald's management provided a cautious outlook for Q3 2024, expecting continued challenging economic conditions that could affect financial results. In particular, the company highlighted possible ongoing inflationary pressures, slowing consumer spending, and currency fluctuations that could negatively impact revenue.

Despite these challenges, McDonald's expects positive contributions from digital sales and loyalty programs and successful product innovations (e.g., the Best Burger project), which could support revenue growth.

Management did not provide specific numerical revenue forecasts for Q3 2024, limiting itself to stating that the current macroeconomic environment requires 'restraint' in expectations.

Promising areas for McDonald's Corp revenue growth

Competition in the fast-food market is intense, and although McDonald's revenue is diversified, the company still depends on consumer demand in both its company-owned units and franchise locations. Therefore, it is essential to keep up with the times, introduce new technologies, study consumer habits, and develop a more appealing menu. McDonald's is implementing the following projects to increase competitiveness and customer retention:

- The Best Burger Initiative – the company has focused on improving the core ingredients of its burgers. The project involves returning to basics and modifying the ingredients that initially made McDonald's products famous. The company aims to retain the traditional flavours that consumers love while making them even better and more modern. The Best Burger project is now implemented in more than 80% of markets

- MyMcDonald's Rewards loyalty program – customers can accumulate points for purchases and redeem them for free meals and other chain products. The program personalises each customer's experience by offering special promotions and discounts based on their preferences and order history

- McDonald's mobile app – allows customers to order food, pre-pay for their purchases online, and receive their orders in the restaurant lounge, through Drive-thru, or with home delivery. The app is also integrated with the loyalty program, making the process of accumulating and using reward points simple and convenient

- Delivery system – McDonald's is actively developing its delivery service through its app, cooperating with many courier services. This allows customers to receive food directly at home, which is especially important during times of low restaurant attendance

Arguments in favour of buying McDonald's Corp shares

- Global diversification – with a broad international reach and a balanced portfolio of both company-owned and franchised restaurants, McDonald's has a stable business model. This strategy enables the company to cope with economic turmoil worldwide, as evidenced by the Q2 2024 results. Declining sales in Australia, Germany, Canada, and the US did not result in a significant revenue drop

- High operating margin – McDonald's is the most profitable among large restaurant chains. The record operating margin of 45.00% demonstrates effective cost management and substantial returns on every dollar invested. By comparison, the operating margin of Yum Brands Inc. (NYSE: YUM) is 32.92%, Chipotle Mexican Grill's (NYSE: CMG) is 17.37%, and that of Starbucks Corp. (NASDAQ: SBUX) is 15.18%

- Dividend payouts and share repurchases – the company has a long history of stable and increasing dividend payouts, making its shares appealing to yield-seeking investors. McDonald's is a dividend aristocrat, meaning it has increased dividend payouts steadily over 25 consecutive years. Such actions underscore the company's commitment to shareholder capital return and confidence in future earnings. Additionally, McDonald's repurchases its shares worth about 1 billion USD every quarter, which positively impacts their price

- Company's resilience to crises – McDonald's has proved resilient to economic shocks. The company maintained stable returns even during full-blown crises, including the 2008 financial collapse. McDonald's traditionally benefits from adverse conditions as consumers switch to more affordable food options. The exception is the period of the COVID-19 pandemic when strict lockdown measures were in force. However, the fast-food chain is now better prepared for such challenges, offering home delivery services to its customers

Arguments against investing in McDonald's Corp stock

Intense competition – McDonald's faces fierce competition at a global level, both from large fast-food chains (Burger King, KFC, Wendy's) and smaller local players. The growing popularity of alternative food formats, including a healthy eating concept and specialised restaurants, and the rapid growth in food deliveries create additional challenges.

Exposure to boycotts and reputational risks – the company is often criticised for its business practices, including environmental issues, ingredient use, working conditions, and impact on public health. The recent boycott of McDonald's in the Middle East forced the company to buy back 225 restaurants in Israel from franchisee Alonyal Ltd. The report indicates that the company generates fewer returns from owning restaurants directly than operating them through franchising.

Technical analysis of McDonald's Corp stock

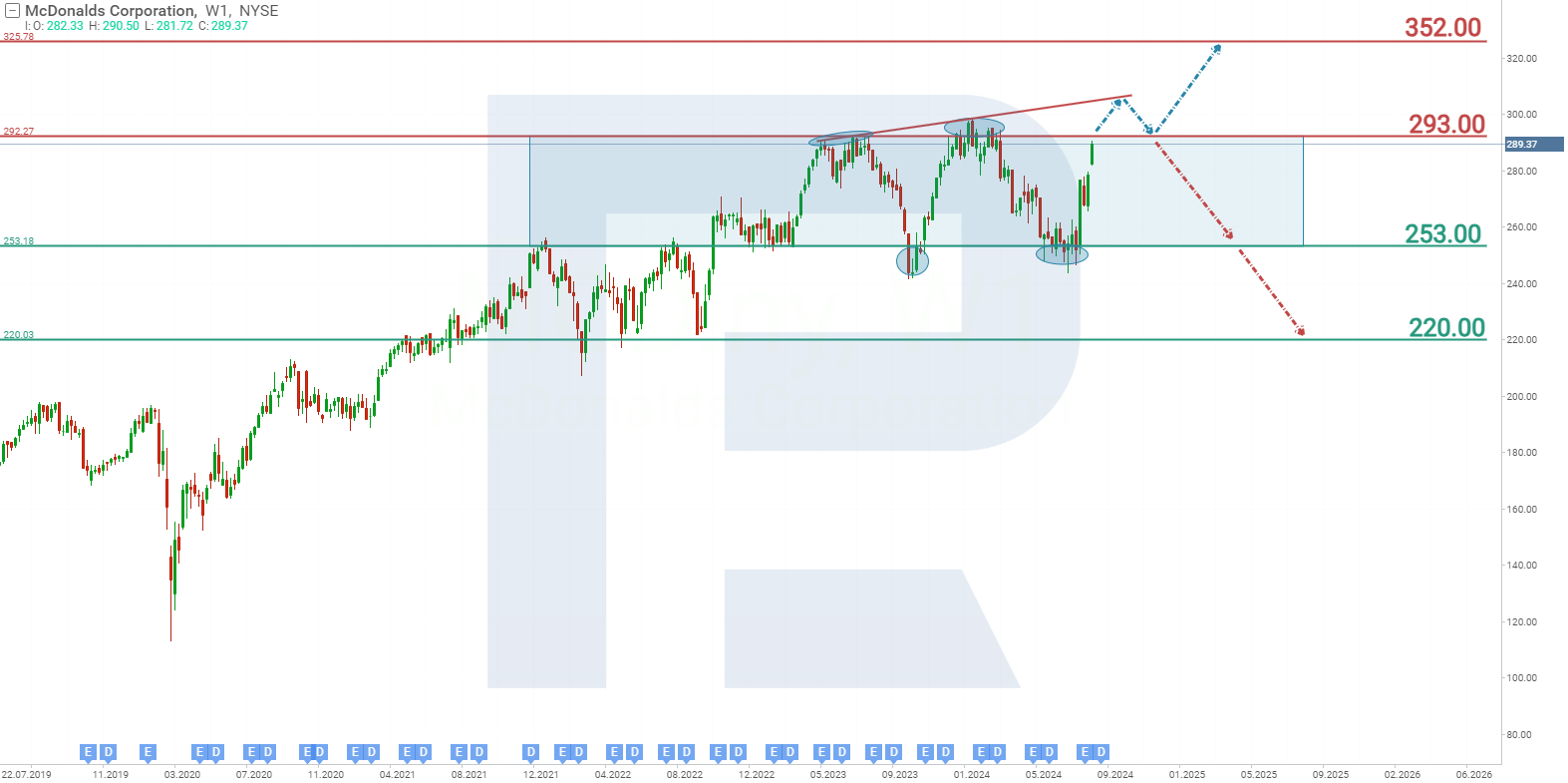

McDonald's Corp shares have been trading between 253 and 293 USD since October 2022. The price slightly surpassed the lower boundary of the range in October 2023 and July 2024, but investor interest in the company's shares rose during this period, pushing up the stock price. This situation demonstrates that 253 USD and lower is the price that market participants consider acceptable for buying McDonald's shares. At 293 USD, there was a lack of buyer interest at that price level. It is obvious that investors speculated on the company's stock over the past two years, buying it at the lower boundary of the price range and selling at the upper one.

The stock price is approaching the 293 USD resistance level again, marking the third time this level has been reached, and it is more aggressive this time, as the shares covered the price range of 40 USD in just four days. MCD stock forecast based on this information suggests two scenarios:

- An optimistic McDonald's stock forecast suggests that the price could rise above the 293 USD resistance level and then test it from the opposite side as support, with the quotes increasing further to 350 USD per share

- A negative McDonald's stock forecast does not rule out a false breakout of the 293 USD resistance level, with the price falling to support at 253 USD. If this level breaks, the stock price could dip to 220 USD

McDonald's Corp stock analysis and forecast

SummaryIn a high-tech world, competition in the fast-food market has increased significantly, and, as the Q2 2024 report shows, it is difficult for McDonald's to maintain high growth rates. However, the company's current business model, introduced in the early 1950s, still proves effective.

McDonald's shares are less about speculation and more about long-term financial investments, for which the company has traditionally rewarded its investors with steadily increasing dividend payouts and share repurchases.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.