Alphabet stock is falling. Is the decline a buying opportunity, or a warning sign of serious challenges?

Alphabet Inc.’s (NASDAQ: GOOG) shares peaked at an all-time high of 193 USD on 10 July. Subsequently, the price began to decline. On 23 July, the company published its Q2 2024 earnings report. Despite the financial results exceeding experts’ forecasts, the stock price continued to fall, dropping by 14% by 26 July. The question arises: does this present an opportunity to purchase Alphabet stock at a lower price, or does it signal challenges for the company’s outlook? This article will analyse investors’ concerns, and the risks associated with investing in Alphabet stock. It will also provide a technical analysis and forecast for Alphabet stock.

About Alphabet Inc.

Google was founded on 4 September 1998 by Lawrence Page and Sergey Brin, PhD students at Stanford University then. What began as a research project soon became one of the world’s largest and most influential tech companies.

On 2 April 2014, Google shares were split into Class A and Class C. Class A shares (ticker symbol: GOOGL) have voting rights at shareholder meetings, while Class C shares (ticker symbol: GOOG) do not. The share split enabled the company founders, Larry Page and Sergey Brin, to retain control over Google even as they issued new shares and raised capital.

Following the restructuring in 2015, Google was rebranded as Alphabet Inc., which now operates several subsidiaries in various technology and innovation fields.

Alphabet Inc.’s main business lines

In its report for July 2024, Alphabet provides data on three business segments: Google Services, Google Cloud, and Other Bets. The latter includes promising areas of business that have yet to become significant revenue generators. Below is more detailed information on each segment:

Google Services

- This segment includes a wide range of products and services, generating the most significant portion of Alphabet Inc.’s income. It comprises search, advertising, video (YouTube service), entertainment, devices (Google Pixel), smart home, cloud services, mapping services, operating systems (Android), voice assistant, and AI

Google Cloud

- This is Alphabet Inc.’s second-largest business segment by revenue, providing cloud computing services to companies and developers. This segment includes computing services, storage, databases, analytics, networking solutions, developer tools, management and security, and business solutions

Other Bets

- This includes various innovative and emerging businesses outside of Google’s core operations. These projects focus on long-term investments in technology and research initiatives with the potential of becoming significant future revenue streams

Alphabet Inc.’s Q2 2024 report

On 23 July, Alphabet released its Q2 2024 earnings report. Below is the comparison of the data with the corresponding period in 2023.

- Revenue - 84.70 billion USD (+14%)

- Net income - 23.60 billion USD (+29%)

- Earnings per share - 1.89 USD (+31%)

- Operating margin - 32% (+300 basis points)

Revenue by segment:

Google Services - 73.9 billion USD (+11%)

- Google Search - 48.50 billion USD (+13%)

- YouTube ads - 8.70 billion USD (+13%)

- Google Network - 7.44 billion USD (-5%)

- Google subscriptions, platforms, and devices - 9.31 billion USD (+14%)

Google Cloud - 10.30 billion USD (+28%)

Other Bets - 0.36 billion USD (+28%)

Operating profit (loss):

- Google Services - 29.70 billion USD (+26%)

- Google Cloud - 1.20 billion USD (+182%)

- Other Bets - 1.10 billion USD, loss increased by 35%

Comments from Alphabet Inc.’s management on the Q2 2024 report

Alphabet’s CEO, Sundar Pichai, stated that the company enjoyed strong search performance and momentum in cloud technology in Q2 2024. Google Cloud revenue exceeded 10 billion USD for the first time, with operating profit surpassing 1 billion USD, reflecting the most significant gain. Artificial intelligence plays a vital role in this segment’s growth.

The company is uniquely positioned to capitalise on AI-provided opportunities. Research and infrastructure leadership enable Alphabet to develop its proprietary solutions, while model expertise ensures control over technology development.

Alphabet Inc.’s forecast for Q3 2024

Alphabet’s Chief Financial Officer, Ruth Porat, predicts continued growth in advertising revenue, including from the Asia-Pacific region. Business margins are also projected to improve. In Q3 2024, Alphabet plans to expand its workforce with new graduates while actively investing in top engineering and technology talent. On the downside, capital expenditures and investments in AI are projected to rise, potentially impacting the company’s profit.

Although Alphabet’s management did not provide specific revenue and profit figures for Q3, experts shared their insights. Roth Capital analysts revised their Q3 2024 earnings estimate from 1.99 to 1.96 USD per share. However, despite a decrease in the earnings per share, analysts raised the price target for Alphabet’s shares to 174-220 USD, representing a 2-28% increase from the quotes as of 31 July.

What concerns did Alphabet Inc.’s shareholders have about the Q2 2024 report?

Following the quarterly report’s release, Alphabet’s stock lost about 5%. Despite strong Q2 results, investors found reasons for concern. Firstly, YouTube ad revenue growth slowed from 20% in Q1 2024 to 13% in Q2. Secondly, investors were alerted by high expenditures on large projects, including in the AI area. Nevertheless, Porat emphasised that the risk of underinvestment was significantly higher than the risk of overinvestment. Despite this, the stock continued to decline in the following days.

Investors have reasons for concern, as in the past decade, the company has closed projects such as:

- Google+ – a social networking service.

- Project Loon – an ambitious project to provide internet services using stratospheric balloons.

- Makani – a project to develop kites for energy production.

- Google Allo – a messaging app launched in 2016.

- Project Ara – an initiative to create modular smartphones.

- Project Tango – a platform for developing mobile devices with a 3D modelling feature.

- Google Nest Secure – a home security system.

Many of these projects were shut down due to high costs and monetisation challenges. Investors are concerned that current projects may also be terminated and, therefore, believe increasing these investments is too risky.

Alphabet Inc.’s promising business lines

Alphabet Inc. has several promising business areas. The following projects could prove successful in the near term:

- Google Cloud – the main focus is now on this segment as it is already generating operating profit, with revenue expected to continue growing rapidly. Google Cloud competes with giants such as Amazon Web Services (AWS) and Microsoft Azure, actively increasing its market share.

- Self-driving vehicles (Waymo) – this division of Alphabet Inc. is developing self-driving technology. The self-driving vehicle sector has enormous potential, and Waymo is considered one of the leaders in this area, with Tesla’s robotaxi as the primary competitor.

- Artificial intelligence (AI) and machine learning (ML) – Alphabet is actively developing AI and machine learning technologies and integrating them into various products and services such as Google, Google Assistant, Google Photos, and autonomous driving. The company expects revenue growth in existing divisions due to the introduction of AI as an assistant. Alphabet also collaborates with companies, helping them integrate AI into business processes to enhance productivity.

Technical analysis of Alphabet Inc.’s stock

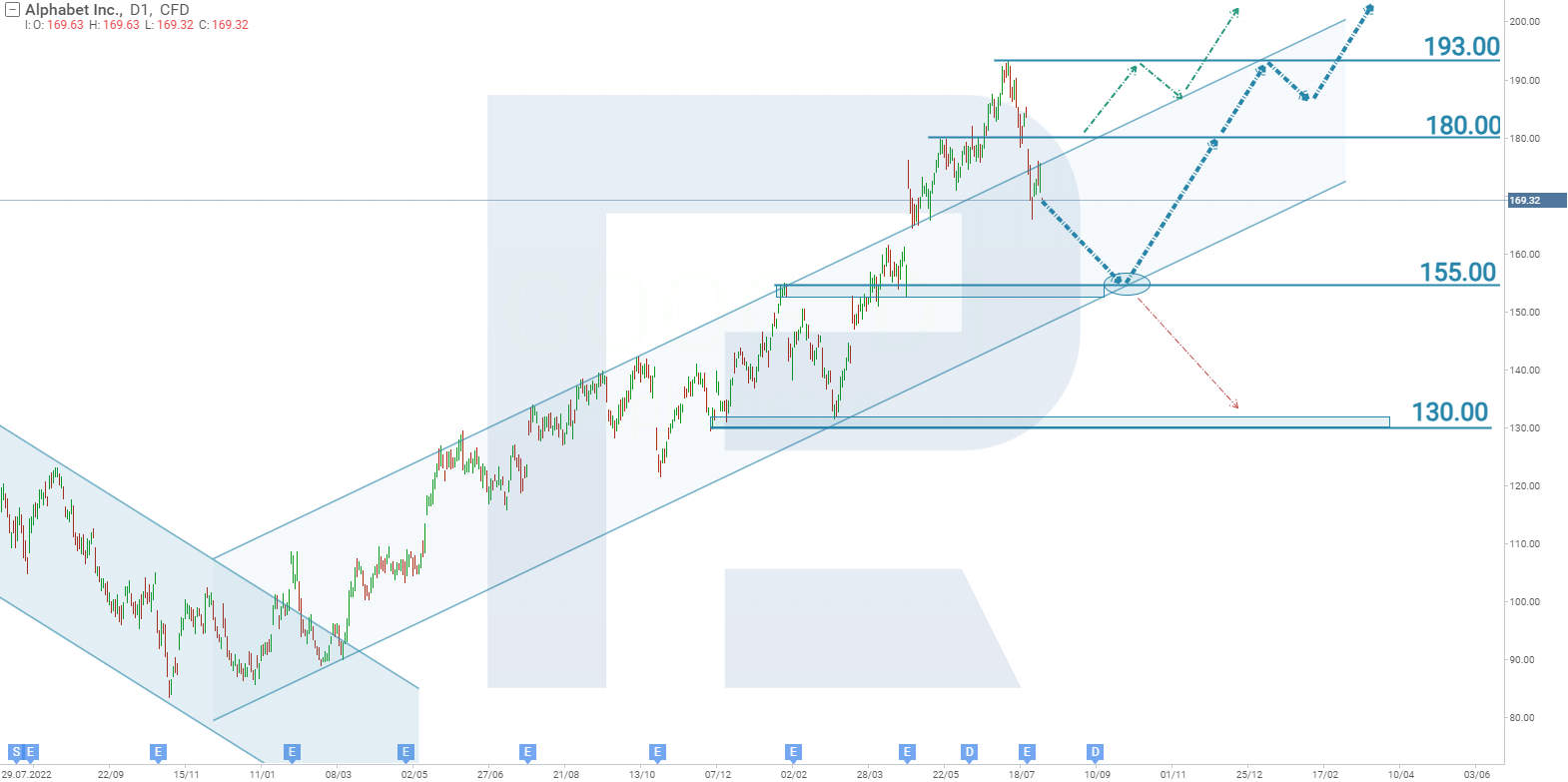

Alphabet’s stock has been trading within an ascending channel since February 2023. On 25 April, the stock price broke above the channel’s upper boundary, with stock growth gaining momentum, driven by the Q1 2024 earnings report. The shares continued to rise until 10 July, when they reached an all-time high of 193 USD and started to decline. The release of the Q2 2024 report triggered a breakout below the channel’s line, with the price returning to the previous range. GOOG stock analysis outlines two scenarios.

The primary GOOG stock forecast suggests a further decline in the stock price to 155 USD. This support level will likely coincide with touching the ascending trendline, which also serves as support for the yen. A rebound from the 155 USD level will indicate the completion of the correction and a resumption of stock price growth. The first target for the upward movement would be the 180 USD resistance level. A breakout above this level could open the potential for a price rise to an all-time high of 193 USD and further upward movement.

(Alphabet Inc.’s stock analysis and forecast)

The secondary scenario suggests sudden investor optimism regarding Google shares, with the price surpassing the 180 USD resistance level and heading towards an all-time high of 193 USD. Subsequently, the price could rise above this level and continue upward.

Risks of investing in Alphabet Inc.’s stock

The principal risk of investing in Alphabet shares is overinvestment in new projects. In this situation, the company may incur higher costs for maintaining unprofitable projects that could later be terminated. Adverse investor reactions to rising innovation costs have shown that they disapprove of such behaviour. Shareholders would certainly prefer the company to allocate these funds to pay dividends or share buybacks, which would benefit them directly. However, the CEO must take risks and balance income and costs to avoid harming the company.

Summary

GOOG’s fundamental analysis based on the Q2 2024 report shows that it is a financially strong company, with management expecting the situation to remain manageable. This could be why the CEO decided to increase investments in innovative projects. Alphabet’s stock price decline has pushed the P/E ratio down to 27.7. For comparison, the P/E ratio for the S&P 500 index is 28.4, meaning that Alphabet’s shares are trading at a fair value. However, compared with competitors such as Apple Inc. (NASDAQ: AAPL) with a P/E ratio of 33.9, Microsoft Corporation (NASDAQ: MSFT) with a P/E ratio of 35.35, and NVIDIA Corp (NASDAQ: NVDA) with a P/E ratio of 63.8, Alphabet’s stock appears undervalued, which is another factor in favour of investing in this company. Technical analysis of Alphabet’s stock indicates there is no need to rush to buy these shares as their value is likely to dip slightly.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.