US Tech analysis: with the correction complete, the index is poised for a new all-time high

A correction in the US Tech stock index is complete, with the price now aiming for a new all-time high. More details in our US Tech price forecast and analysis for next week, 25-29 November 2024.

US Tech forecast: key trading points

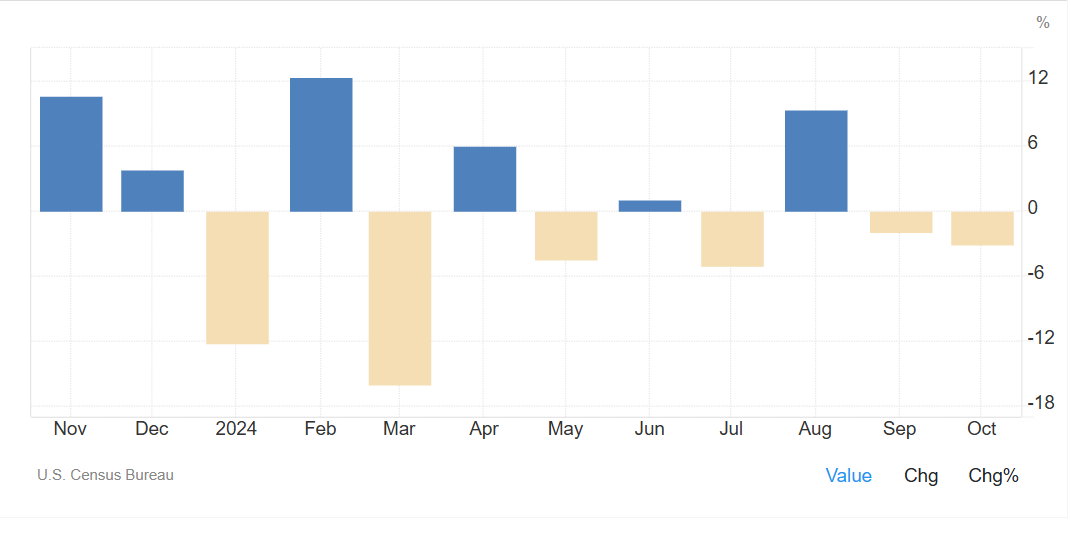

- Recent data: Housing Starts decreased by 3.1% in October compared to the September reading

- Economic indicators: this metric represents the number of residential projects initiated during the month

- Market impact: the indicator influences related industries, including the production of construction materials, furniture, household appliances, and financial services (e.g. mortgage lending)

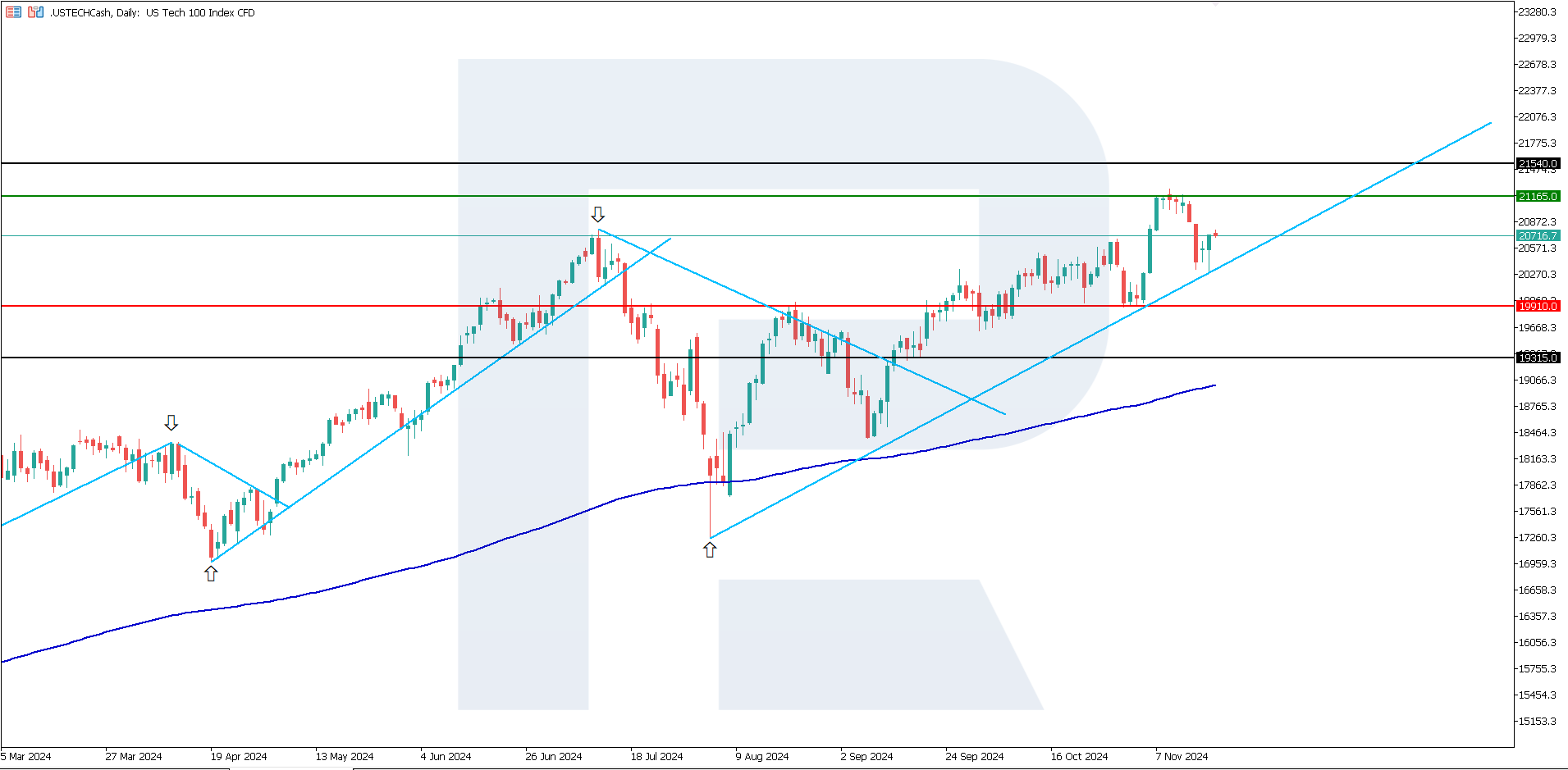

- Resistance: 21,165.0, Support: 19,910.0

- US Tech price forecast: 21,540.0

Fundamental analysis

The current decrease in Housing Starts (-3.1% m/m) from the previous reading of -1.9% indicates a weakening construction sector, probably due to elevated interest rates. This trend may lead to a short-term downturn in the stock market, particularly in construction-related segments. However, if investors interpret it as a sign of easing inflationary pressures, the market could gain support amid expectations of changes to Federal Reserve policy.

Source: https://tradingeconomics.com/united-states/housing-starts-mom

The decline in construction projects may indicate sluggish consumer demand and the adverse effects of high Federal Reserve interest rates. Lower construction activity may signal that the Fed intends to slow the economy to combat inflation. This could reinforce future expectations of further monetary policy easing, benefiting equities.

Potential easing of Federal Reserve pressure could support stocks in rate-sensitive sectors such as technology and consumer discretionary. However, there are also political risks. President-elect Donald Trump’s policy on tariffs, fiscal stimulus, and immigration will likely prevent the US from reaching a 2% inflation target. The US Tech index forecast is moderately positive.

US Tech technical analysis

The US Tech stock index is in an uptrend following a correction. According to technical analysis, the US Tech index is poised to break above the 21,165.0 resistance level and hit a new all-time high. The next growth target could be 21,540.0. The uptrend is medium-term, with no indications of reversal.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 19,910.0 support level could see the index fall to 19,315.0

- Optimistic US Tech forecast: a breakout above the 21,165.0 resistance level could propel the index to 21,540.0

Summary

The recent drop in Housing Starts (-3.1% m/m) from the previous reading of -1.9% signals a weakening construction sector, likely influenced by high interest rates. Reduced construction activity may signal the Federal Reserve’s continued monetary policy easing course. This situation will be particularly beneficial for the technology sector.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.