US Tech analysis: the uptrend weakens, with a correction being highly likely

The US Tech stock index is in an uptrend. However, the quotes have been hovering between the current resistance and support levels for over a week. The US Tech forecast for next week is moderately optimistic.

US Tech forecast: key trading points

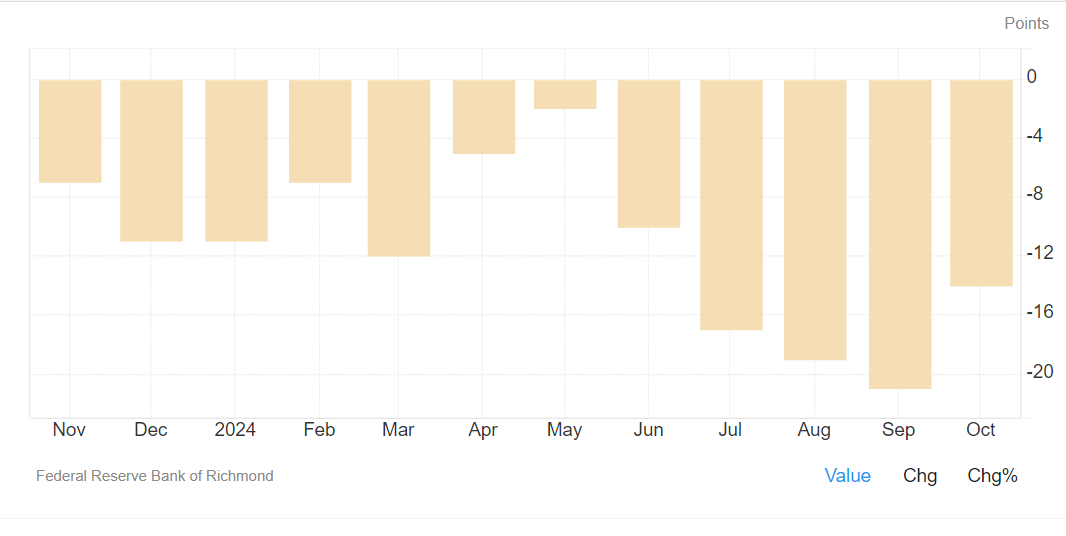

- Recent data: the Richmond Manufacturing Index came in at -14 points in October

- Economic indicators: published by the Federal Reserve Bank of Richmond and measures changes in manufacturing conditions (orders, shipments, employment, and inventories)

- Market impact: under the current conditions, the index’s impact on the market is ambiguous and depends on how traders interpret the data

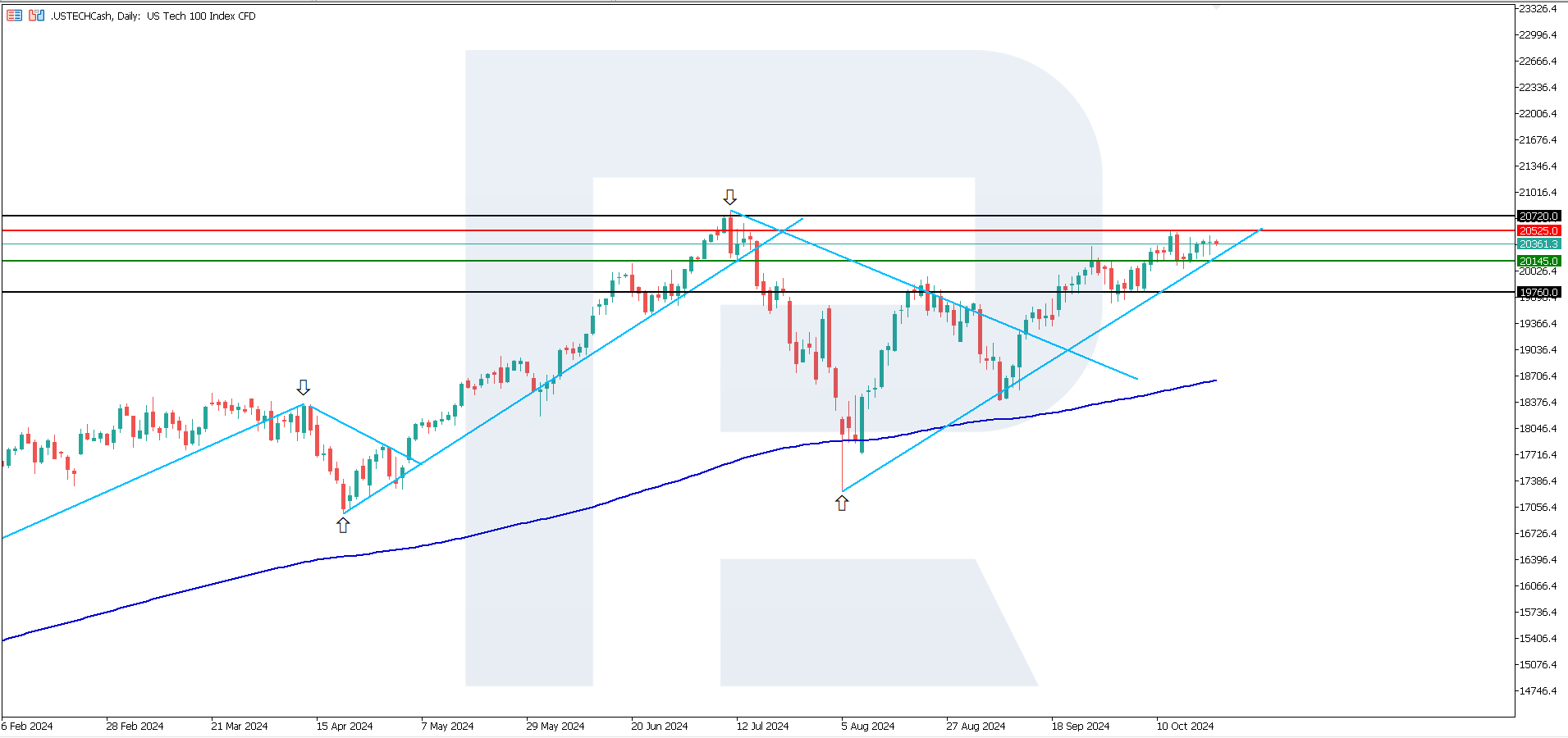

- Resistance: 20,525.0, Support: 20,145.0

- US Tech price forecast: 20,720.0

Fundamental analysis

The Richmond Manufacturing Index came in at -14 in October, above expectations of -19 and the previous reading of -21. This means that manufacturing activity in the Richmond region continues to contract but more slowly than a month ago.

Source: https://tradingeconomics.com/united-states/richmond-fed-manufacturing-index

The negative index reading indicates weakness in the manufacturing sector, while an improvement from the previous month and expectations may be considered a sign of stabilisation. This may temporarily support the stock index, especially in anticipation of more positive economic data.

One unusual divergence in corporate US forecasts is observed this season: while analysts have lowered their forecasts, company CEOs point to another strong quarter. According to data collected by Bloomberg Intelligence, analysts expect the S&P 500 companies to report 4.2% growth in Q3 earnings compared to last year. This is below the July forecast of 7.0%, while CEOs expect an increase of about 16.0%. The impact on the market could be ambiguous and will depend on how investors interpret the data reflecting the general state of the economy. The US Tech index forecast is moderately optimistic.

US Tech technical analysis

The US Tech stock index is in an uptrend. However, the quotes have failed to break above the resistance level at 20,525.0. According to technical analysis, the US Tech index still has growth potential, although this has significantly reduced as large sellers have appeared. This suggests a higher likelihood of a correction in the index.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 20,145.0 support level could send the index down to 19,760.0

- Optimistic US Tech forecast: a breakout above the 20,525.0 resistance level could drive the index to 20,720.0

Summary

The Richmond Manufacturing Index came in at -14 in October, exceeding expectations of -19. The negative index reading indicates weakness in the manufacturing sector, while an improvement from the previous month and expectations may be considered a sign of stabilisation. The impact of this indicator on the market will depend on how traders interpret the data reflecting the state of the economy.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.