US Tech analysis: the downtrend subsides, with the potential for growth to a new all-time high visible

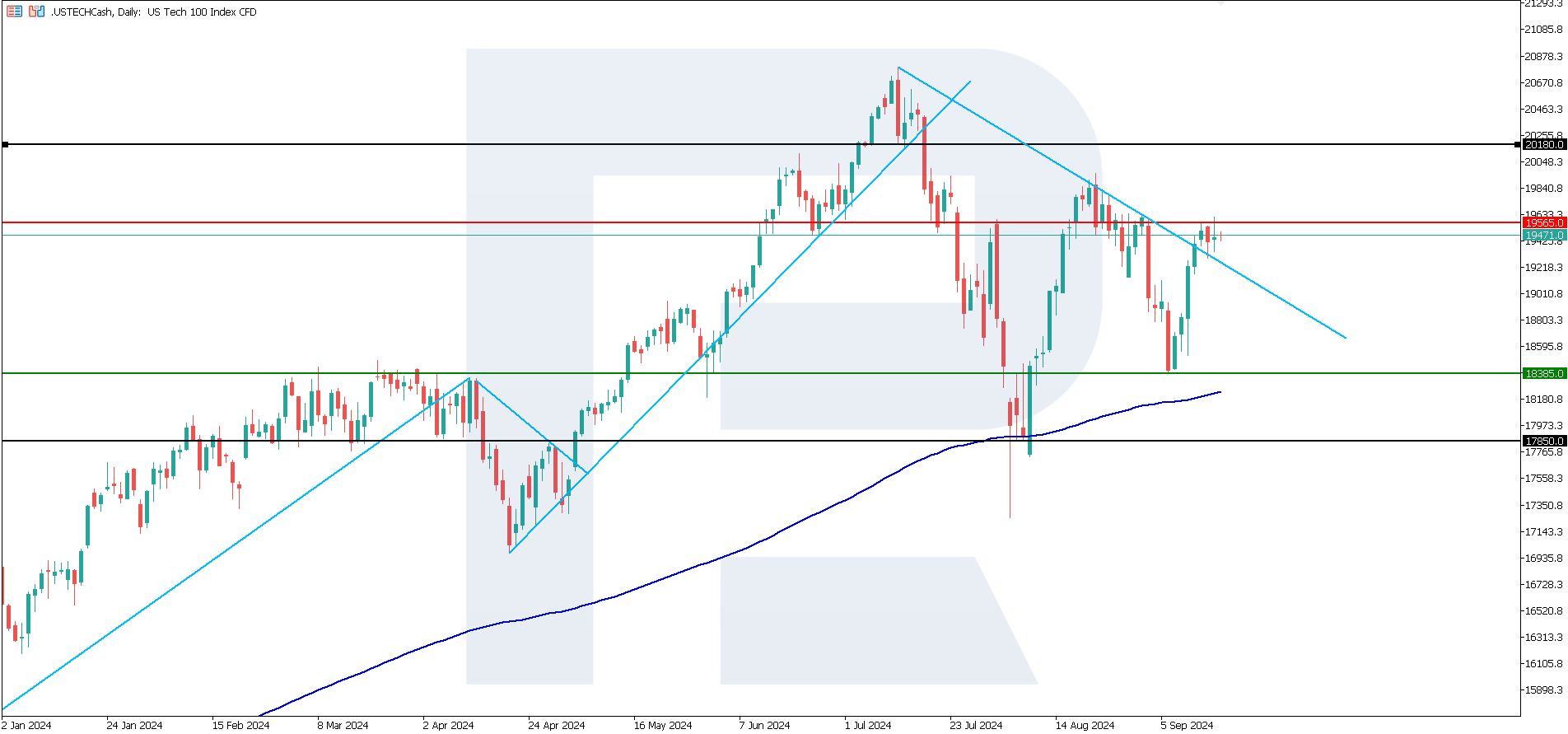

After rebounding from the 200-day Moving Average, the US Tech stock index breached the downtrend line. The US Tech index forecast is moderately optimistic.

US Tech forecast: key trading points

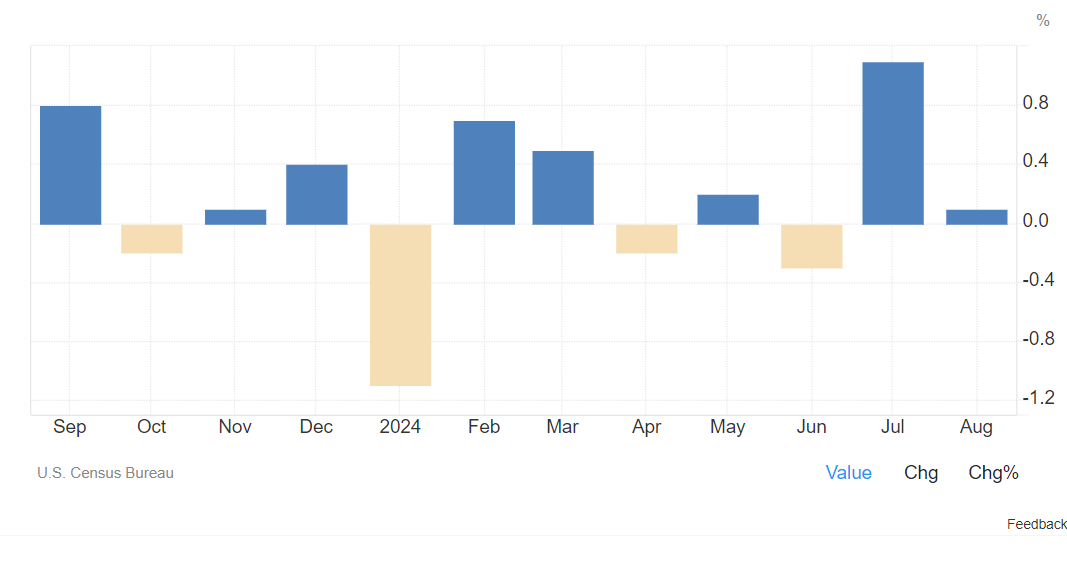

- Recent data: US retail sales rose by 0.1% in August

- Economic indicators: the retail sales figure indirectly reflects the future GDP and inflation dynamics

- Market impact: sales growth may entail an increase in demand inflation, which may affect the US Federal Reserve’s future plans to lower the key rate

- Resistance: 19,565.0, Support: 18,385.0

- US Tech price forecast: 20,180.0

Fundamental analysis

As reported by the US Department of Commerce, retail sales grew by 0.1% in August, while they were expected to decrease by 0.3%. Retail sales growth rates for the previous month were revised from 1.0% to 1.1%. Sales excluding autos and fuel rose by 0.1%, falling short of the expected 0.3% increase.

Source: https://tradingeconomics.com/united-states/retail-sales

The US regulator will make an interest rate decision today. There is virtually no doubt that the rate will be lowered. However, the question remains whether it will be a 0.25 or 0.50% rate cut. Most analysts are inclined to the first option. However, JPMorgan Chaseinvestment specialists believe that a 50-basis-point key rate cut is quite likely.

It is worth noting that the stock market will be influenced not only by the rate decision, but also by the Federal Reserve’s forecasts. In the latest one released in June, the regulator referred to only one 0.25% rate cut in 2024. The Fed’s forecast will likely be eased in September. For this reason, the US Tech forecast for next week is moderately optimistic.

US Tech technical analysis

The US Tech index rebounded from the 200-day Moving Average and then breached the downtrend line. In terms of technical analysis, the index is entering an uptrend, aiming for a new all-time high. If the current resistance level at 19,565.0 breaks, the nearest target could be 20,180.0. Otherwise, a sideways range could form between the current support and resistance levels.

Key levels for the US Tech price forecast include:

- Resistance level: 19,565.0 – breaking above this level, the price could target 20,180.0

- Support level: 18,385.0 – with a breakout below the support level, the price could decline to 17,850.0

Summary

The US Federal Reserve will make an interest rate decision today, with the rate likely to be lowered. The stock market will be influenced not only by the rate decision, but also by the regulator’s forecasts. If they are eased, the US Tech will gain new momentum for growth.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.