US Tech analysis: the decline continues, with only the US Fed able to reverse the trend

The US Tech stock index is in a downtrend and under pressure ahead of the US Federal Reserve key rate meeting. Therefore, the US Tech forecast is negative.

US Tech forecast: key trading points

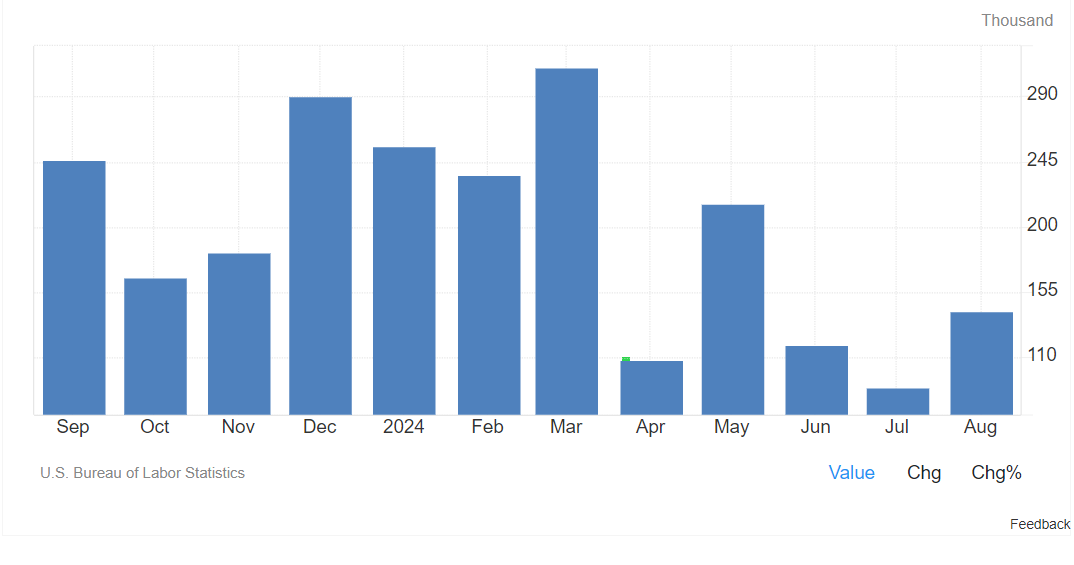

- Recent data: the number of jobs in the US increased by 142,000 in August

- Economic indicators: monetary policy parameters depend on the state of the US employment market

- Market impact: the increased likelihood of a Federal Reserve key rate cut drives demand for the US national debt to lock in the current yield but will lead to growth in stock prices in the future

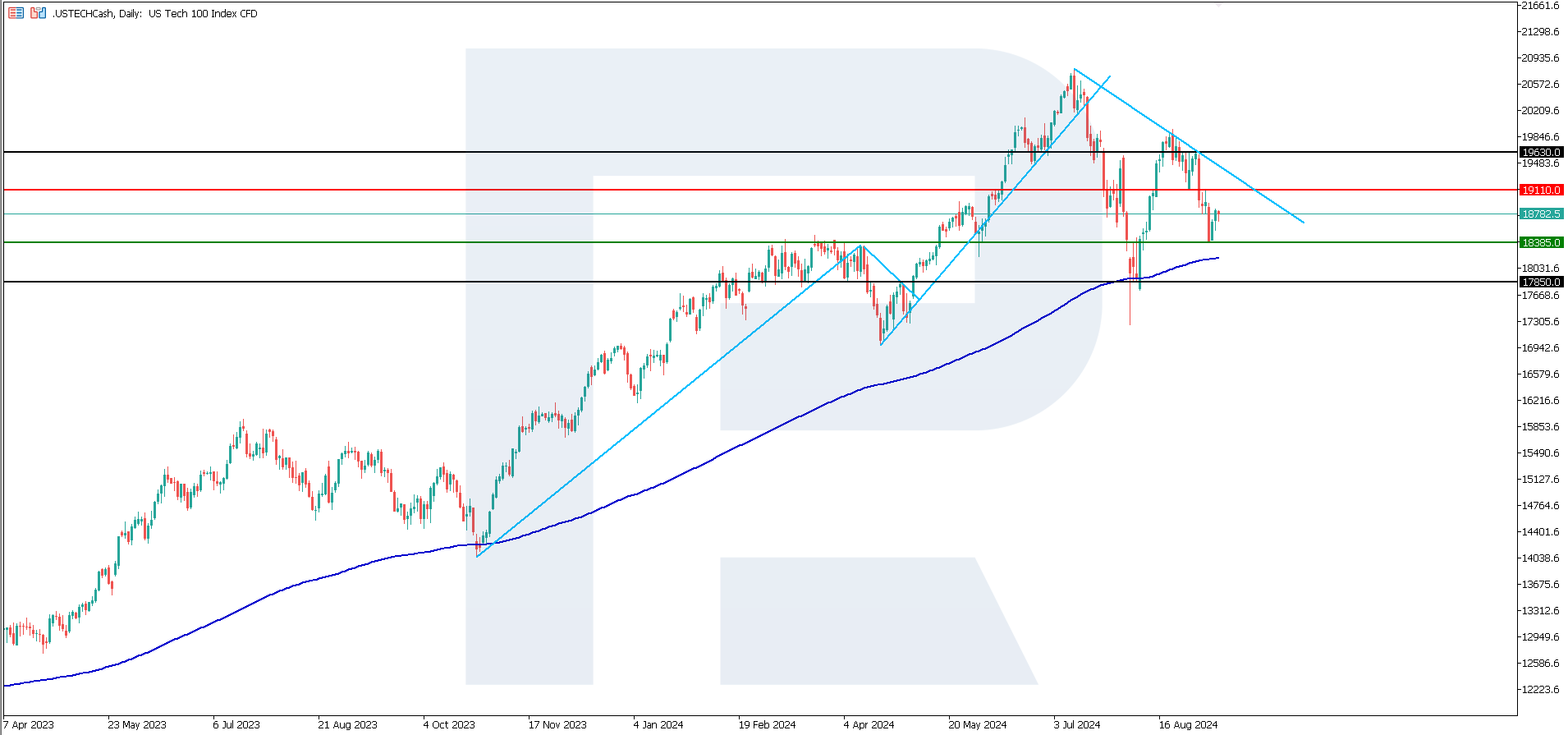

- Resistance: 19,110.0, Support: 18,380.0

- US Tech price forecast: 17,850.0

Fundamental analysis

As reported by the US Department of Labor on 6 September, the number of jobs in the US increased by 142,000 in August, falling short of the expected 160,000. The previous reading was revised down to 89,000 from 114,000. The unemployment rate decreased from 4.3% to 4.2%, aligning with expectations. The average hourly earnings rose by 0.4%, exceeding the forecasted 0.3%.

Source: https://tradingeconomics.com/united-states/non-farm-payrolls

US Secretary of the Treasury Janet Yellen sought to reassure the public on Wednesday that the US economy remains strong despite a series of weak employment reports that rattled investors and negatively affected the stock market.

Employment data raised concerns about whether the Federal Reserve can achieve a so-called soft landing by increasing interest rates to bring inflation under control and then lowering them before the economy goes into recession. The Fed is expected to cut interest rates this month. The US Tech forecast for next week is negative.

US Tech technical analysis

The US Tech stock index is in a downtrend and is again approaching the 200-day Moving Average, which has not happened since October 2023. If this level breaks and the index secures below it, a medium-term downtrend will highly likely form. In terms of the US Tech technical analysis, the outlook for the index is negative.

The key levels to watch in the US Tech price forecast include:

- Resistance level: 19,110.0 – a breakout above this level will drive the price to 19,630.0

- Support level: 18,385.0 – a breakout below the support level will push the price down to 17,850.0

Summary

According to the US Department of Labor report, the number of jobs in the US increased by 142,000 in August. The Secretary of the Treasury believes there is no need to fear a recession as the employment market is strong enough. Nevertheless, market participants expect the US Federal Reserve to lower interest rates as early as this month.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.