US 500: the index hits new all-time highs after the US Fed rate cut

The US 500 stock index is in an uptrend and will likely reach another all-time high. Find out more in our US 500 price forecast and analysis for next week, 18-22 November 2024.

US 500 forecast: key trading points

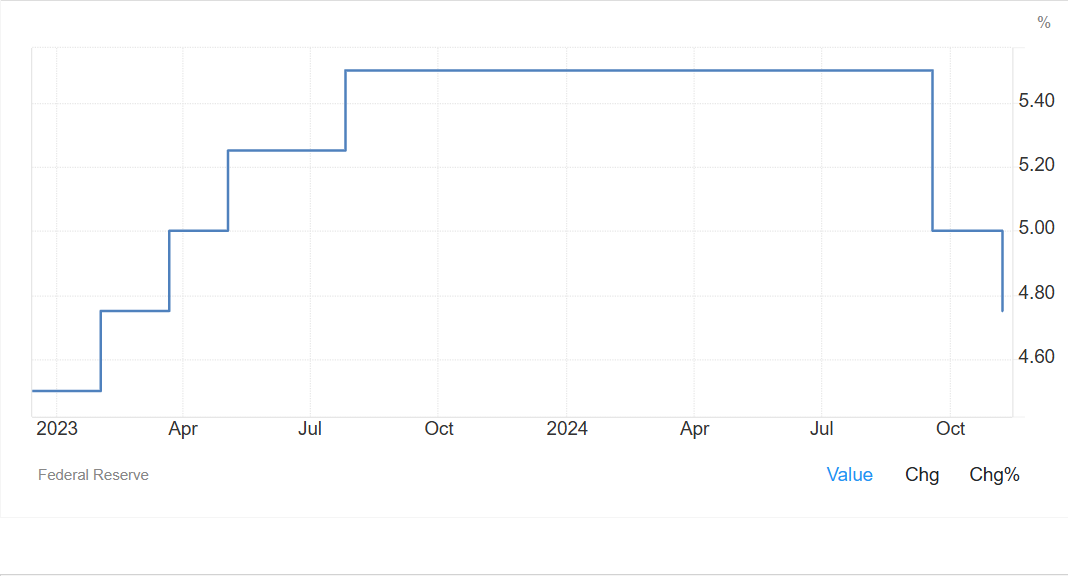

- Recent data: the US Federal Reserve lowered the interest rate to 4.75%

- Economic indicators: the interest rate determines the value of money in the economy

- Market impact: a rate cut positively impacts the stock market and drives economic growth

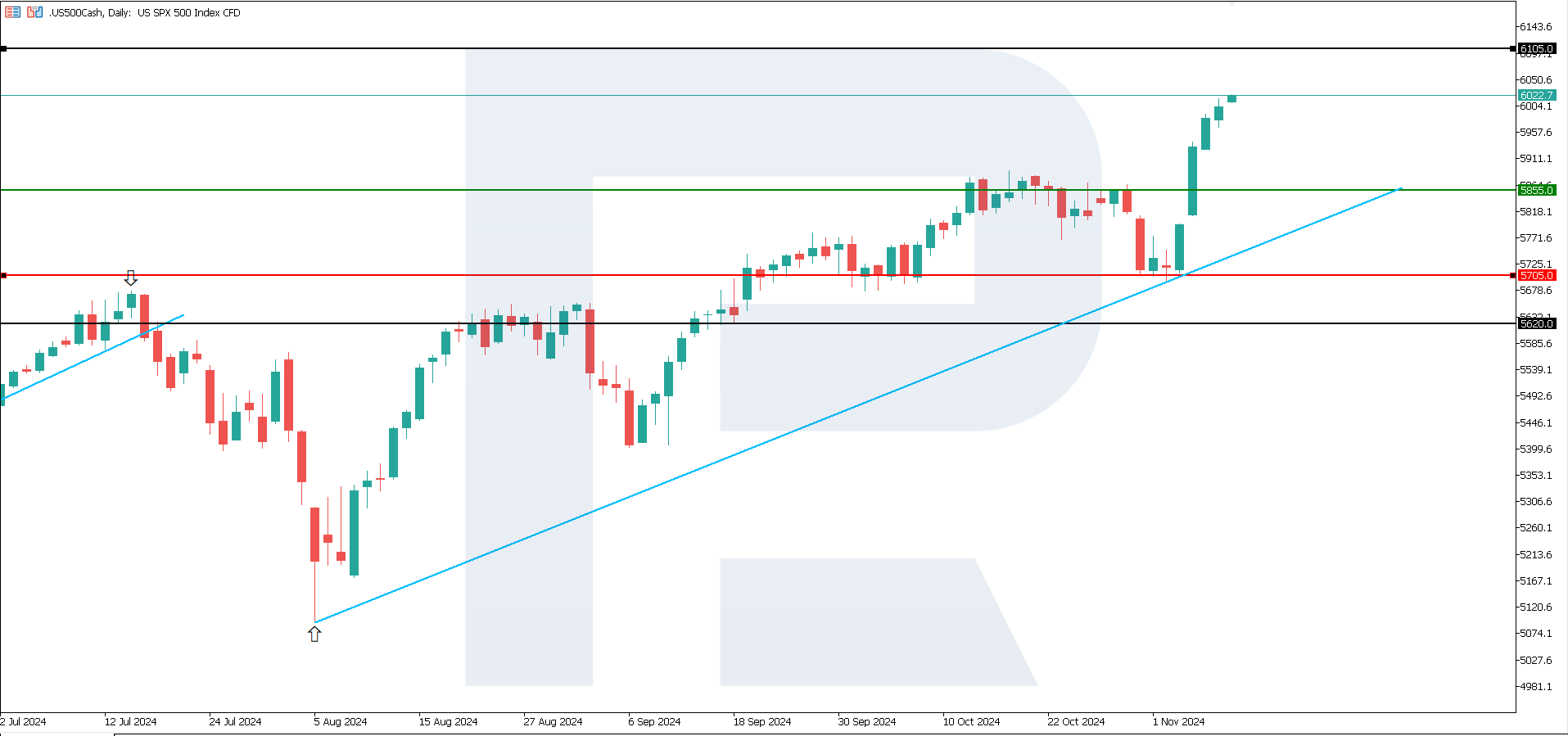

- Resistance: 5,855.0, Support: 5,705.0

- US 500 price forecast: 6,105.0

Fundamental analysis

The Fed’s press office reported that the US Federal Reserve reduced interest rates by 25 basis points to the 4.50-4.75% range. Two consecutive interest rate cuts in the current cycle were last seen in March 2020. Lowering the key rate makes loans cheaper for businesses and consumers, stimulating economic activity in the US.

Source: https://tradingeconomics.com/united-states/interest-rate

The Federal Reserve notes that the current data points to sustained economic growth. The 0.25% Federal Reserve rate cut may positively impact the stock market, especially stocks of companies focused on domestic demand and the consumer sector. Affordable loans typically encourage increased spending by businesses and consumers, which could improve the earnings of retail trade, consumer services, and technology companies.

Lower rates also reduce corporations’ borrowing costs, encouraging investment in development and business process improvement. Such Federal Reserve measures typically boost optimism among investors, which can drive stock prices. With sustained economic growth, as the regulator mentioned, the market may anticipate an increase in companies’ earnings, supporting the stock market. The US 500 index forecast remains positive.

US 500 technical analysis

The US 500 stock index hit a new all-time high at the opening of trading and is in a strong uptrend. According to the US 500 technical analysis, any decline can be interpreted as a correction, not a trend reversal. The index has confidently secured levels above the previously breached resistance at 5,855.0, with a new one yet to form.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,705.0 support level could drive the index down to 5,620.0

- Optimistic US 500 forecast: if the price holds above the previously breached 5,855.0 resistance level, it could rise to 6,105.0

Summary

The US Federal Reserve reduced interest rates by 25 basis points to 4.50-4.75%. Lower rates also reduce corporations’ borrowing costs, encouraging investments in development and improving business conditions. The US 500 stock index hit a new all-time high at the opening of trading and is in a strong uptrend.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.