US 500 analysis: the uptrend continues despite mixed inflation data

The US 500 stock index is in an uptrend and continues to hit new all-time highs. The US 500 forecast for next week is moderately optimistic.

US 500 forecast: key trading points

- Recent data: the US CPI rose by 2.4% over the past 12 months

- Economic indicators: after labour market data, inflation is one of the crucial gauges for the US Federal Reserve in determining its future monetary policy

- Market impact: if inflation eases, there is hope that the Fed will continue a soft monetary policy, which will positively impact the stock market

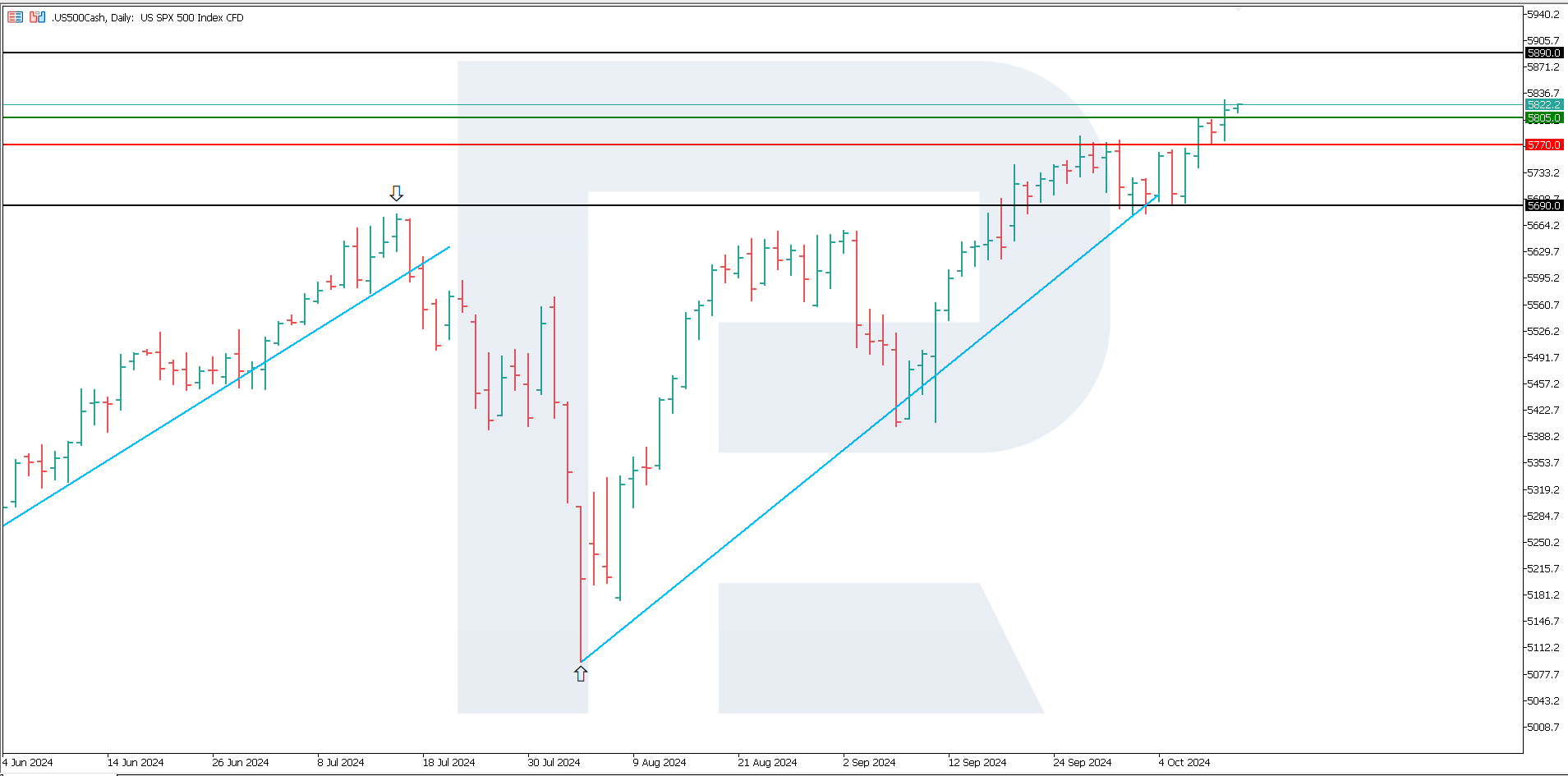

- Resistance: 5,805.0, Support: 5,770.0

- US 500 price forecast: 5,890.0

Fundamental analysis

The inflation report data shows that the CPI has increased by 2.4% over the past 12 months, while analysts expected the reading to be 2.3%. The result is slightly above the Federal Reserve’s 2% inflation target.

Source: https://tradingeconomics.com/united-states/inflation-cpi

With inflation remaining close to the target and the interest rate already reduced by 0.5%, the regulator may slow the pace of further cuts. Despite soft lending conditions, inflation at 2.4%, combined with rising housing and food costs, may raise concerns about consumer activity. If inflation falls without accompanying economic growth, investors may become more cautious.

Market participants will likely expect additional clarification from the Federal Reserve about its inflation and unemployment data assessment. If the regulator’s plans to cut interest rates do not change, the stock market will remain strong. However, investors will remain uncertain until then. The US 500 index forecast remains moderately positive.

US 500 technical analysis

The US 500 stock index is in an uptrend and will likely reach another all-time high. According to the US 500 technical analysis, a breakout below the 5,770.0 support level may signal a trend reversal and the beginning of a correction. However, the quotes are more likely to hold above the previously breached resistance level at 5,805.0.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,770.0 support level could push the index down to 5,690.0

- Optimistic US 500 forecast: if the price holds above the breached resistance level at 5,805.0, it could rise to 5,890.0

Summary

The inflation report data shows that the CPI has increased by 2.4% over the past twelve months. If inflation falls without accompanying economic growth, investors may become more cautious. If the price holds above the breached resistance level at 5,805.0, it could rise to 5,890.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.