US 500 analysis: strong labour market data boosts the index

The US 500 stock index closed with gains last Friday following the release of strong US labour market data. The US 500 forecast for next week is moderately positive.

US 500 forecast: key trading points

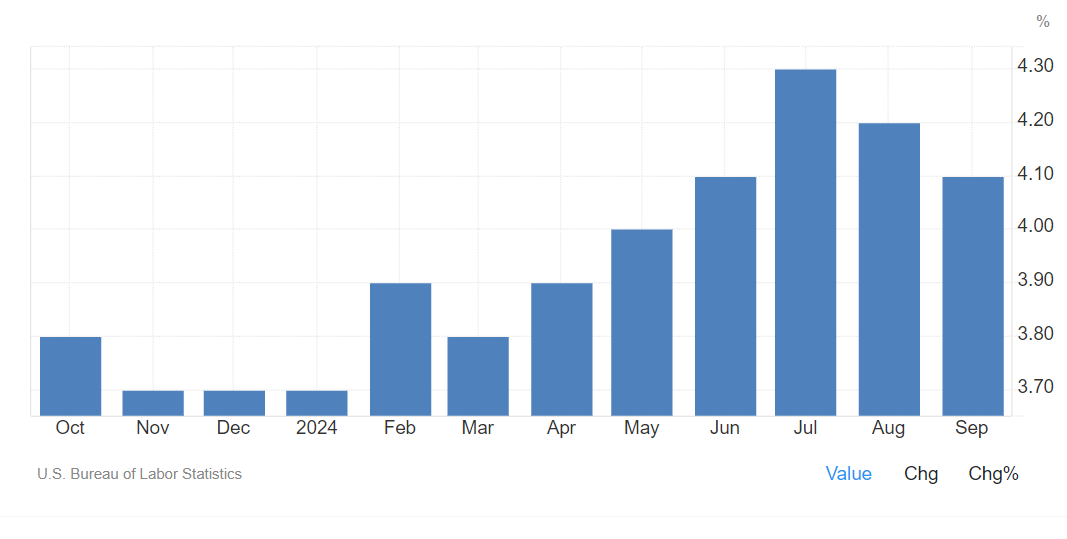

- Recent data: US unemployment reached 4.1% in September

- Economic indicators: the unemployment rate is one of the leading indicators for the US Federal Reserve concerning future monetary policy decisions

- Market impact: strong labour market data gives the regulator reason to delay cutting interest rates, which may negatively impact the stock market

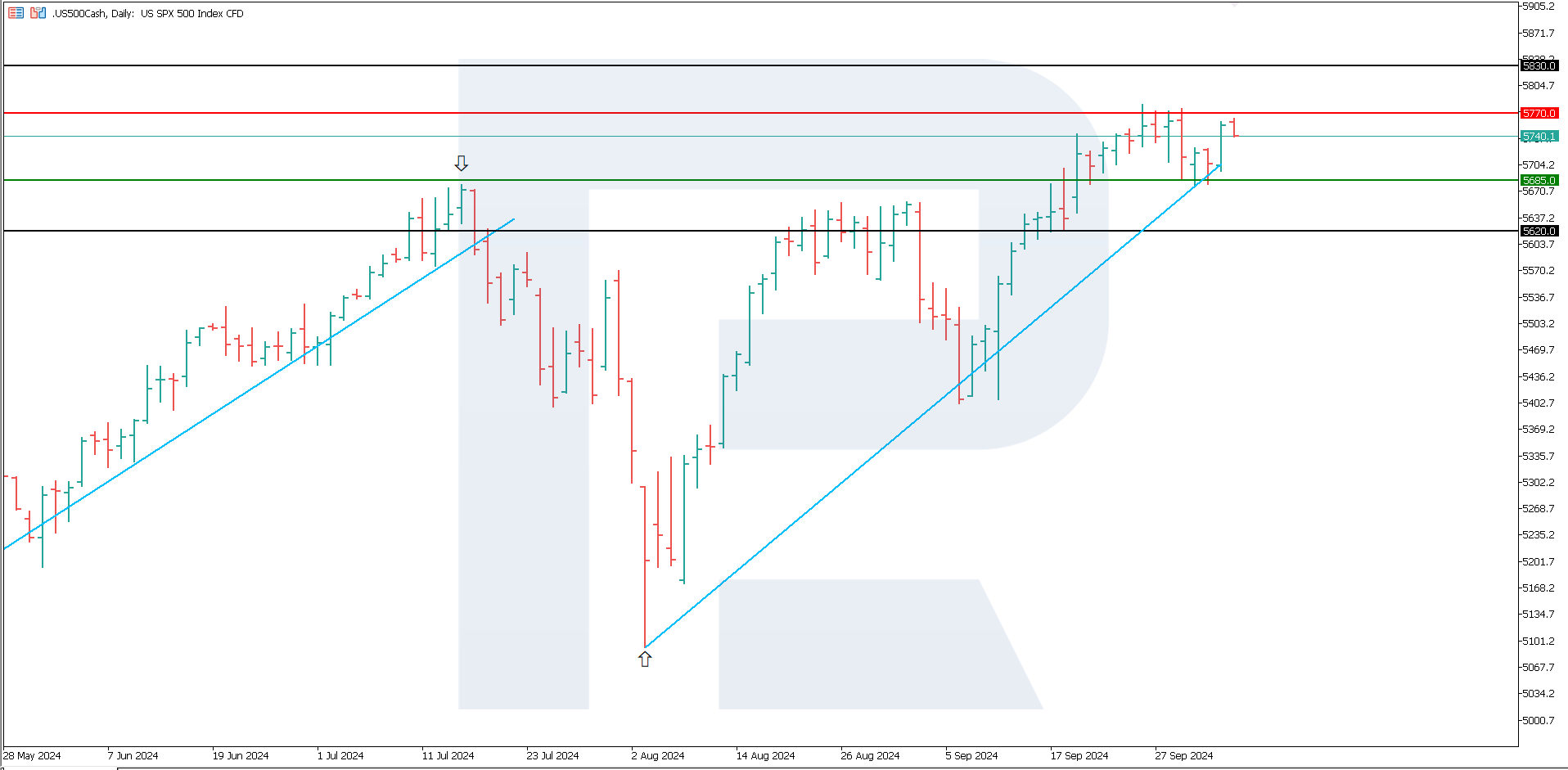

- Resistance: 5,770.0, Support: 5,685.0

- US 500 price forecast: 5,830.0

Fundamental analysis

The number of new US jobs surpassed expectations in September. The nonfarm payroll data and the unemployment rate in September were highly positive. Nonfarm payrolls increased by 254,000, well above expectations. As a result, the labour market weakness discussed in July and August was just a seasonal cooling.

Source: https://tradingeconomics.com/united-states/unemployment-rate

The unemployment rate stood at 4.1% in September, below the consensus forecast of 4.2%, while expectations of 4.3% were also reasonable. Nonfarm payrolls increased by 254,000, exceeding the expected 147,000, marking the highest reading since March 2024.

Thus, the US Federal Reserve may pause key rate cuts. Although this fact will adversely affect the stock market, the current interest rate cut is enough to stimulate economic activity. In particular, mortgage rates have decreased significantly. For this reason, the US 500 index forecast is moderately optimistic.

US 500 technical analysis

The US 500 stock index remains in the uptrend but is losing momentum: the quotes have already broken below the support level. This could be considered a slight correction, so from the US 500 technical analysis perspective, the potential for further growth remains. If the price breaks and settles below the 5,685.0-support level, this will signal a trend reversal.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: if the quotes break below the 5,685.0-support level, they may fall to 5,620.0

- Optimistic US 500 forecast: a breakout above the 5,770.0-resistance level could drive the index to 5,830.0

Summary

In September, the number of new US jobs exceeded expectations, with nonfarm payrolls increasing by 254,000 against the expected 147,000, marking the most substantial growth since March 2024. Amid such a strong labour market, the US Federal Reserve may keep the interest rate at the current level until the end of the year. However, the implemented key rate cut is sufficient for further stock market growth.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.