US 500 analysis: the index is poised for a new all-time high amid US employment market data

The US 500 stock index is attempting to reach a new all-time high following a correction in early August 2024. The US 500 forecast remains moderately optimistic.

US 500 forecast: key trading points

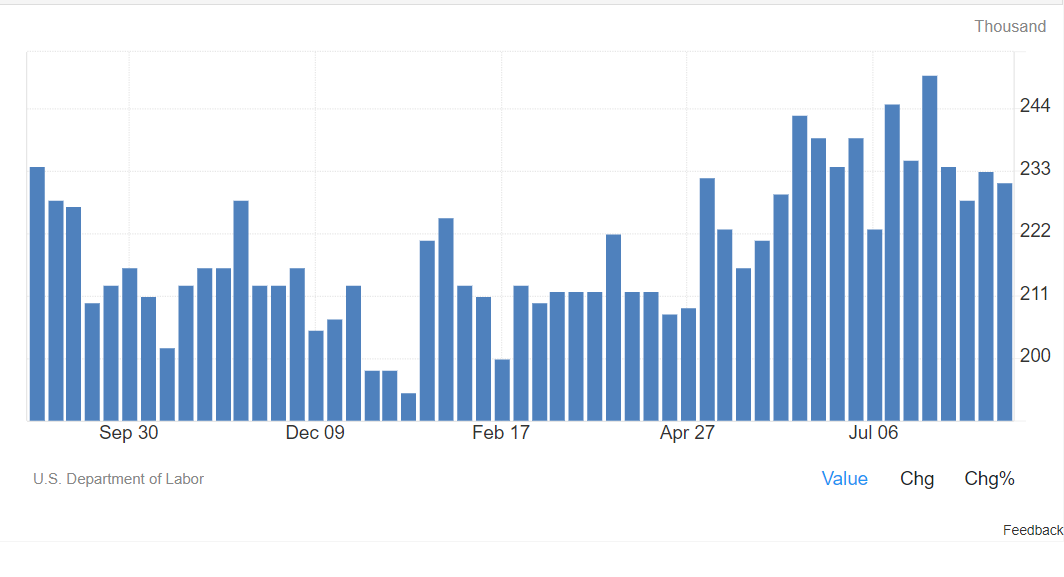

- Recent data: US initial jobless claims reached 231,000

- Economic indicators: this indicator is an indirect gauge of the US employment market, which the Federal Reserve focuses on when deciding on future key rates

- Market impact: further weakening of the US employment market increases the likelihood of a more significant Federal Reserve interest rate cut

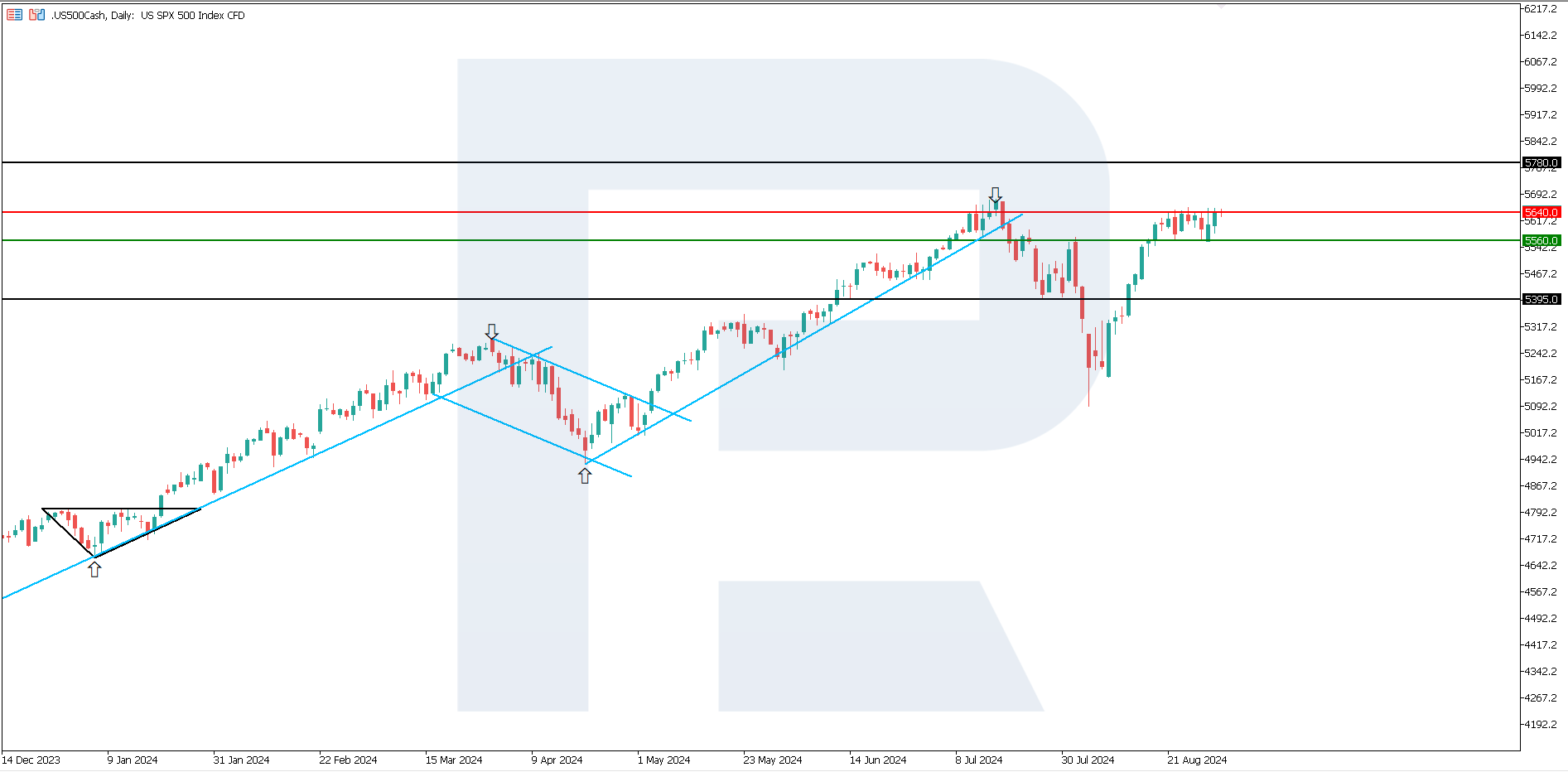

- Resistance: 5,640.0, Support: 5,560.0

- US 500 price forecast: 5,780.0

Fundamental analysis

The US Department of Labor reported late Thursday that US initial jobless claims decreased by 2,000 to 231,000 over the past week, while economists had expected the number of claims to be 230,000.

Source: https://tradingeconomics.com/united-states/jobless-claims

Overall claims increased by 13,000 to 1.87 million. The weakening of the US employment market signals an overall economic slowdown. Inflation is also easing and moving towards the Federal Reserve targets.

Market participants expect decisive actions from the Federal Reserve at the upcoming meeting regarding the key rate reduction. If the regulator continues to maintain the current monetary policy parameters, the US economy risks falling into a recession. Companies will have difficulty servicing and repaying their debts, which may increase the number of bankruptcies and unemployment. The US 500 forecast for next week remains moderately positive.

US 500 technical analysis

The US 500 stock index has recovered after a large-scale correction in early August this year. However, it has yet to reach a new all-time high. Market participants may require additional incentives from the US Federal Reserve. It is also worth noting that there is no clear trend.

Key levels in the US 500 index forecast:

- Resistance level: 5,640.0 – if the price breaks above this level, the subsequent growth target could be 5,780.0

- Support level: 5,560.0 – if the price breaks below the support level, it could decline further to 5,395.0

Summary

The US 500 stock index is aiming for a new all-time high. Market participants are likely anticipating the release of US employment market data this Friday. US initial jobless claims decreased by 2,000 to 231,000 over the past week, with the total number of claims increasing by 13,000 to 1.87 million. The US 500 price forecast suggests growth to 5,780.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.