US 30 analysis: slowing growth with signs of correction

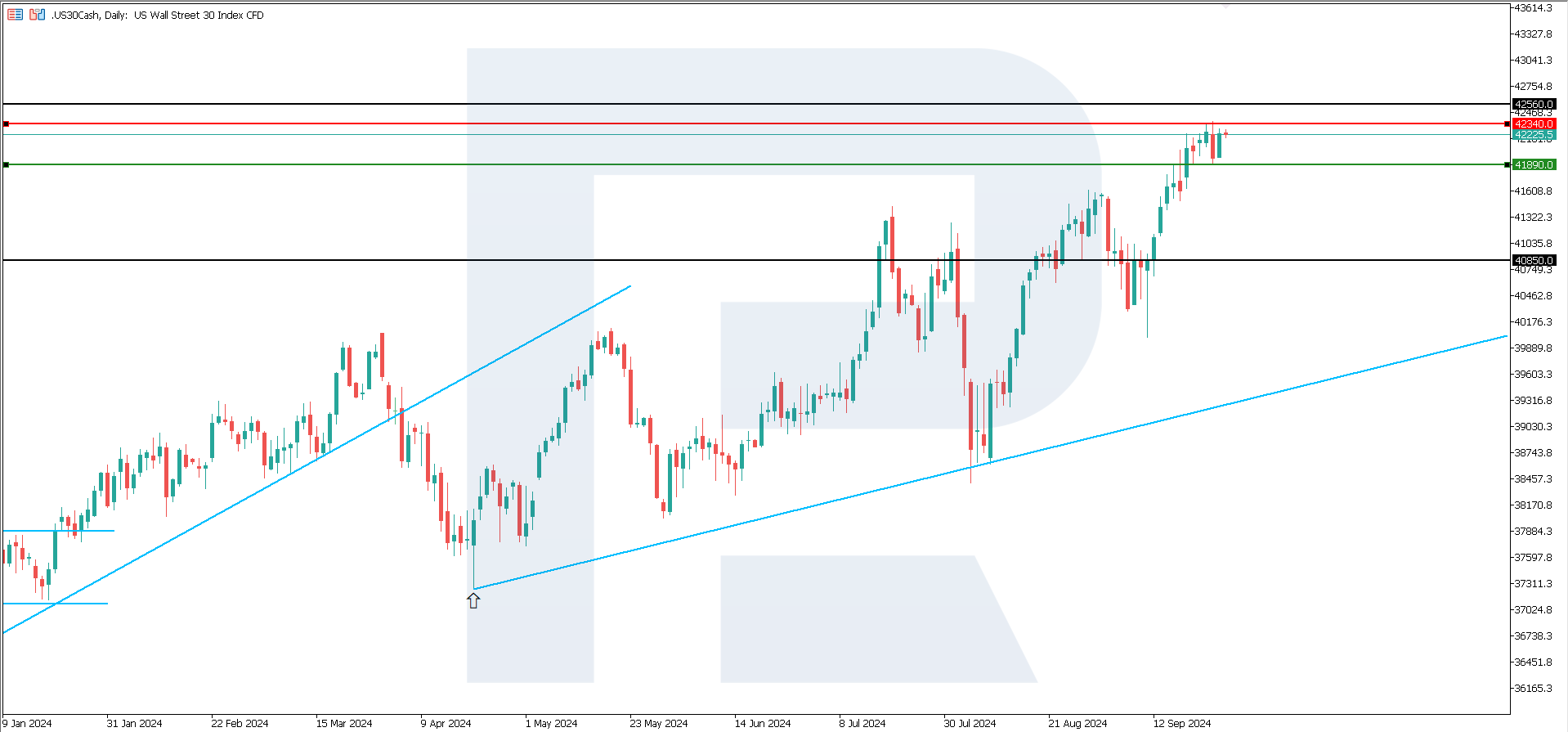

The US 30 stock index made several historic highs last week, but the growth rate is slowing down, and a corrective decline may be imminent. Therefore, the forecast for the US 30 for next week is negative.

US 30 forecast: key trading points

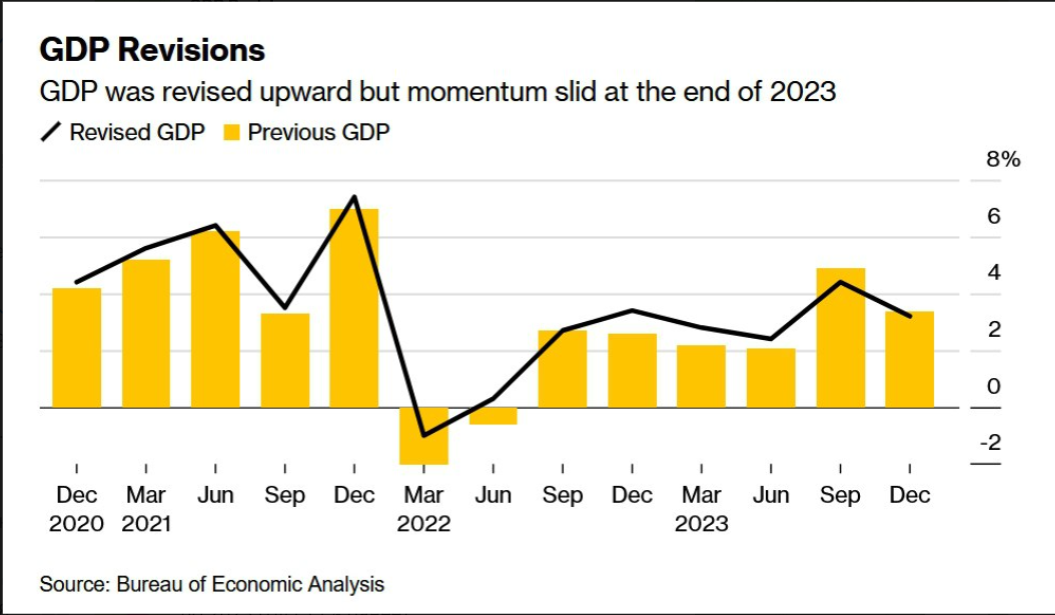

- Recent data: the US GDP growth rate has been revised up by 5.5% from Q2 2020 to 2023 (5.1% previously)

- Economic indicators: GDP growth reflects the state of the economy as a whole and its development prospects

- Market impact: investors tend to increase their investments in countries with growing GDP

- Resistance: 42,340.0, Support: 41,890.0

- US 30 price forecast: 40,850.0

Fundamental analysis

According to revised government data, the US economy has recovered from the pandemic on a larger scale than previously estimated, mainly due to higher consumer spending in 2022 and 2023.

GDP increased by 5.5% from Q2 2020 to 2023 (5.1% previously). US jobless claims fell to a four-month low (218k), indicating a slowdown in job growth.

Orders for business equipment at US factories rose modestly in August, demonstrating that companies are limiting investment ahead of the election and potential further reductions in borrowing costs. Recovery demand may increase as soon as credit rates are reduced. However, the downturn will not end until then. Therefore, the forecast for the US 30 is negative.

US 30 technical analysis

The US 30 stock index recovered relatively quickly after the decline in early August and resumed its upward trend. Growth is slowing down, with signs of an impending correction. From the point of view of technical analysis of US 30, the most likely breach of the current support level is 41,890.0, with a target of 40,850.0.

We can distinguish the following scenarios for the US 30 price outlook:

- Pessimistic US 30 forecast: if support at 41,890.0 holds, a potential decline could target 40,850.0

- Optimistic US 30 forecast: if resistance at 42,340.0 is breached, the index will rise to 42,560.0

Summary

According to the revised governmental data, the US GDP increased by 5.5% from Q2 2020 to 2023 (5.1% previously). The US 30 stock index has recovered relatively quickly after the early August downturn. Still, it is slowing down, and the likelihood of breaching the support level at 41,890.0 and moving towards 40,850.0 has increased.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.