US 30 analysis: historical highs expected to renew within the uptrend framework

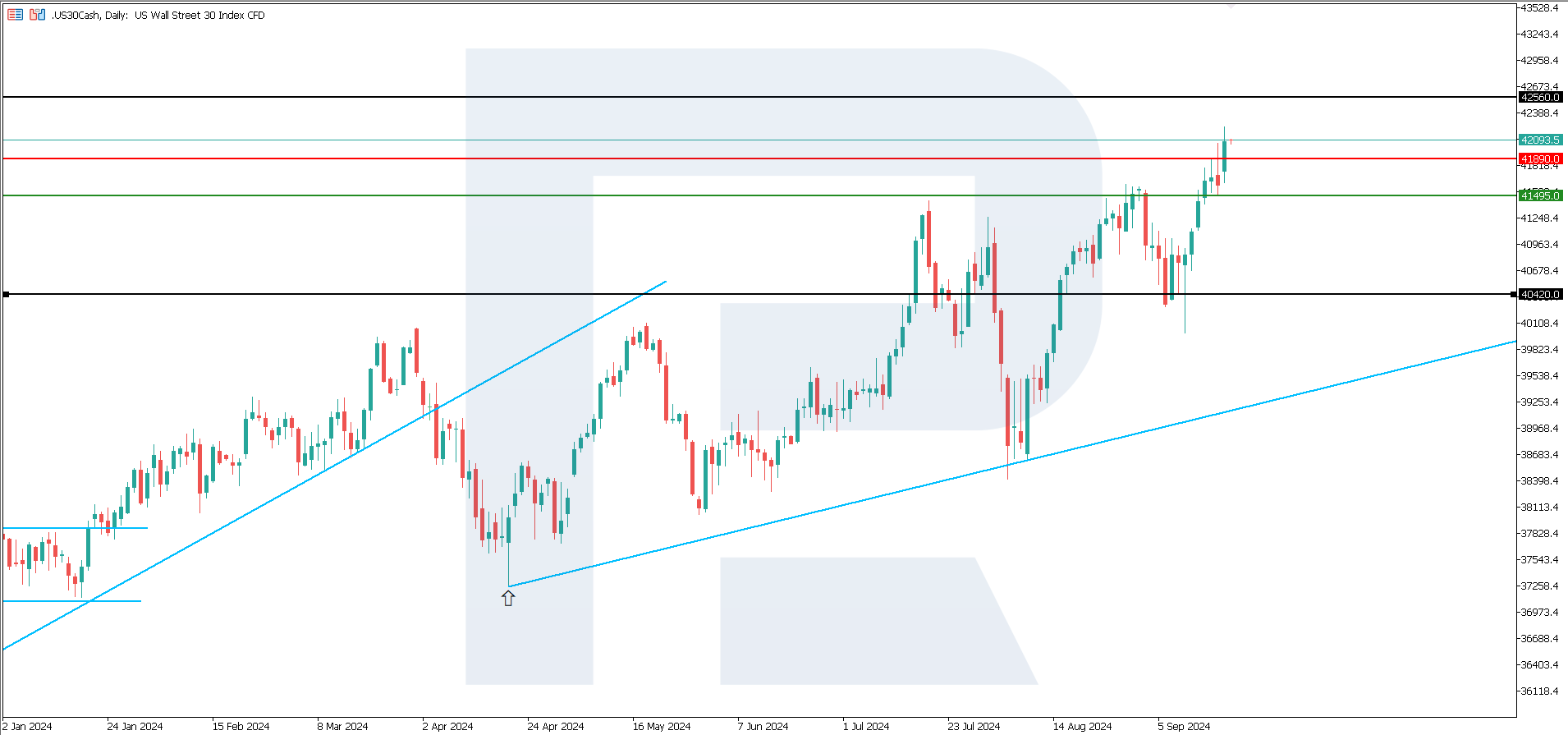

The US 30 stock index has shown remarkable strength as it continues its upward momentum and has hit all-time highs twice after the recent US Federal Reserve meeting. Analysis of the US 30 index remains optimistic, with a forecast indicating the potential for further gains as the uptrend solidifies. The US 30 forecast for the next week is also positive, with several key factors supporting the case for continued growth.

US 30 forecast: key trading points

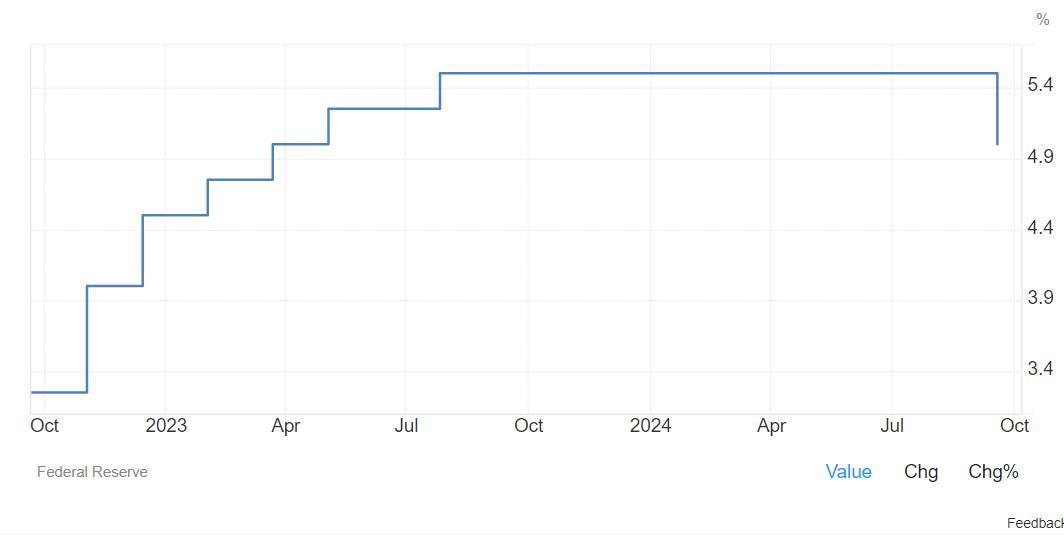

- Recent data: The US Fed cut its key interest rate by 0.5% to 5.0%

- Economic indicators: The Fed key rate determines the ‘cost of money’ in the economy, and its reduction leads to a fall in the cost of credit

- Market impact: a reduction in the discount rate positively affects the stock market in the long term

- Resistance: 41,890.0, Support: 41,495.0

- US 30 price forecast: 42,560.0

Fundamental analysis

The Federal Open Market Committee (FOMC) cut the benchmark interest rate by 50 basis points to 4.75-5.00%, the first rate cut in more than four years. All but one FOMC member supported this 50-bps rate cut.

Source: https://tradingeconomics.com/united-states/interest-rate

The Fed expects the benchmark rate to be at 3.40% by the end of 2025, stating that it will ‘carefully assess’ the economic outlook when deciding whether to cut interest rates again. The Fed raised the so-called neutral rate to 2.90% from 2.80%. According to a summary of economic forecasts, the Federal Reserve plans to cut the rate by another 50 points in the last two meetings of this year.

The US inflation rate is projected to continue declining and reach 2.00% in 2026. The Fed expects the US economy to grow at 2.00% in 2024 and remain at that level for the next three years. The Fed slightly lowered its gross domestic product growth estimate for this year to 2.0% from 2.1% in its June forecast. The unemployment rate forecast was raised to 4.4% at the end of this year, up from the previous forecast of 4.0% made just three months ago. These developments and the Fed’s plan to continue cutting rates offer a bullish outlook for the US 30 index.

US 30 technical analysis

The US 30 stock index continues to make new all-time highs within an uptrend. The resistance at 41,890.0 has been breached, and no new resistance has yet formed. From the technical analysis perspective, the US 30 index retains the potential for further growth. There is a high degree of probability that the index will continue to update its historical highs.

Key levels for US 30 price forecast:

- Resistance level: 41,890.0 - breached with a probable upside target of 42,560.0

- Support level: 41,495.0 - if support is breached, quotes may fall to 40,420.0

Summary

The US Fed’s decision to lower the interest rate to 5.00% represents the first easing of monetary policy in four years, signalling a supportive environment for stock market growth. The Fed’s inflation, GDP growth, and unemployment projections further reinforce the positive outlook for the economy, contributing to bullish sentiment regarding the US 30 index. With the index already breaking past 41,890.0, traders can anticipate further upside potential, with a target price of 42,560.0 in the coming weeks. The overall US 30 forecast, based on both technical and fundamental analysis, points to continued strength in the market.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.