JP 225 analysis: the index holds above 39,000.0

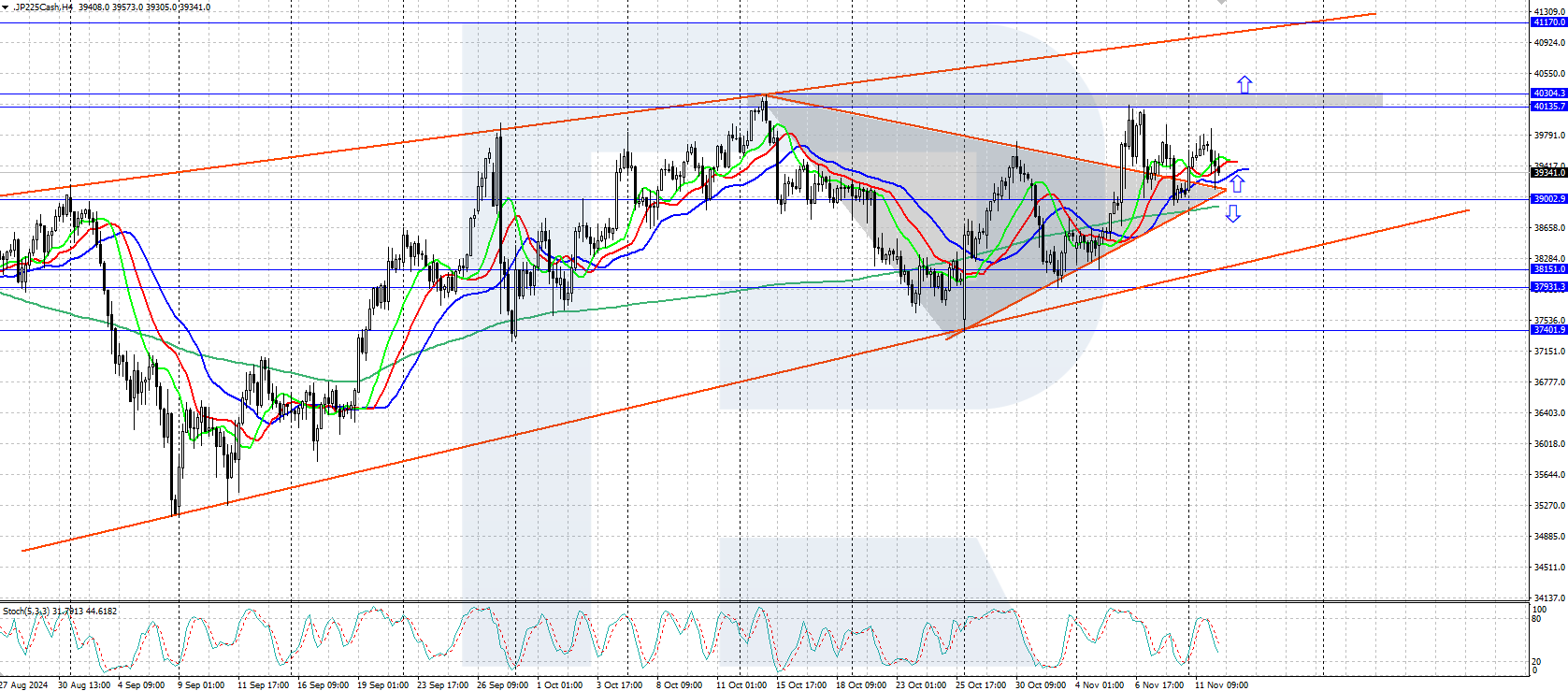

The JP 225 stock index is rising moderately, with a triangle pattern formed on the chart. The JP 225 forecast for the next week is positive.

JP 225 forecast: key trading points

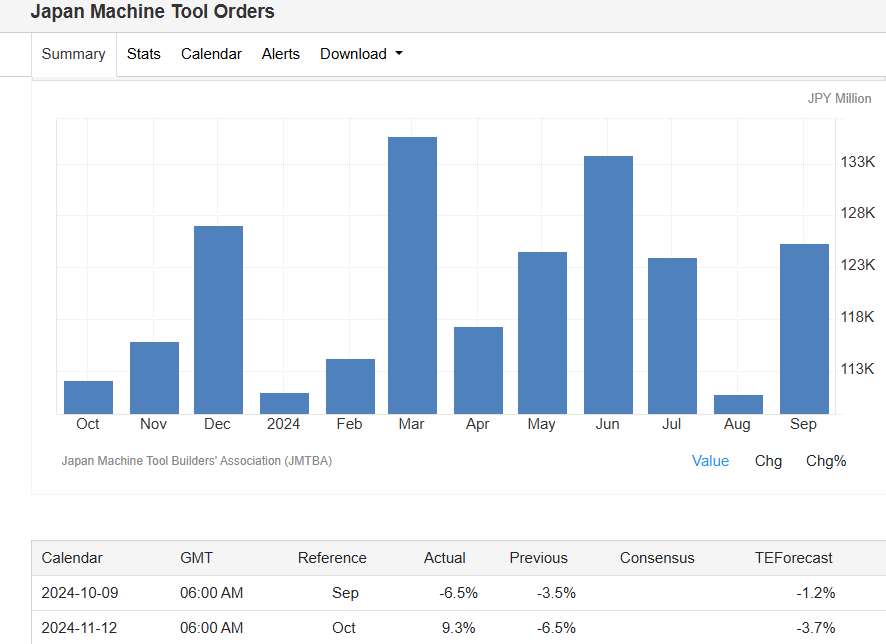

- Recent data: machine tool orders in Japan increased by 9.3%

- Economic indicators: these orders reflect the change in the total value of new orders placed with machine tool builders

- Market impact: the increase in orders positively impacts the country’s economy

- Resistance: 40,135.0, Support: 39,000.0

- JP 225 price forecast: 41,000.0

Fundamental analysis

The Japan Machine Tool Builders’ Association reported that Japan’s machine tool orders rose 9.3% year-on-year to 122.419 billion JPY in October 2024, recovering from a 6.5% decline the previous month. Growth was primarily driven by a 13.6% year-on-year increase in foreign orders.

Source: https://tradingeconomics.com/japan/machine-tool-orders

The JP 225 index gradually strengthens its position following the movements of the US stock market. The post-election rally sent the leading US indices to all-time highs, fuelled by optimism after Donald Trump’s victory in the presidential election and the Republican Party’s victory in Congress.

The Bank of Japan’s last meeting summary revealed a split among policymakers regarding the timing of future interest rate hikes. Some Board members expressed concerns over global economic uncertainty and rising market volatility, especially the ongoing yen decline. However, the central bank maintained its forecast, according to which it plans to raise the benchmark interest rate to 1.0% by the second half of fiscal 2025.

JP 225 technical analysis

The JP 225 stock index trades within an ascending price channel, with a triangle pattern formed on the chart. The quotes broke above the pattern’s upper boundary, suggesting further asset growth.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: if the price secures below the 39,000.0 support level, the index could plunge to 38,151.0

- Optimistic JP 225 forecast: a breakout above the 40,135.0 resistance level could drive the price to 41,000.0

Summary

The JP 225 stock index is rising moderately, with the triangle technical pattern formed on the chart. The forecast for next week is optimistic, with the asset likely to resume growth.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.