JP 225 analysis: the index is trading within a sideways channel again

The JP 225 stock index is again trading within a sideways channel between the current resistance and support levels without a clear trend. The JP 225 forecast for next week is pessimistic.

JP 225 forecast: key trading points

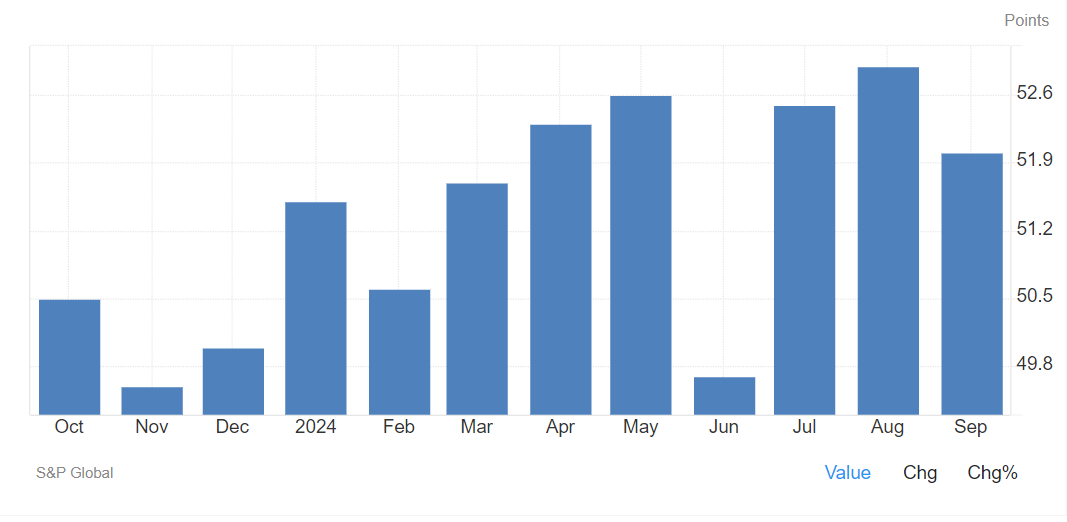

- Recent data: the Composite PMI reached 52 in September

- Economic indicators: the index reflects the level of business activity in the economy and is calculated based on data from the manufacturing and services sectors

- Market impact: a decrease in the Composite PMI may raise doubts among market participants about future economic growth

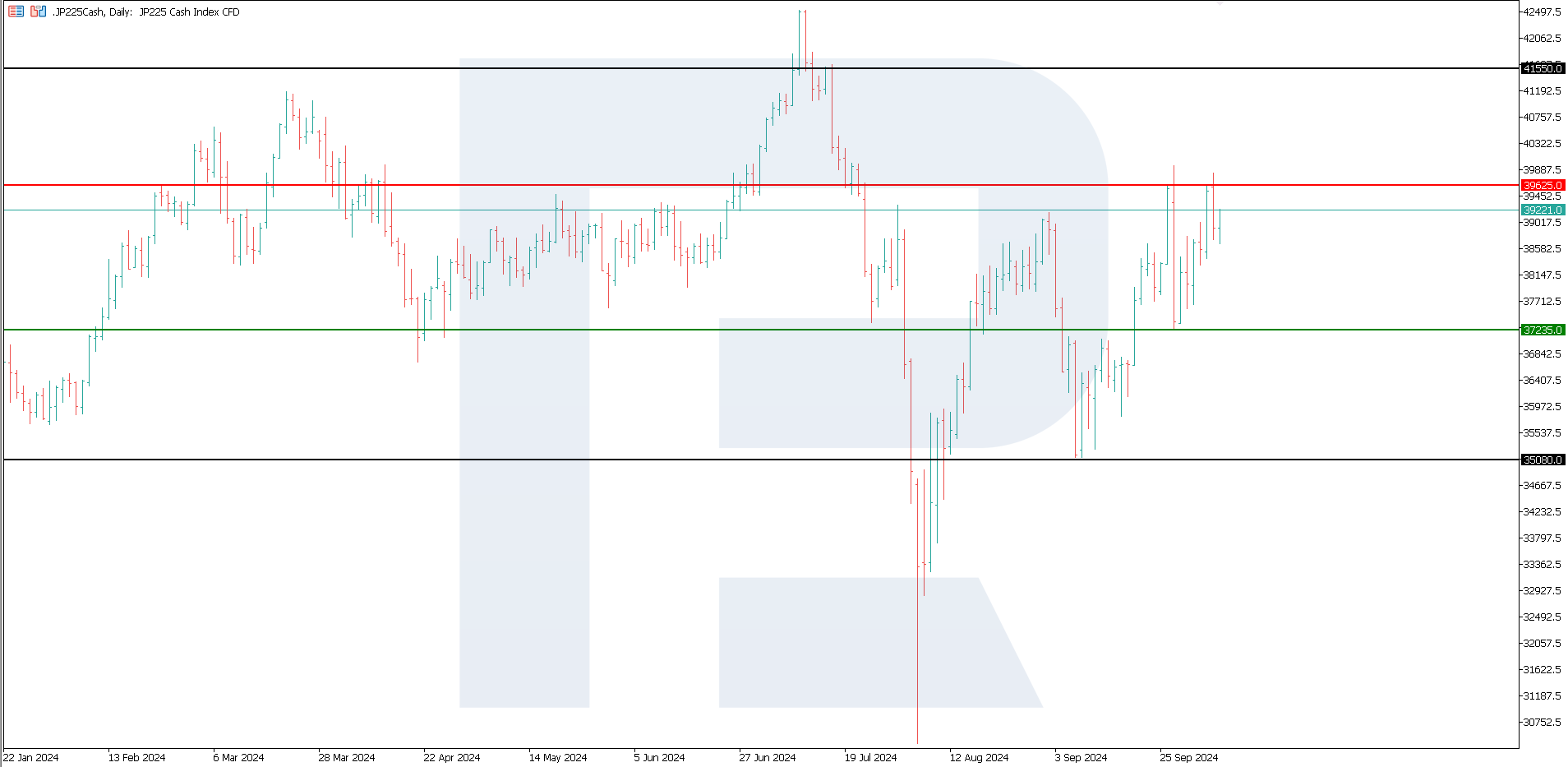

- Resistance: 39,625.0, Support: 37,235.0

- JP 225 price forecast: 35,080.0

Fundamental analysis

The Composite PMI reading of 52.0 (compared to 52.9 last month) indicates slower growth than in the previous period. Although the figure remains above 50.0, which suggests expansion, the slower growth rate may signal potential economic challenges in the coming months.

Source: https://tradingeconomics.com/japan/composite-pmi

The decrease in the Composite PMI points to an economic slowdown in Japan, which may lead to a short-term decline in stock prices, particularly in sectors sensitive to changes in the economic cycle. However, if investors expect additional stimulus measures from the central bank, this may support the market and even drive growth in certain sectors.

In turn, the Bank of Japan is not planning to reduce interest rates and is considering raising them by the end of the year. Given this, demand from non-resident investors in the stock market is unlikely, leaving domestic investors as the primary buyers. The JP 225 index forecast remains pessimistic.

JP 225 technical analysis

The JP 225 stock index is trading within a sideways channel. According to JP 225 technical analysis, there is no clear trend. However, the likelihood of a decline to the lows seen in early August 2024 is higher. A breakout below the current 37,235.0 support level will signal the beginning of a downtrend.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 37,235.0 support level could push the index down to 35,080.0

- Optimistic JP 225 forecast: a breakout above the resistance level could propel the index to 41,550.0

Summary

The JP 225 stock index is trading within a sideways channel. A pessimistic scenario of a decline to 35,080.0 is more likely. This trend is driven mainly by Japan’s negative economic figures and investor expectations. The regulator’s policy does not provide the necessary incentives for stock market growth.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.