JP 225 analysis: the index is trading within a sideways range between the current support and resistance levels

The JP 225 stock index remains in the sideways range without a clear trend, unable to fully recover from the decline in early August this year. The JP 225 forecast for next week is negative.

JP 225 forecast: key trading points

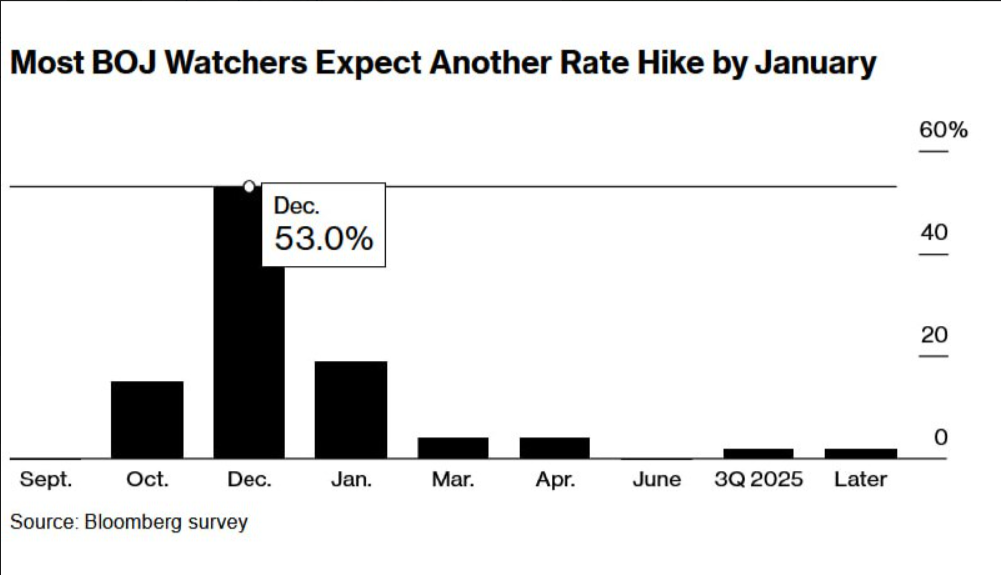

- Recent data: 53% of potential investors expect an interest rate hike in 2024, according to a Bloomberg survey

- Economic indicators: investor sentiment measures demand for various types of assets

- Market impact: the expectation of a BoJ key interest rate hike will support domestic investors’s interest in the debt market

- Resistance: 39,290.0, Support: 30,400.0

- JP 225 price forecast: 29,110.0

Fundamental analysis

According to a Bloomberg survey, 53% of investors expect the Bank of Japan to raise the interest rate in December this year. Demand will likely remain only for Japanese debt securities, while the stock market will be under pressure.

The Bank of Japan Policy Board will hold a two-day meeting that will end on 20 September. It is expected to leave monetary policy unchanged after two rate hikes this year. Economists expect further interest rate increases later this year or early next year. The BoJ stated that financial conditions remain favourable after two rate hikes.

Non-residents continue to reduce their investments in the Japanese stock market, with outflows reaching record highs over the past 12 months. At the moment, the JP 225 index forecast is negative.

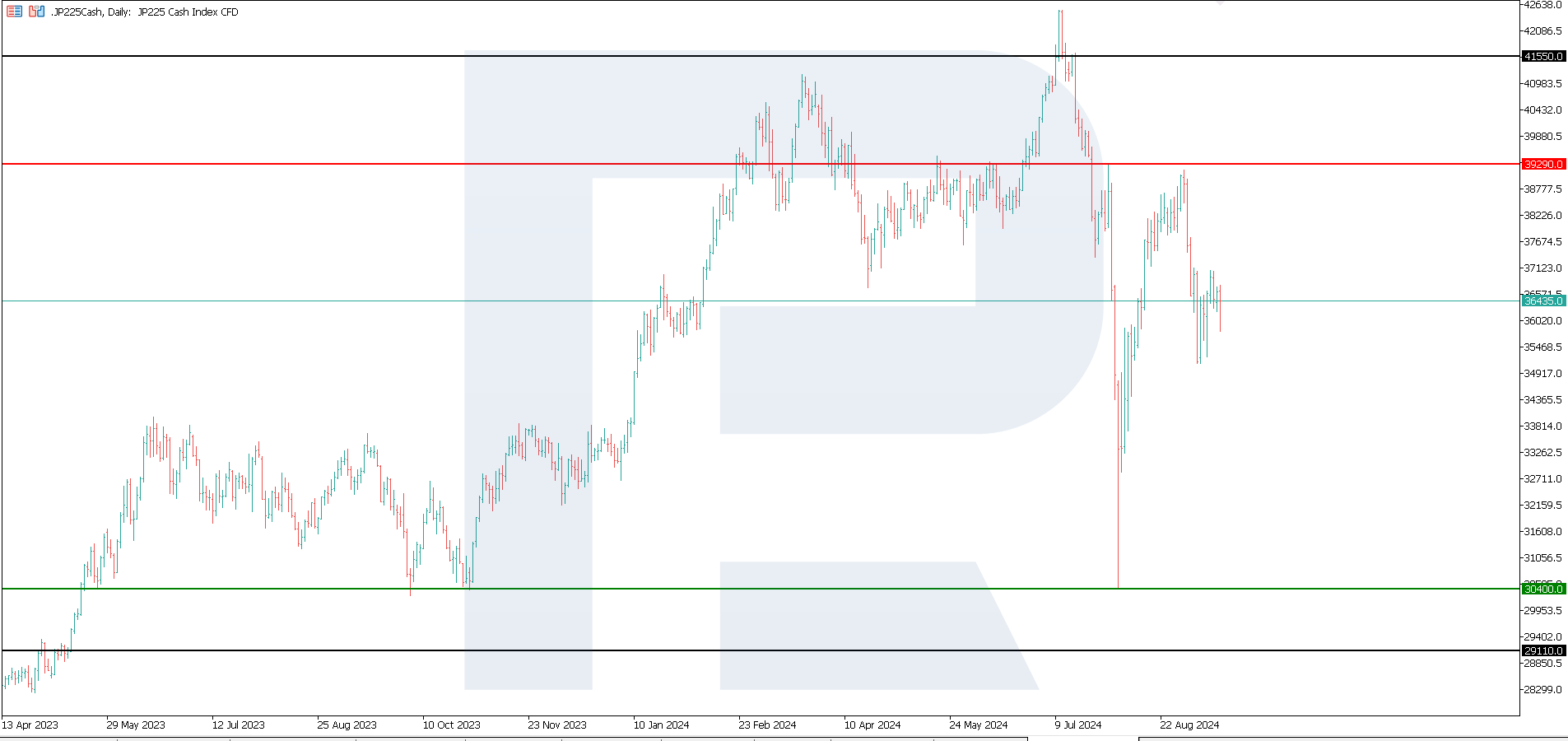

JP 225 technical analysis

The JP 225 index is in a sideways range, having failed to reach a new all-time high and recover from the decline in early August. In terms of technical analysis, after failing to surpass the 39,290.0 level, the JP 225 index could decline further and break below the 30,400.0 support level, heading towards 29,110.0.

Key levels for the JP 225 price forecast include:

- Resistance level: 39,290.0 – a breakout above this level could drive the price to 41,550.0

- Support level: 30,400.0 – a breakout below the support level could cause the price to decline to 29,110.0

Summary

According to Bloomberg data, 53% of investors expect the BoJ to raise interest rates in December this year. Japan’s central bank also sees no reason to change the current monetary policy. Demand for government bonds will probably remain unchanged. However, the stock market will highly likely remain under pressure.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.