JP 225 analysis: the price may remain in the channel for a long time

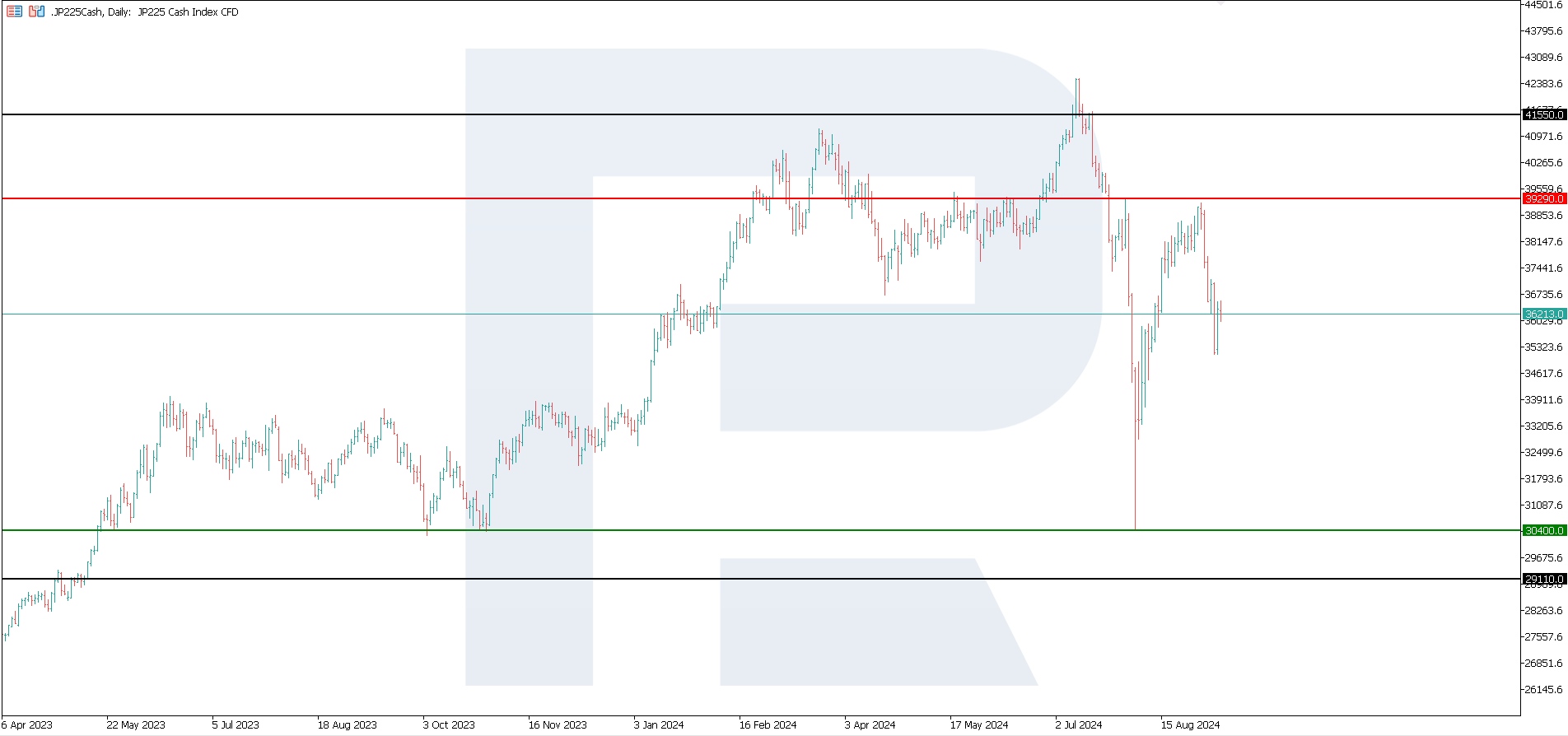

After recovering by 28.78%, the JP 225 stock index failed to break above the 39,290.0 resistance level. The JP 225 forecast is negative.

JP 225 forecast: key trading points

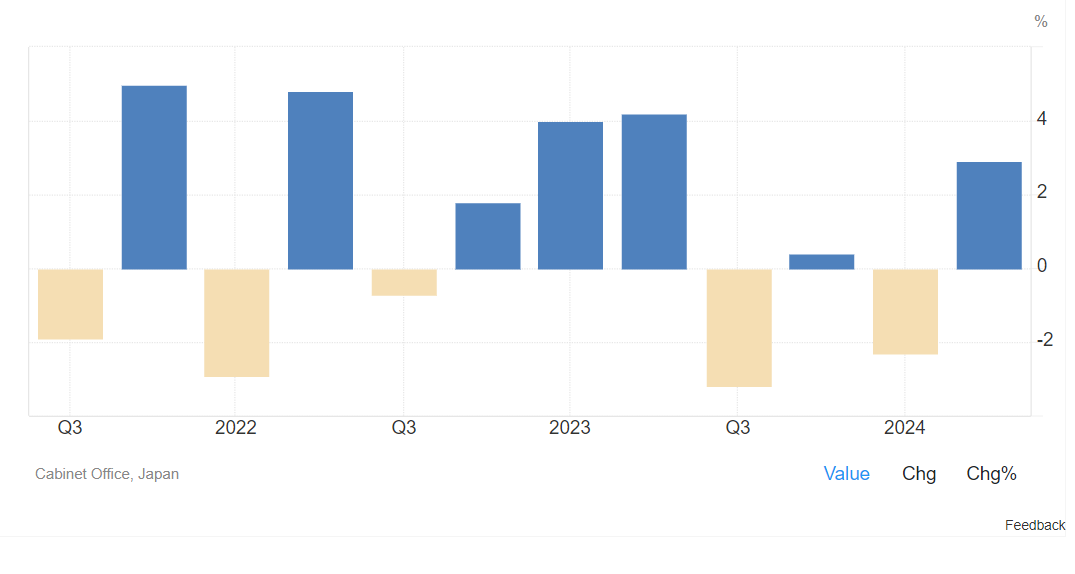

- Recent data: Japan’s GDP grew by 2.9% year-over-year in Q2 2024

- Economic indicators: GDP growth rates reflect the overall state of the Japanese economy

- Market impact: negative indicators (or those falling short of expectations) diminish the country’s investment prospects

- Resistance: 39,290.0, Support: 30,400.0

- JP 225 price forecast: 29,110.0

Fundamental analysis

Japan’s GDP grew by 2.9% year-over-year in Q2 2024, while analysts expected the reading to be 3.1%. In fact, economic growth rates do not meet the expectations of potential foreign investors.

Source: https://tradingeconomics.com/japan/gdp-growth-annualized

Japanese ministries have set a new record in their budget requests for the upcoming fiscal year in April 2025. The country is struggling with the need to increase social security and defence spending while maintaining control over its debt obligations. Amid monetary policy tightening, the latter is crucial for macroeconomic stability.

Bank of Japan Governor Kazuo Ueda reiterated that the central bank will continue to raise interest rates if the economy and prices are in line with the Bank of Japan’s expectations. Monetary policy tightening may increase investor interest in Japanese debt. The JP 225 forecast for next week is negative.

JP 225 technical analysis

In terms of technical analysis, the JP 225 may form a sideways channel between the current resistance and support levels. Without significant fundamental triggers, the quotes may stay in it for an extended period. However, the price is very likely to break below the support level, so the JP 225 price forecast is negative.

Key levels to watch in the JP 225 index include:

- Resistance level: 39,290.0 – a breakout above this level could propel the price to 41,550.0

- Support level: 30,400.0 – if the price breaks below the support level, the index may fall to 29,110.0

Summary

Japan’s GDP grew by 2.9% year-over-year in Q2 2024, although it was expected to increase by 3.1%. The Bank of Japan's head promises to maintain the current monetary policy parameters. The government intends to increase its spending for the upcoming fiscal year, which jeopardises macroeconomic stability. In terms of fundamental analysis, the JP 225 index will remain under pressure.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.