JP 225 analysis: the index reached its highest level in the past month

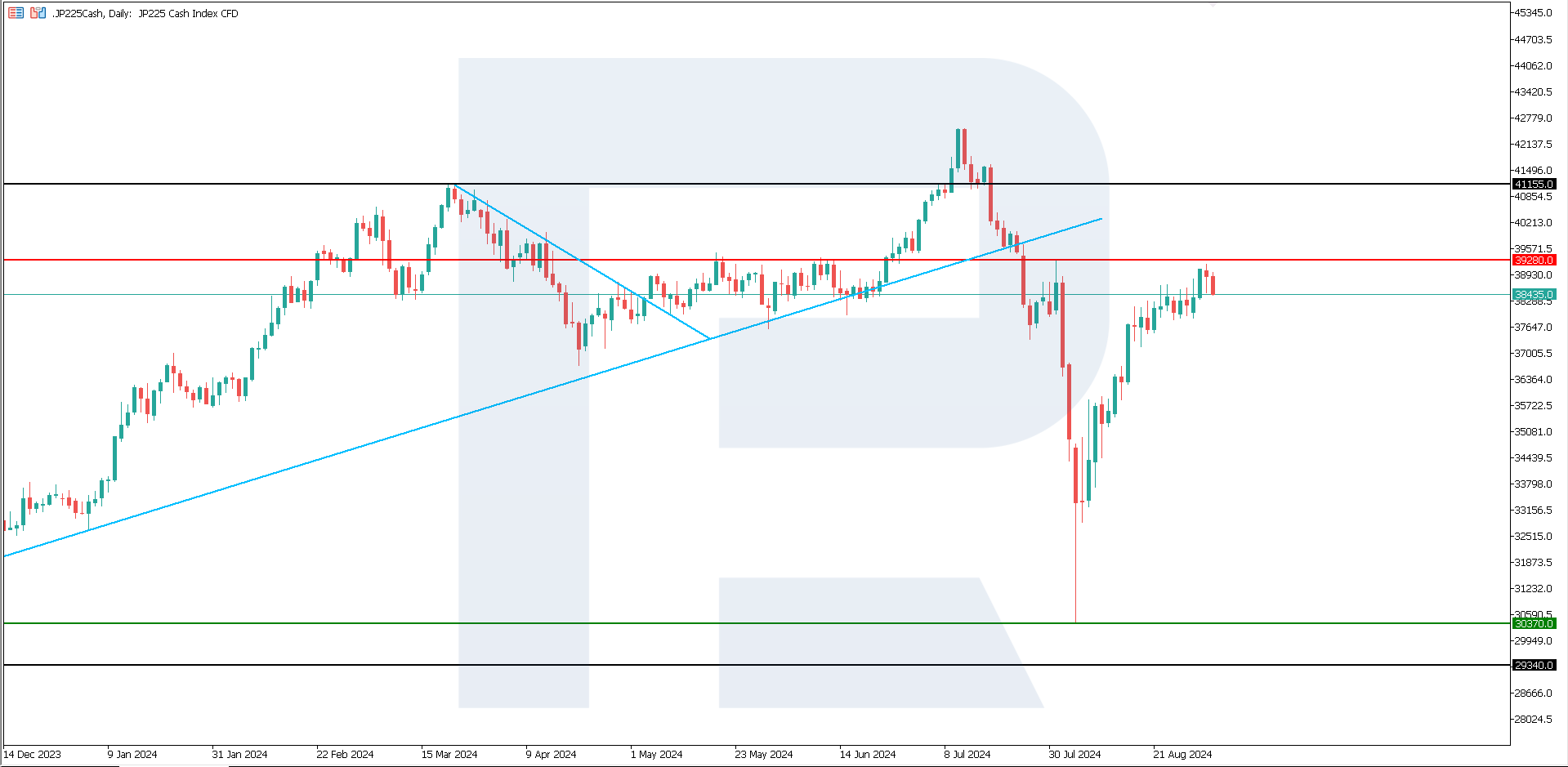

One of the primary sources of panic on 5 August was a decline in Japanese stocks: the JP225 index closed with a loss of 12.4%. However, it is now actively recovering, with quotes rising by 28.8% from their lows.

JP 225 forecast: key trading points

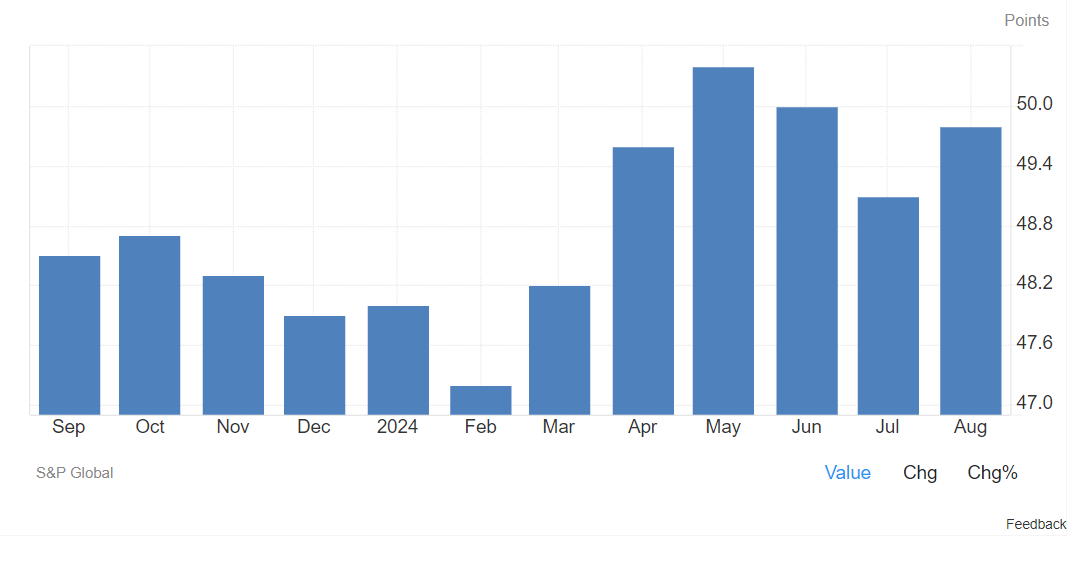

- Recent data: manufacturing PMI reached 49.8

- Economic indicators: the manufacturing sector is a significant part of Japan’s export-oriented economy

- Market impact: a reading above 50.0 indicates positive dynamics in manufacturing industries; however, this sector currently shows weakness in Japan

- Resistance: 39,280.0, Support: 30,370.0

- JP 225 price forecast: 41,155.0

Fundamental analysis

The manufacturing PMI reached 49.8 points, below the 50.0 level needed to indicate growth in this economic segment. However, it exceeded analysts’ expectations, who forecasted the PMI at 49.5 points.

Source: https://tradingeconomics.com/japan/manufacturing-pmi

Bank of Japan Governor Kazuo Ueda confirmed his readiness to raise borrowing costs if inflation moves steadily towards the 2% target. He signalled that recent market fluctuations would not interfere with the BoJ’s long-term plans.

However, Ueda warned that financial markets remain nervous, which may influence the Bank of Japan’s inflation outlook. This means that yen movements and stock prices will play a key role in deciding the timing of the next interest rate hike, supporting a moderately optimistic JP 225 forecast for next week.

JP 225 technical analysis

The JP 225 has been experiencing a local uptrend since 5 August 2024, but it remains relatively weak after the decline. The support and resistance levels formed after a 12.4% fall have yet to be breached. Therefore, the JP 225 forecast may be considered moderately optimistic. However, according to the JP 225 technical analysis, the price is not expected to reach an all-time high soon.

Key levels for the JP 225 price forecast include:

- Resistance level: 39,280.0 – a breakout above this level could enable the price to rise to 41,155.0

- Support level: 30,370.0 – a breakout below the support level may push the index down to 29,340.0

Summary

The JP 225 stock index has renewed its highest level from last month. It recovered after the decline on 5 August, showing a relative growth of 28.8%. The further growth target is at the 41,155.0 level. As a result, the JP 225 index forecast is moderately optimistic.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.