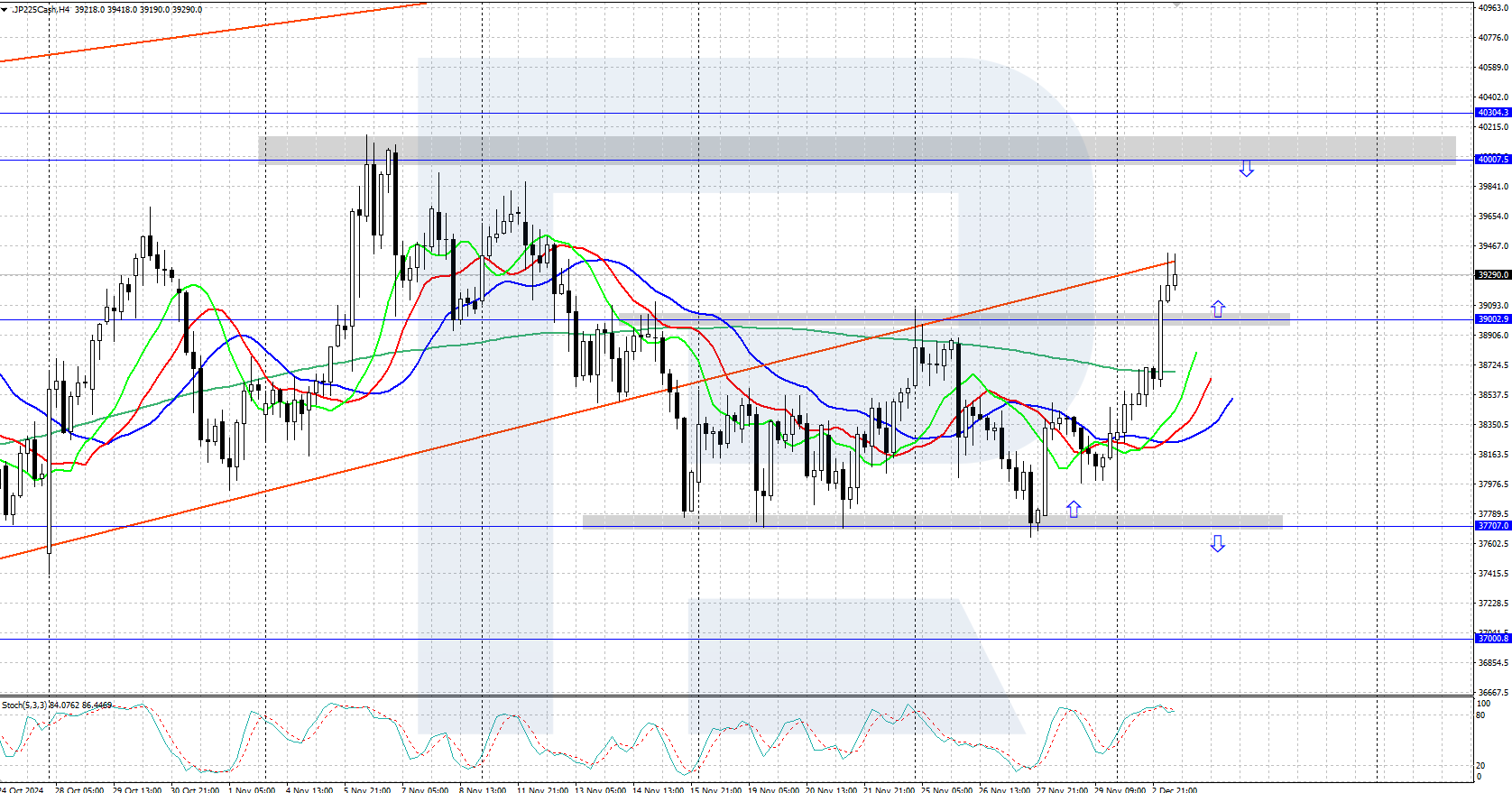

JP 225 analysis: the index rises above 39,000.0

The JP 225 stock index experiences upward momentum on the chart, securing a position above 39,000.0. The JP 225 forecast for next week is positive.

JP 225 forecast: key trading points

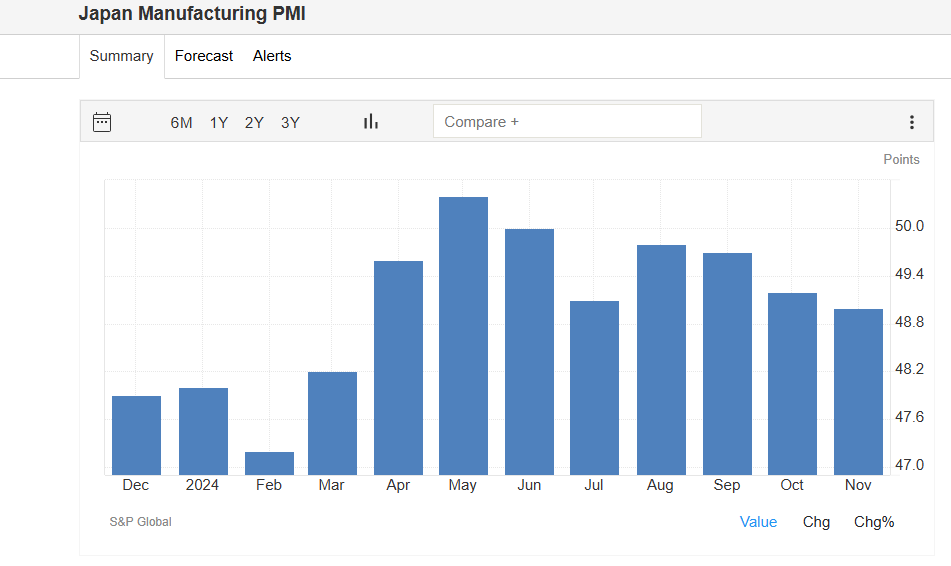

- Recent data: the Jibun Bank Japan manufacturing PMI dropped to 49.0 points in November

- Economic indicators: this is a leading indicator that measures business activity in Japan’s manufacturing sector

- Market impact: an increase in the index indicates a positive trend in the Japanese manufacturing industry, while a decrease signals a negative trend

- Resistance: 40,000.0, Support: 39,000.0

- JP 225 price forecast: 39,900.0

Fundamental analysis

The Jibun Bank Japan manufacturing PMI fell to 49.0 points in November, the lowest reading since March 2024. This marks the fifth consecutive month of declining manufacturing activity amid a steady decrease in new orders and subdued domestic and international demand.

Source: https://tradingeconomics.com/japan/manufacturing-pmi

The JP 225 index showed substantial gains on Tuesday following the rise of US stock indices S&P 500 and Nasdaq Composite, which reached new all-time highs, driven by the outperformance of major US tech companies. The biggest gainers in the Japanese stock market were Disco (+6.1%), Lasertec (+4.3%), and Tokyo Electron (+4.3%).

Last weekend, Bank of Japan Governor Kazuo Ueda stated that further interest rate hikes are approaching as economic data aligns with expectations. The markets estimate the likelihood of a 25-basis-point December interest rate hike at approximately 60%.

JP 225 technical analysis

The JP 225 stock index shows upward momentum, securing a position above 39,000.0. The index now has the potential for growth towards the psychologically significant resistance level of 40,000.0.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: if the price falls below the 39,000.0 support level, the index could drop to 37,700.0

- Optimistic JP 225 forecast: if the price secures above 39,000.0, the index could rise to 40,000.0

Summary

Following the lead of major US indices, the JP 225 stock index has shown steady growth and has secured a position above 39,000. The forecast for the index next week is positive.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.