World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 11 April 2025

The US government's decision to postpone new tariffs triggered a rally in global indices. Find out more in our analysis and forecast for global indices for 11 April 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: US President Donald Trump suspended reciprocal tariffs for 90 days

- Market impact: investors were enthusiastic about the news, with demand for stocks rising significantly

Fundamental analysis

With the introduction of tariffs, major US companies could see lower revenues and income. For example, the Magnificent Seven corporations have more than half of their sales outside the US. Reciprocal tariffs would have had a devastating effect on their financial performance. The Japanese and German export-oriented economies would also come under pressure.

With such harsh statements about new tariffs and panic in the stock market, the US authorities probably sought to reduce the 10-year Treasury bond yield. The decline in the stock market boosts demand for these assets. However, it faded away on the third day, with yields rising again. Thus, the budget deficit issue will unlikely be solved. For this reason, the US authorities cancelled their decision to impose reciprocal tariffs.

US 30 technical analysis

The US 30 stock index rose by 7.87% at the end of yesterday’s trading session, marking a record since 2020. The support level formed at 37,060.0. Despite the general optimism, the global trend remains downward. If the support level does not break, a sideways channel will likely form.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 37,060.0 support level could send the index down to 35,060.0

- Optimistic US 30 forecast: a breakout above the 42,535.0 resistance level could drive the index to 43,890.0

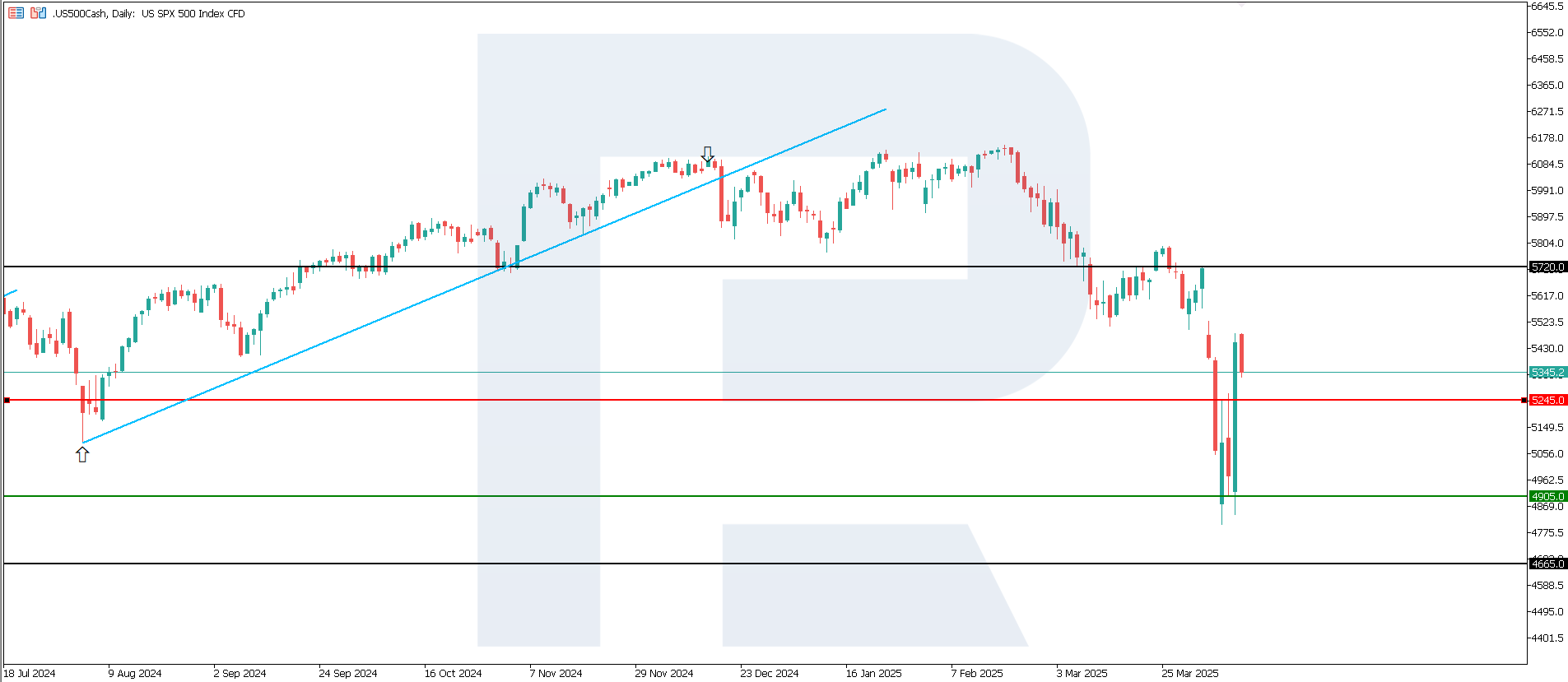

US 500 technical analysis

The US 500 stock index has seen record gains since 2008, adding 9.51%. The support level shifted to 4,905.0, with resistance at 5,245.0. The latter was breached when the price corrected upwards, indicating the beginning of an uptrend.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 4,905.0 support level could send the index down to 4,665.0

- Optimistic US 500 forecast: if the price consolidates above the previously breached resistance level at 5,245.0, the index could climb to 5,720.0

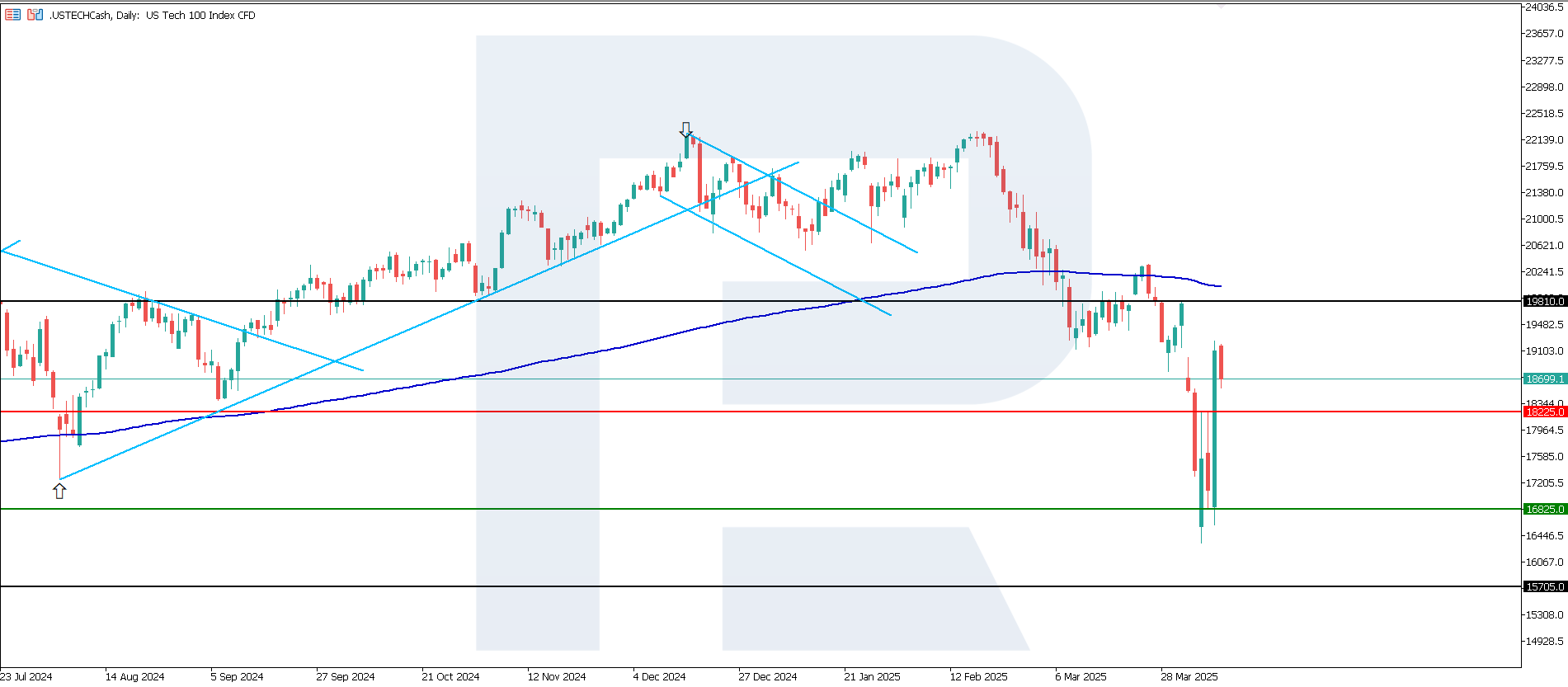

US Tech technical analysis

The US Tech index soared by 12.16%, a record since 2021. The price broke above the 18,225.0 resistance level, with the support level at 16,825.0. However, the index is still trading below the 200-day Moving Average, indicating the unsustainability of the uptrend.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 16,825.0 support level could push the index down to 15,705.0

- Optimistic US Tech forecast: if the price consolidates above the previously breached resistance level at 18,225.0 resistance level, the index could rise to 19,810.0

Asian index forecast: JP 225

- Recent data: Japan’s current account totalled 4.06 trillion JPY in February

- Market impact: the indicator is ambiguous for investors as it may strengthen the yen and put pressure on stocks of exporting companies

Fundamental analysis

The current account totalled 4.06 trillion JPY in February. A positive reading (surplus) indicates that more money is coming into the country than going out due to exports, investment, and other foreign economic transactions.

A current account surplus typically points to an inflow of foreign currency and may strengthen the yen. A strong yen could negatively impact the competitiveness of exporters, putting pressure on their shares. However, the big news right now is a 90-day postponement of US tariffs.

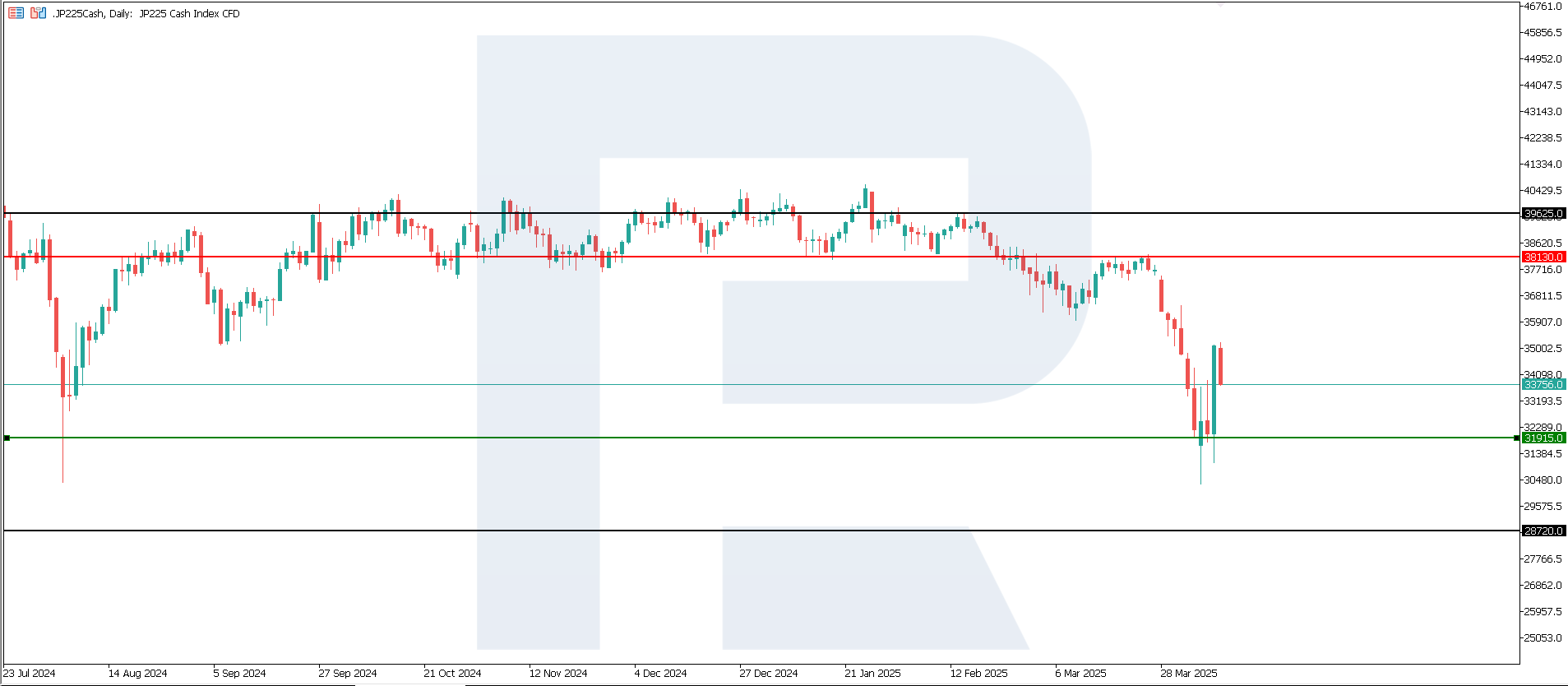

JP 225 technical analysis

The JP 225 stock index has formed a giant channel between the current support and resistance levels. The global trend remains negative. A false breakout below the 31,915.0 support level is possible, followed by an upward reversal of the trend.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 31,915.0 support level could send the index down to 28,720.0

- Optimistic JP 225 forecast: a breakout above the 38,130.0 resistance level could propel the index to 39,635.0

European index forecast: DE 40

- Recent data: Germany’s manufacturing PMI came in at 48.3 in March

- Market impact: growth from the February indicator may bolster investor confidence

Fundamental analysis

Although the PMI remains below 50.0, signalling a contraction in the sector, the current reading of 48.3 is up from the previous value of 46.5. This suggests that the rate of contraction in production is slowing down, and the situation in the industry is improving. The rate of decline in the manufacturing sector is slowing, which is potentially favourable for the equity market.

Although the reading of 48.3 signals an ongoing downturn in the German manufacturing sector, the uptick from the previous month points to easing negative trends, which may have a moderately positive impact on the German stock market.

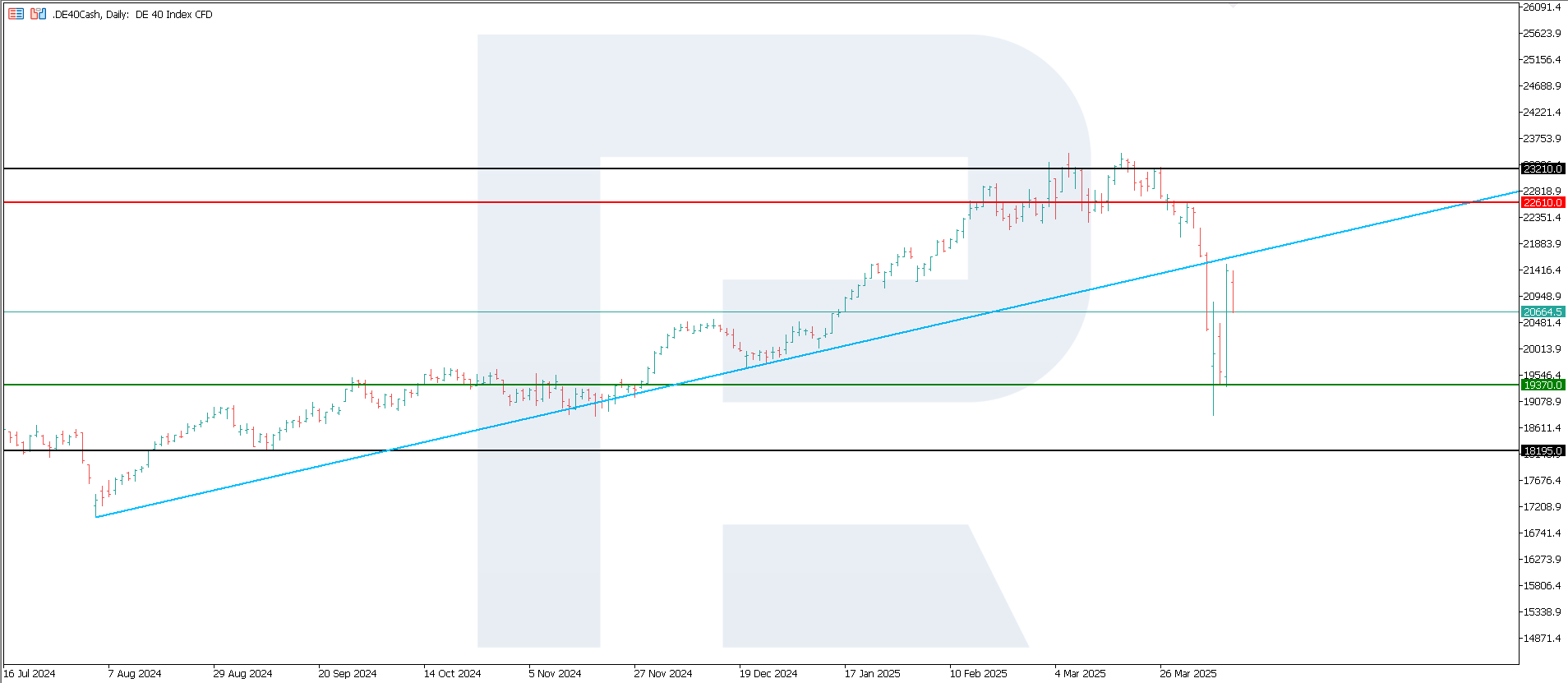

DE 40 technical analysis

Despite growing by more than 11%, the DE 40 stock index remains in a downtrend. A sideways channel is possible. The support level formed at 19,370.0 after a correction.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 19,370.0 support level could push the index down to 18,195.0

- Optimistic DE 40 forecast: a breakout above the 22,610.0 resistance level could drive the index to 23,210.0

Summary

The US government’s decision to pause reciprocal tariffs for 90 days triggered a rally in all global indices. However, not all of them entered an uptrend, with sideways channels and the absence of a directional trend possible as the tariff delay creates uncertainty. The US 500 and US Tech indices are the only ones to confidently enter the uptrend.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.