World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 19 December 2024

US indices forecast: US 30, US 500, US Tech

- Recent data: the US Federal Reserve cut the key interest rate by 25 basis points to 4.25-4.50%

- Market impact: the key rate directly affects the stock market in the medium term, with a rate cut driving growth in sectors dependent on cheap money

Fundamental analysis

The rate cut makes loans more affordable for businesses and consumers, stimulating economic activity. Companies can access to cheaper loans, which may increase investments and profits. Low interest rates make bonds and deposits less attractive to investors, driving interest towards stocks.

The Fed’s decision signals its commitment to supporting the economy, which boosts investor confidence. The rate cut could spur consumer and investment spending, potentially increasing inflationary pressures. This may pose a risk factor moving forward. For this reason, the US Federal Reserve does not intend to rush with key rate cuts in 2025, which the market had not anticipated. This statement could be the main reason for the correction in global stock markets. The US 30, US 500, and US Tech index forecast is moderately positive in the medium term.

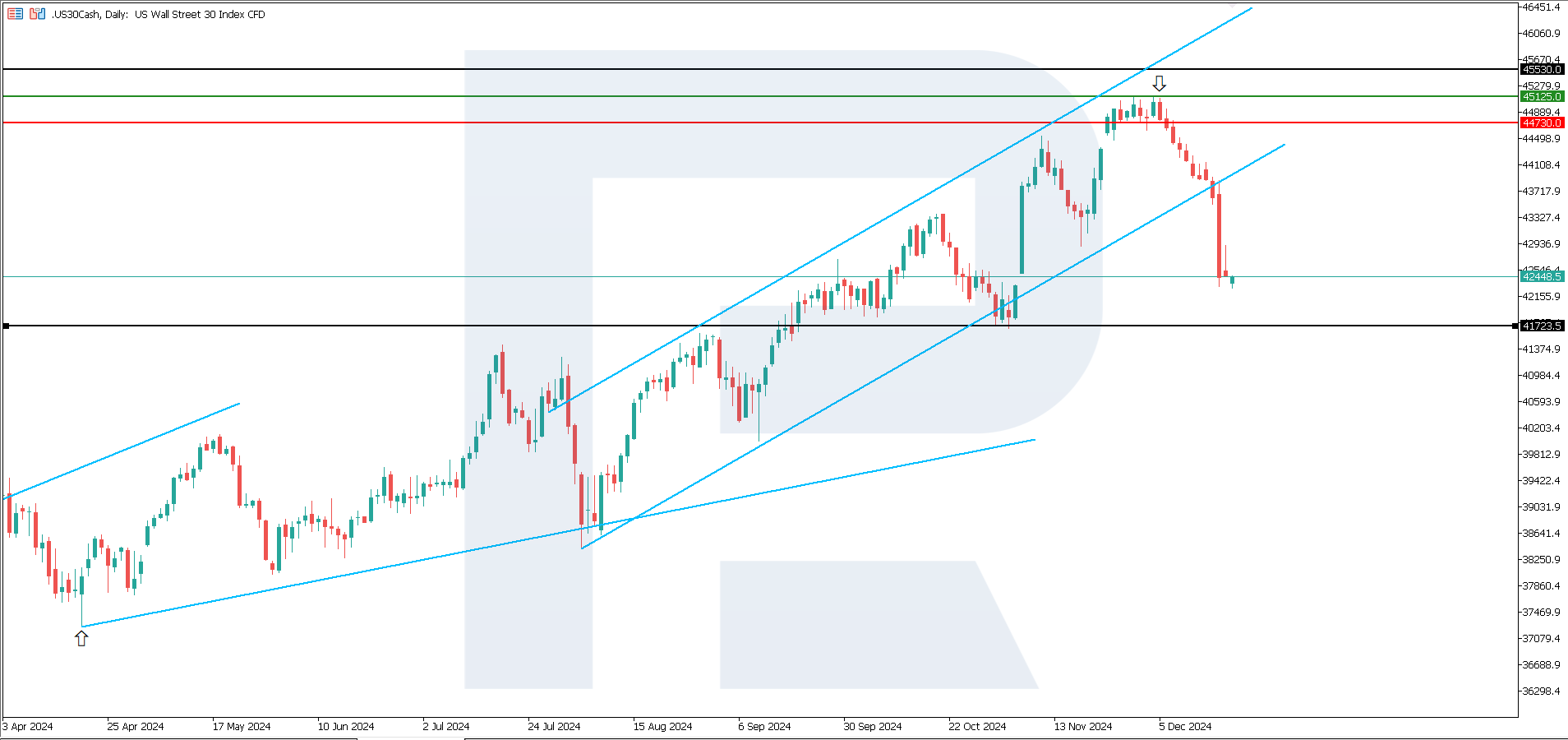

US 30 technical analysis

According to technical analysis, the US 30 stock index entered a downtrend, but it will unlikely be prolonged. A breakout of the ascending channel indicates a relatively strong bearish position. However, the potential for a decline is limited, and once it ends, the index may resume growth towards the end of the year.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 44,730.0 support level could push the index down to 41,720.0

- Optimistic US 30 forecast: a breakout above the 45,125.0 resistance level could propel the price to 45,530.0

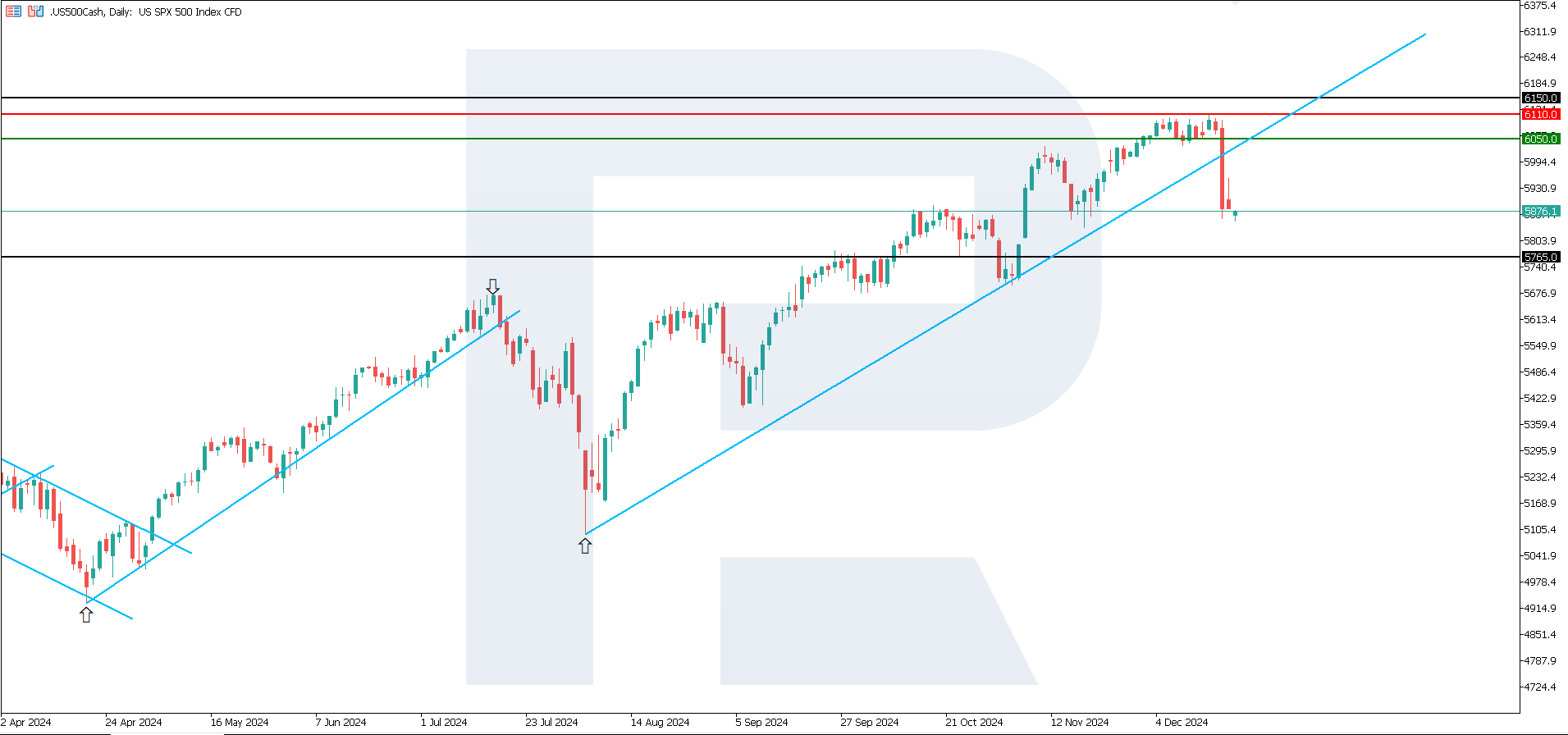

US 500 technical analysis

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 6,050.0 support level could send the index down to 5,765.0

- Optimistic US 500 forecast: a breakout above the 6,110.0 resistance level could drive the index to 6,150.0

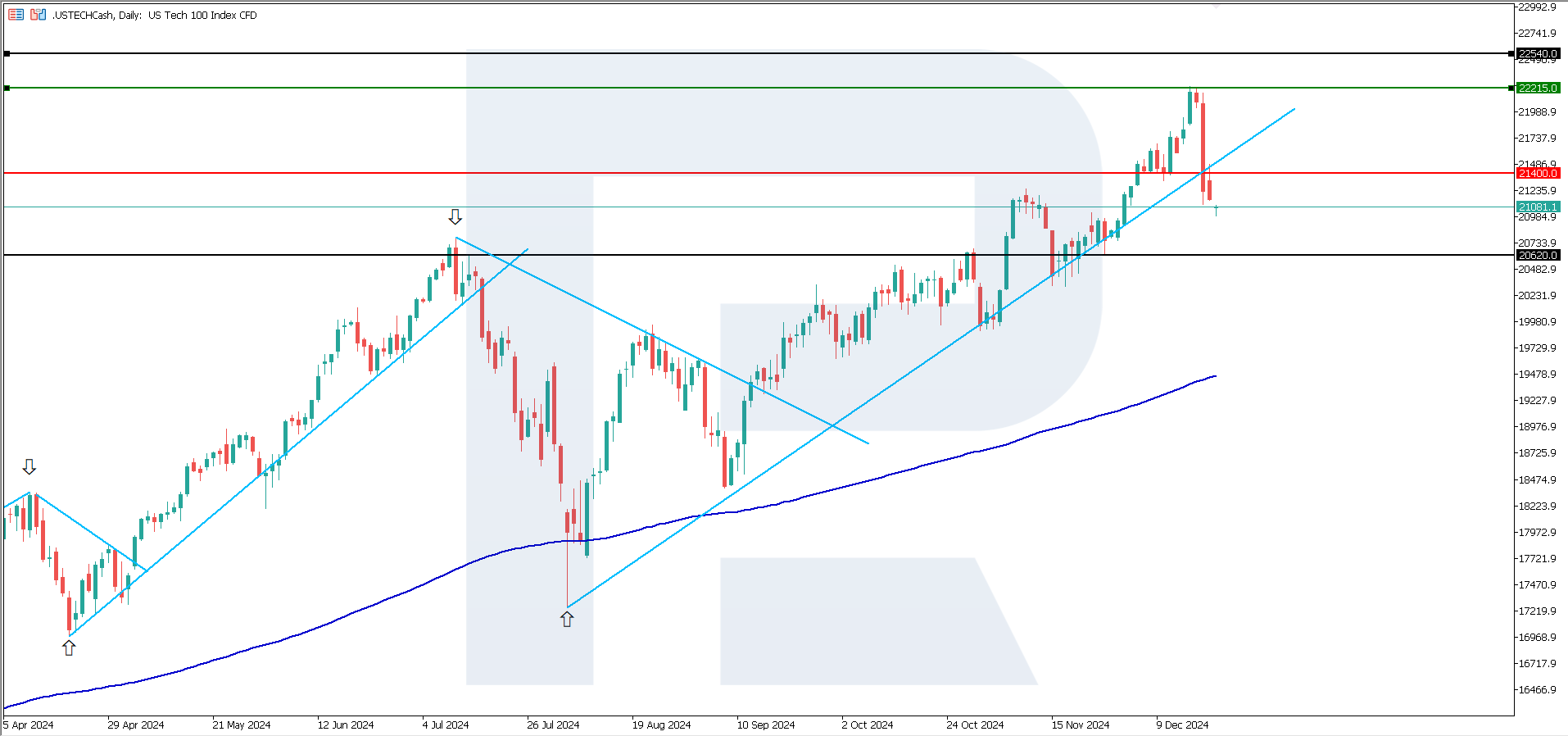

US Tech technical analysis

The US Tech stock index plunged more than others, falling by over 5%. According to the US Tech technical analysis, the decline is expected to continue but will unlikely be sustained. A sideways range will likely form, and the uptrend is expected to resume, targeting a new all-time high before the year ends.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 21,400.0 support level could push the index down to 20,620.0

- Optimistic US Tech forecast: a breakout above the 22,215.0 resistance level could propel the index to 22,540.0

Asia index forecast: JP 225

- Recent data: the Composite Purchasing Managers’ Index (PMI) for December preliminarily came in at 50.8 points

- Market impact: a reading above 50.0 indicates overall economic growth, which is likely to boost investor sentiment

Fundamental analysis

The composite PMI shows that Japan’s economy has resumed moderate growth, driven by the services sector. The manufacturing PMI remained below 50, indicating a downturn in the manufacturing sector. The improvement from the previous reading suggests some stabilisation. Growth in the services sector shows recovering consumer activity.

Positive data from the services sector could stimulate stock market growth, especially in companies focused on domestic demand. However, the ongoing decline in the manufacturing PMI could deter investors from investing heavily in this sector. As a result, they will closely monitor the Bank of Japan’s interest rate decision. The JP 225 index forecast is moderately negative.

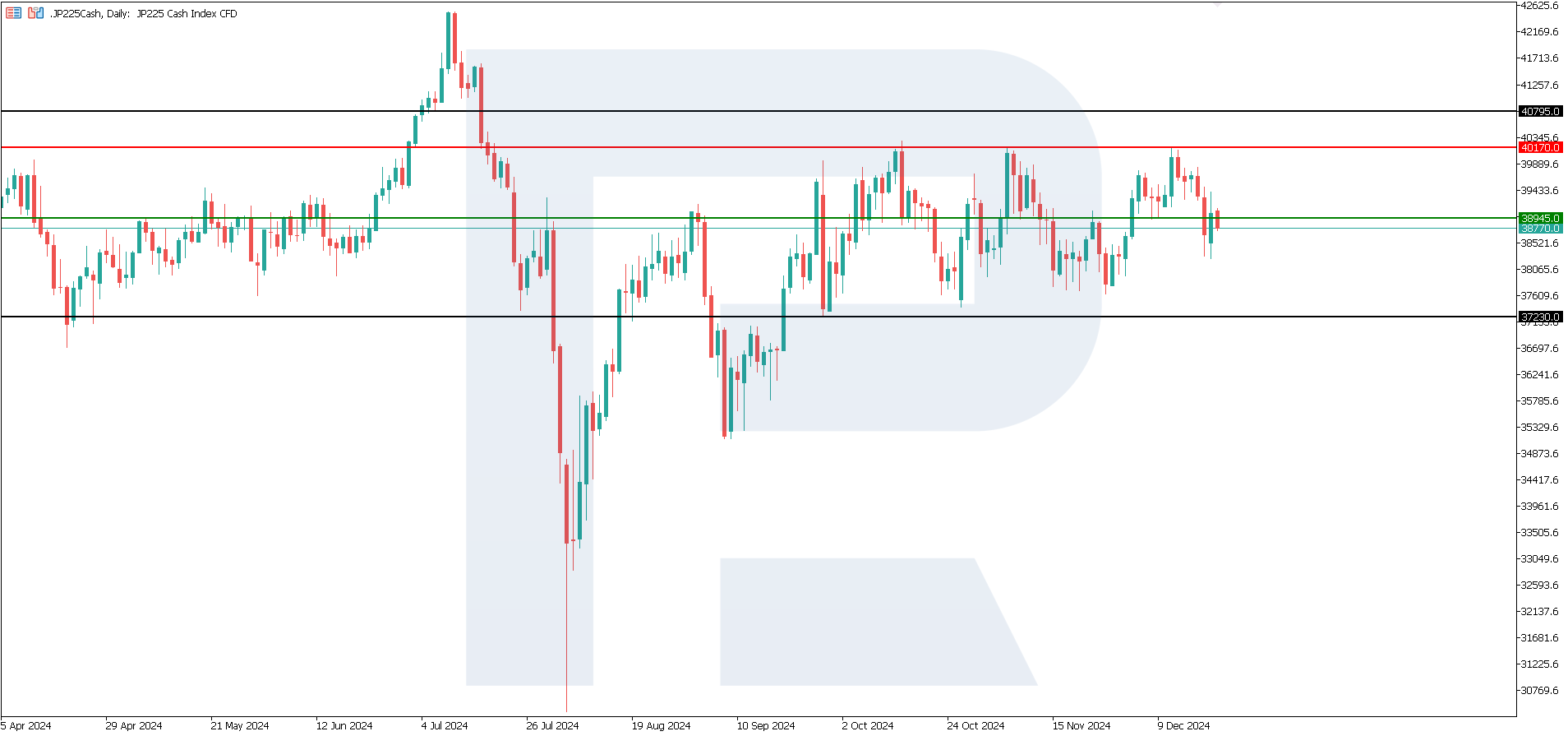

JP 225 technical analysis

The JP 225 stock index has traded within a global sideways channel since mid-summer 2024. According to the JP 225 technical analysis, there are no indications of a sustained uptrend. If the price secures above the previously breached support level at 38,945.0, the decline will halt, and a local sideways channel will form.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 38,945.0 support level could send the index down to 37,230.0

- Optimistic JP 225 forecast: a breakout above the 40,170.0 resistance level could push the index to 40,750.0

European index forecast: DE 40

- Recent data: the ZEW Economic Sentiment Index came in at 15.7 points

- Market impact: the indicator reflects the expectations of economists and analysts regarding economic activity for the next six months. Readings above zero indicate optimism, while those below zero signal pessimism

Fundamental analysis

The ZEW Economic Sentiment Index came in at 15.7 points, well above expectations of 6.8 and the previous reading of 7.4. This signals an improvement in economic expectations despite current challenges. Experts expect the situation to improve, likely due to reduced risks of an energy crisis and high inflation.

This could reflect optimism regarding stabilising economic activity and a potential recovery in 2025. The improved sentiment may be linked to signs of easing inflation, measures by the European Central Bank, and the resilience of the German manufacturing industry. As the improved sentiment boosts investor confidence, the stock market could experience growth. The DE 40 index forecast is moderately optimistic.

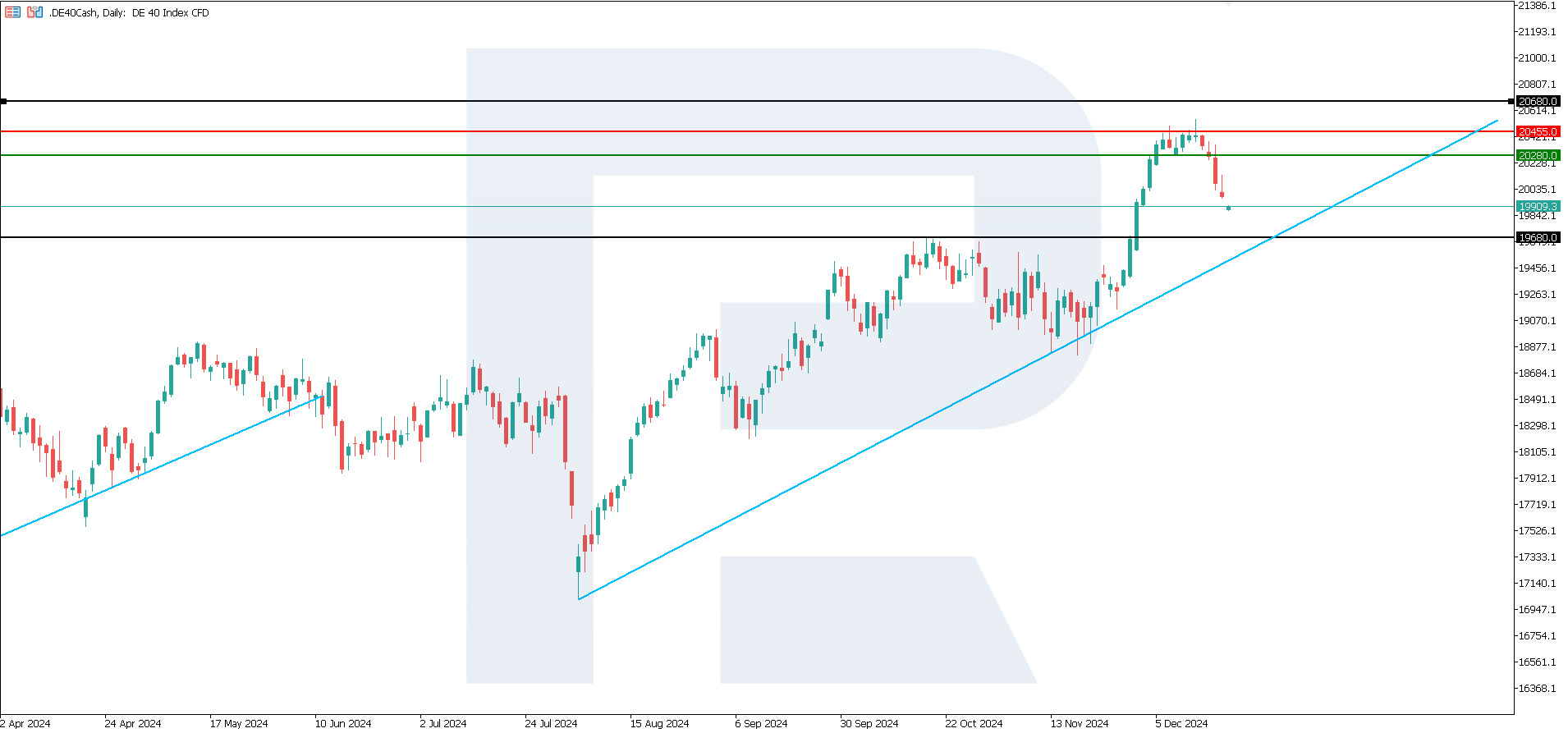

DE 40 technical analysis

The DE 40 stock index plunged by 2.55% amid overall negative sentiment among investors globally, leading to a correction. According to the DE 40 technical analysis, the correction will be short-lived, with the uptrend resuming afterwards. However, a limited decline remains possible if the price does not return to 20,280.0.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: if the price secures below the previously breached 20,280.0 support level, the index could fall to 19,680.0

- Optimistic DE 40 forecast: if the price breaks above the 20,450.0 resistance level, it could rise to 20,680.0

Summary

The Federal Reserve rate cut is a powerful stimulus to the stock market, especially for sectors sensitive to interest rates. All indices (US 30, US 500, and US Tech) may show growth, with tech stocks likely to see the most substantial gains.

The significantly better ZEW Economic Sentiment Index indicates optimism among analysts, potentially leading to growth in the DE 40 index. However, current economic challenges, such as high inflation and energy prices, are yet to be fully overcome.

Growth in the services sector supports positive sentiment in the stock market, which may drive growth in the JP 225 index. Investors will monitor data on external demand and the Bank of Japan’s actions to assess further economic outlooks.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.