US Tech analysis: a decline is more likely despite a correction

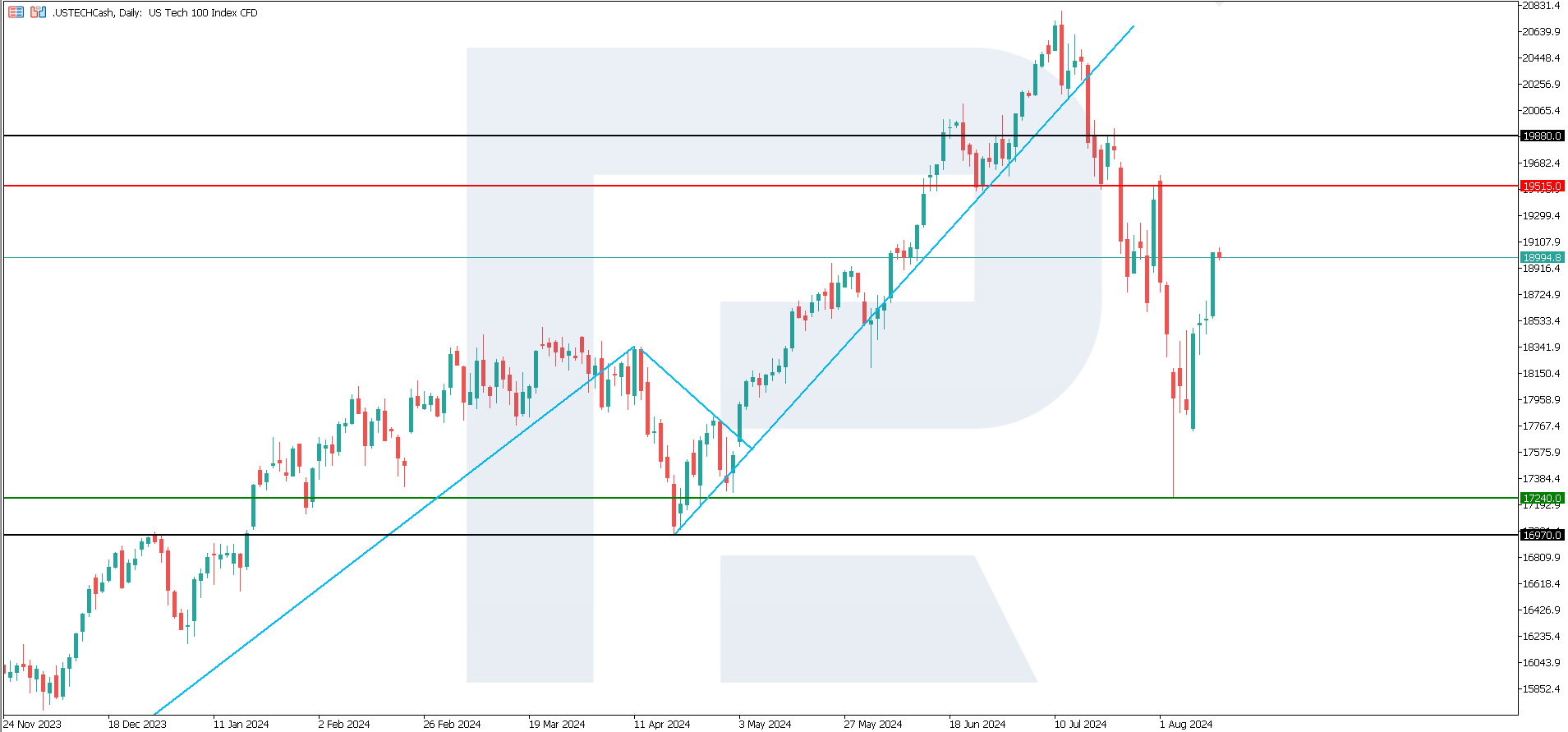

The US Tech stock index has fallen by more than 28% from its highest levels. The ongoing corrective rise does not suggest a reversal of the current downtrend. Therefore, the US Tech index forecast is negative, with further declines anticipated.

US Tech forecast: key trading points

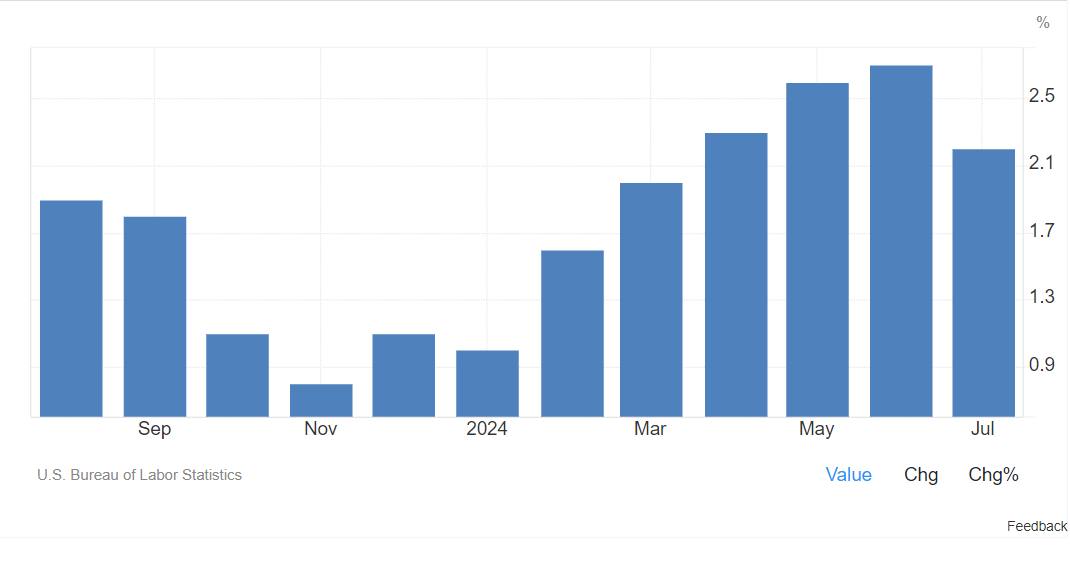

- Recent data: the US PPI index rose by 0.1% in July

- Economic indicators: the producer inflation index directly affects the overall inflation level

- Market impact: any slowdown in price growth rates positively impacts expectations for a US Federal Reserve interest rate cut

- Resistance: 19,515.0, Support: 17,240.0

- US Tech price forecast: 16,970.0

Fundamental analysis

The US Department of Labor released data on July’s wholesale prices. According to yesterday’s report, the PPI index showed an increase of 0.1% in producer prices, falling short of experts’ forecasts of 0.2% growth. Prices of basic goods (excluding volatile items) remained unchanged over the month. The PPI index rose by 2.2% over the past 12 months, while its core component increased by 2.4%.

Source: https://tradingeconomics.com/united-states/producer-prices-change

US corporations appear less concerned about a recession, with expectations dropping to their lowest level since 2021. The Federal Reserve’s success in combating inflation became the most encouraging factor for businesses, currently awaiting a key rate cut that could boost business activity.

Based on the Bank of America’s monthly survey results, more than half of fund managers (60%) expect at least four Federal Reserve interest rate cuts within the next year. Large investors will likely continue to increase their investments in the US national debt at the Federal Reserve’s current interest rate. The US Tech forecast for next week suggests a further decline.

US Tech technical analysis

The US Tech stock index rose by nearly 11% following a decline on 5 August. However, the fall was so rapid that such a correction is insufficient to reverse the trend. The price will likely dip further and break below the support level, with a target at 16,970.0. This pessimistic US Tech price forecast is due to the price consolidation below 19,490.0.

Key levels for the US Tech analysis:

- Resistance level: 19,515.0 – if the price breaks above this level, it could rise to 19,880.0

- Support level: 17,240.0 – if the price falls below this support level, it could decline to 16,970.0

Summary

The US Tech stock index has fallen by over 28% from its peak levels. However, despite a corrective rise of nearly 11%, a trend reversal is not anticipated. The downside target could be 16,970.0. The US PPI rose by 0.1% in July, supporting expectations for decisive Federal Reserve actions to reduce the key rate.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.