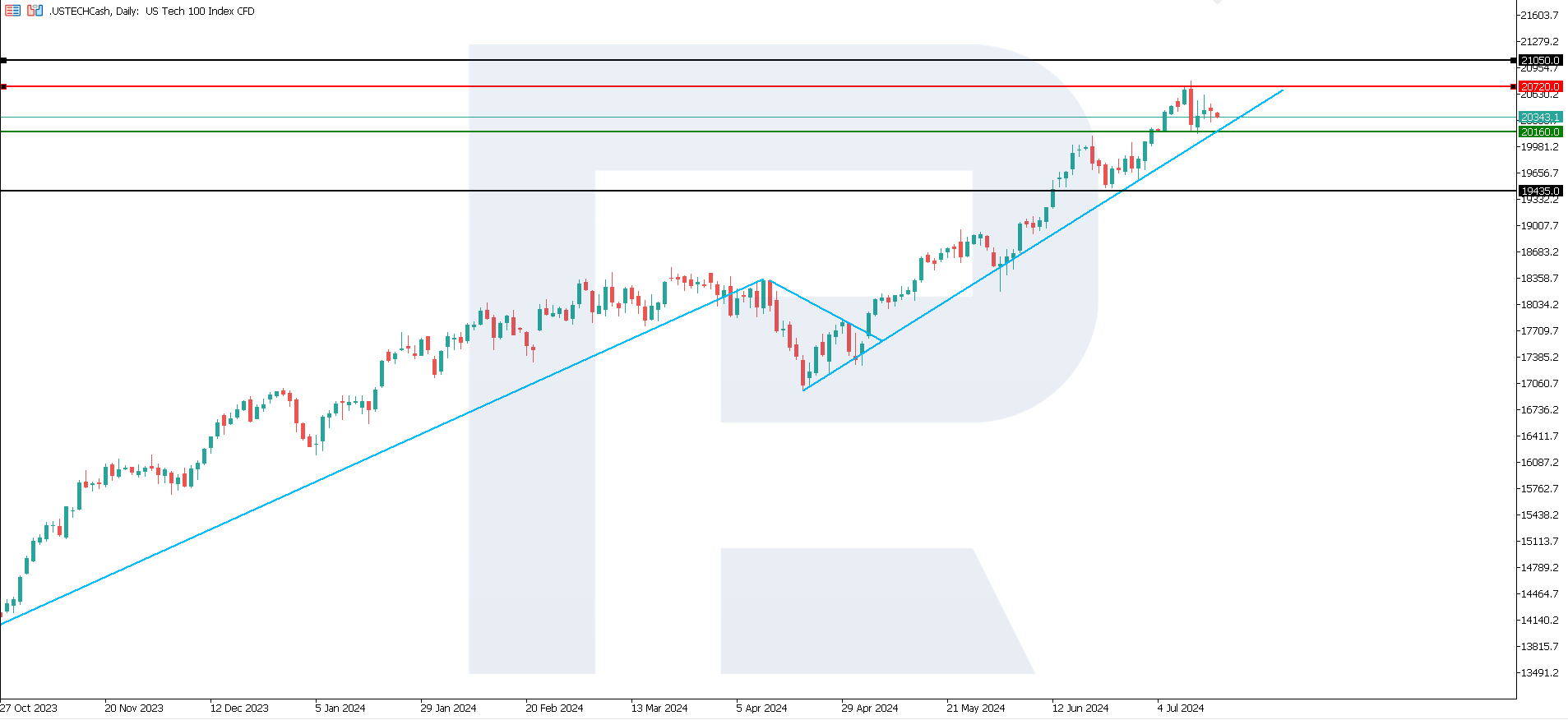

US Tech analysis: the index is poised to hit a new all-time high following a correction

The US Tech stock index reached a new all-time high on the news of easing US inflation and corrected to 3%. Potential for further growth persists until the end of the week amid comments from US Federal Reserve Chair Jerome Powell.

US Tech trading key points

- Recent data: US Federal Reserve Chair Jerome Powell said that recent economic data added to policymakers’ confidence that inflation is moving towards the Fed’s 2% target

- Economic indicators: a US key rate cut may boost demand in the stock market

- Market impact: cheaper credit resources help stimulate economic growth and avoid recession

- Resistance: 20,720.0, Support: 20,160.0

- US Tech price target: 21,050.0

Fundamental analysis

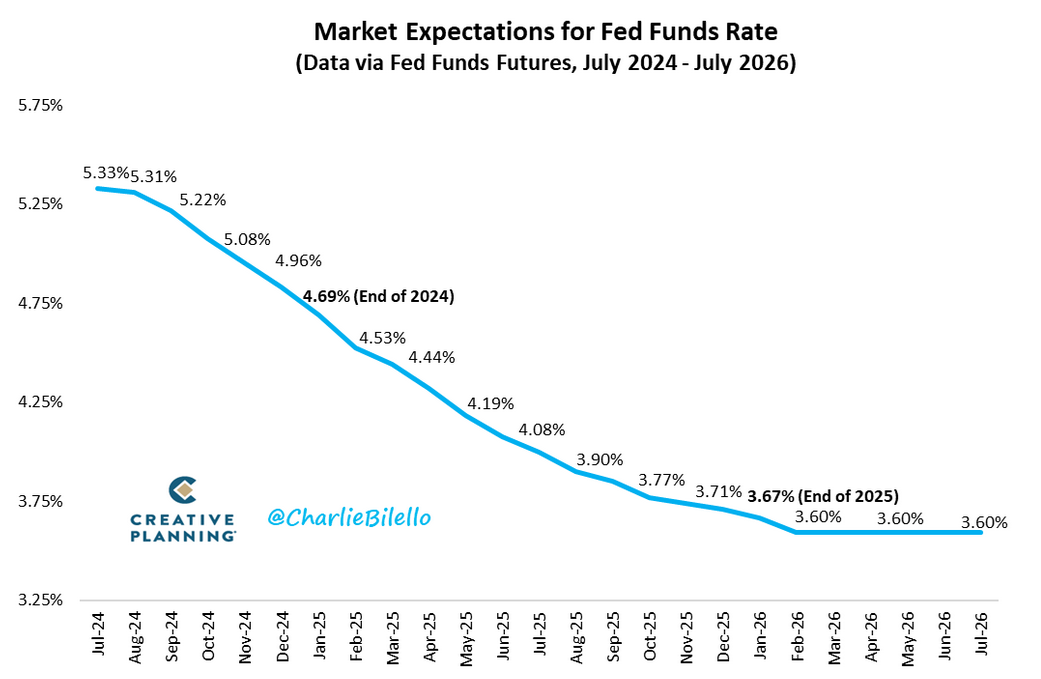

US Federal Reserve Chair Jerome Powell said that Q2 economic data added to policymakers’ confidence that inflation is moving towards the Fed’s 2% target and this could open the way for an interest rate reduction soon.

Source: https://bilello.blog/2024/the-week-in-charts-7-15-24

Although Powell noted the latest three inflation indicators, he added that he was not going to be sending a clear signal about the timing of an interest rate cut. He described the employment market as no longer overheated compared to the previous recovery period after the COVID-19 pandemic, adding that unexpected weakness could be a reason for the Federal Reserve to react.

Throughout the year, the Federal Reserve has maintained the borrowing cost at the highest level in more than 20 years, seeking to bring inflation down to the 2% target. Officials aim to slow price growth without causing undue damage to the employment market, which held up amid high borrowing costs before the June 2024 data release.

US Tech technical analysis

The US Tech stock index remains in a strong uptrend. Following a 3% correction, the price is rising again, poised to break above the current 20,720.0 resistance level. This will be a new all-time high, which could be set by the end of this week or early next week.

Key US Tech levels to watch include:

- Resistance level: 20,720.0 – if the price breaks above this level, it could target 21,050.0

- Support level: 20,160.0 – a breakout below this level will signal a trend reversal, with the target at 19,435.0

Summary

The US Tech stock index continues to rise following a corrective decline, testing the uptrend’s support line. The next growth target is 21,050.0. A fundamental driver of a further rally could be a comment from US Federal Reserve Chair Jerome Powell, where he hinted at an imminent interest rate cut.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.