US Tech analysis: steady growth may slow down amid US Federal Reserve chair’s comments

The US Tech stock index is reaching new all-time highs for the fourth consecutive session, driven by US employment market data.

US Tech trading key points

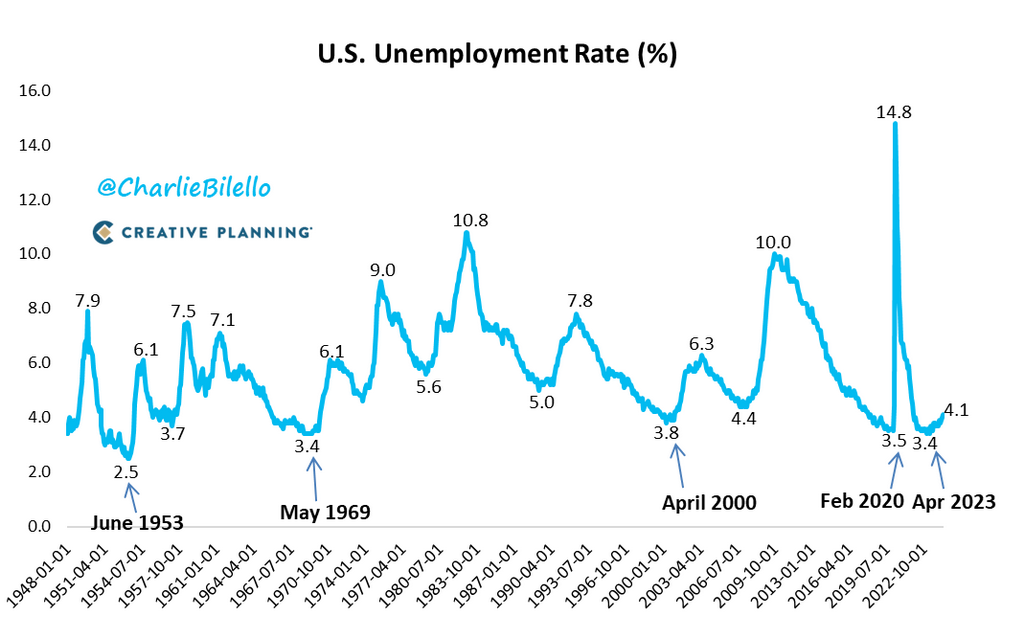

- Recent data: the US unemployment rate rose to 4.1% in June

- Economic indicators: according to the US Department of Labor statistics, the leading market indicators show weakness in the sector. This gives the US Federal Reserve sufficient reasons to lower interest rates

- Market impact: a reduction in interest rates positively impacts the growth rates of the technology sector in the stock market

- Resistance: 20,490.0, Support: 20,160.0

- US Tech price target: 20,920.0

Fundamental analysis

The US unemployment rate rose to 4.1% in June, marking the highest reading since November 2021. US Federal Reserve Chair Jerome Powell addressed the Senate Banking Committee in Washington. Market participants expected clear signals from him yesterday following the release of the latest US employment market statistics.

Source: https://bilello.blog/2024/the-week-in-charts-7-8-24

Powell left open the question of when the Federal Reserve will lower interest rates while the market anticipates a September cut. While he told senators that he did not expect interest rate hikes, he refrained from providing a timeline for their reduction.

According to Powell, the latest inflation statistics showed moderate progress. Still, improved data would strengthen the Federal Reserve’s confidence that inflation is returning to the 2% target, providing a reason to lower interest rates.

Nevertheless, it is notable that the ratio between the capitalisation of growth stocks and value stocks in the US has reached the highest level since the dot-com bubble.

US Tech technical analysis

The US Tech stock index is in an uptrend on the daily timeframe, hitting a new all-time high for the fourth consecutive session. A correction is likely, which might initiate a downtrend. However, growth potential remains.

Key US Tech levels to watch include:

- Resistance level: 20,490.0 – after breaking above this level, the price might target 20,920.0

- Support level: 20,160.0 – a breakout below this level will signal a trend reversal with a target at 19,435.0

Summary

The US Tech stock index is reaching new historical highs for the fourth consecutive trading session within the uptrend, with the next potential target at 20,920.0. Investor sentiment will largely be influenced by comments from US Federal Reserve Chair Jerome Powell on further monetary policy as all the previously mentioned conditions for an interest rate cut are now in place.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.