US 30 analysis: buybacks of large companies support a correction

The US 30 stock index is rising rather actively as part of a correction after the decline. The main driver is the buyback operations of the companies. The US 30 index forecast remains pessimistic.

US 30 forecast: key trading points

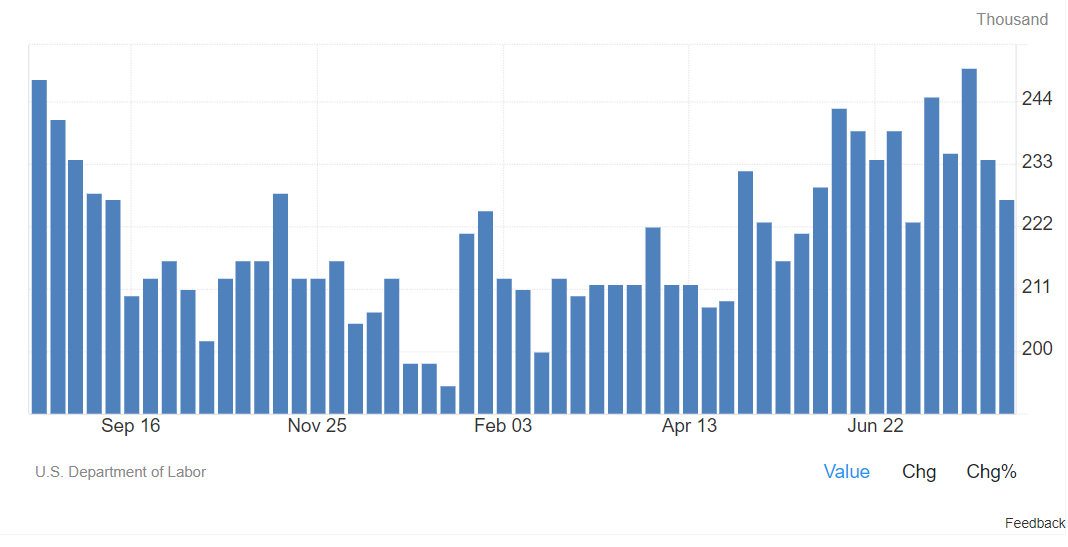

- Recent data: initial jobless claims reached 227,000

- Economic indicators: inflation and employment market indicators are crucial for the Federal Reserve’s future monetary policy

- Market impact: a weakening employment market increases the likelihood of a Federal Reserve key rate cut in September

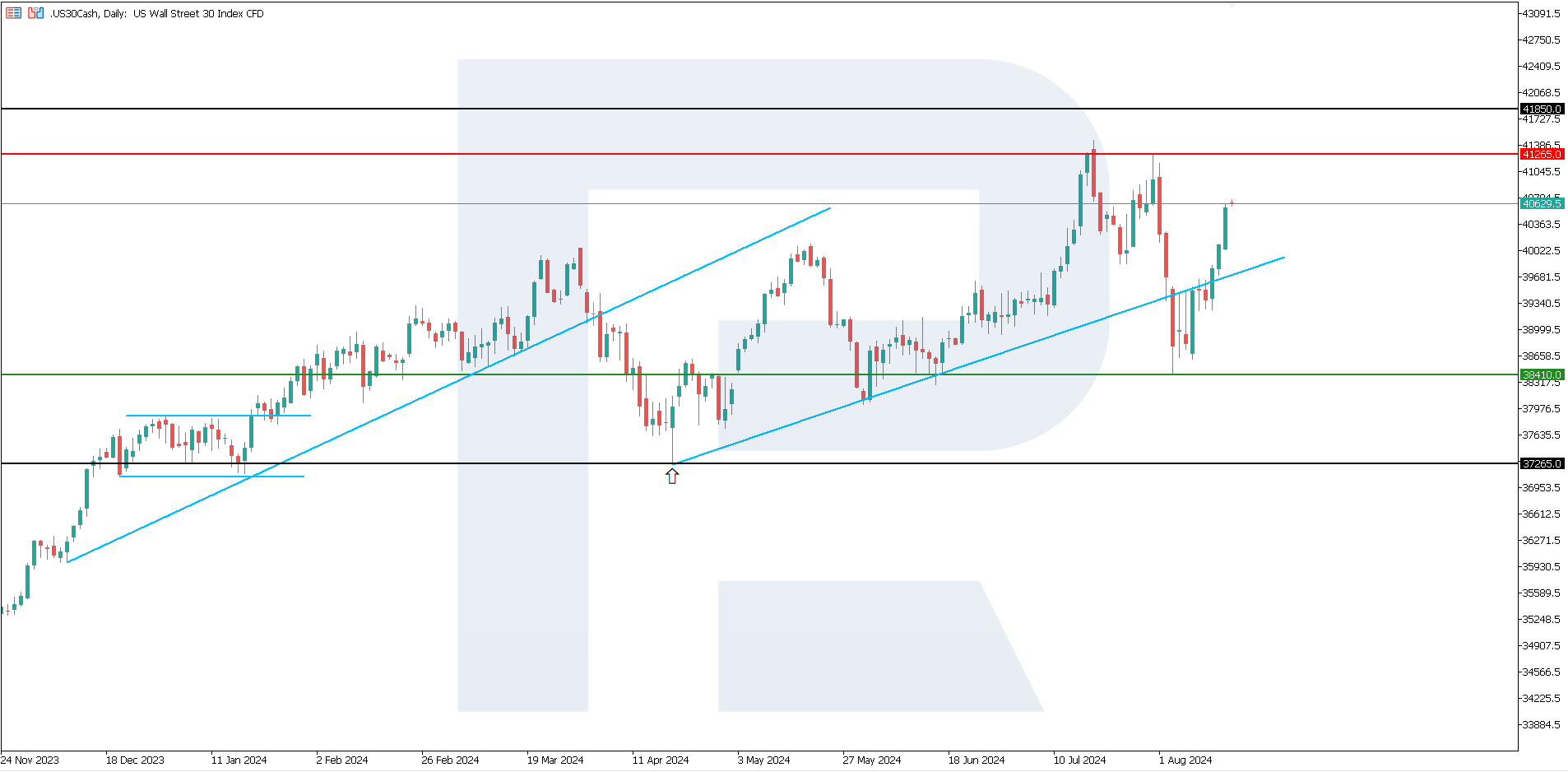

- Resistance: 41,265.0, Support: 38,410.0

- US 30 price forecast: 37,265.0

Fundamental analysis

The US Department of Labor informed on Tuesday that initial jobless claims decreased by 6,000 to 227,000 last week, while economists expected them to be 234,000. Total claims declined by 7,000 to 1.86 million.

Source: https://tradingeconomics.com/united-states/jobless-claims

The consumer price index stood at 0.2% in July, reaching 2.9% year-over-year, below the expected 3.0%. The producer price index (PPI) has previously shown that inflation is steadily falling. Therefore, the Federal Reserve has no arguments left in favour of maintaining the current monetary policy, with the first cut in September being highly likely.

While annual price growth rates continue to go down, the July increase in housing prices compared to June raises concerns. The Federal Reserve pays special attention to the latter when analysing inflation dynamics. However, this may have no significant impact on a decision to lower the interest rate in September. For this reason, demand for the US government bonds might rise, with a decline in the stock market persisting until the key rate is cut. The US 30 forecast for next week is negative.

US 30 technical analysis

The US 30 stock index continues its ascent as part of a correction after a sharp decline on 5 August. The price is unlikely to break above the current 41,265.0 resistance level. Once the correction is complete, the second downward impulse is expected with the aim of breaking below the 38,410.0 support level. According to the US 30 price forecast, the index may reach 37,265.0.

Key levels for the US 30 analysis:

- Resistance level: 41,265.0 – if the price breaks above this level, it could target 41,850.0

- Support level: 38,410.0 – if the price breaks below the support level, it could aim for 37,265.0

Summary

Initial jobless claims decreased by 6,000 to 227,000 last week, while the consumer price index stood at 0.2% in July, reaching 2.9% year-over-year, below the expected 3.0%. Next week, US Federal Reserve Chair Jerome Powell will deliver a speech on the economic outlook at Jackson Hole. The further US 30 movements will largely depend on his comments.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.