US 30 analysis: the uptrend gathered momentum following the release of consumer inflation statistics

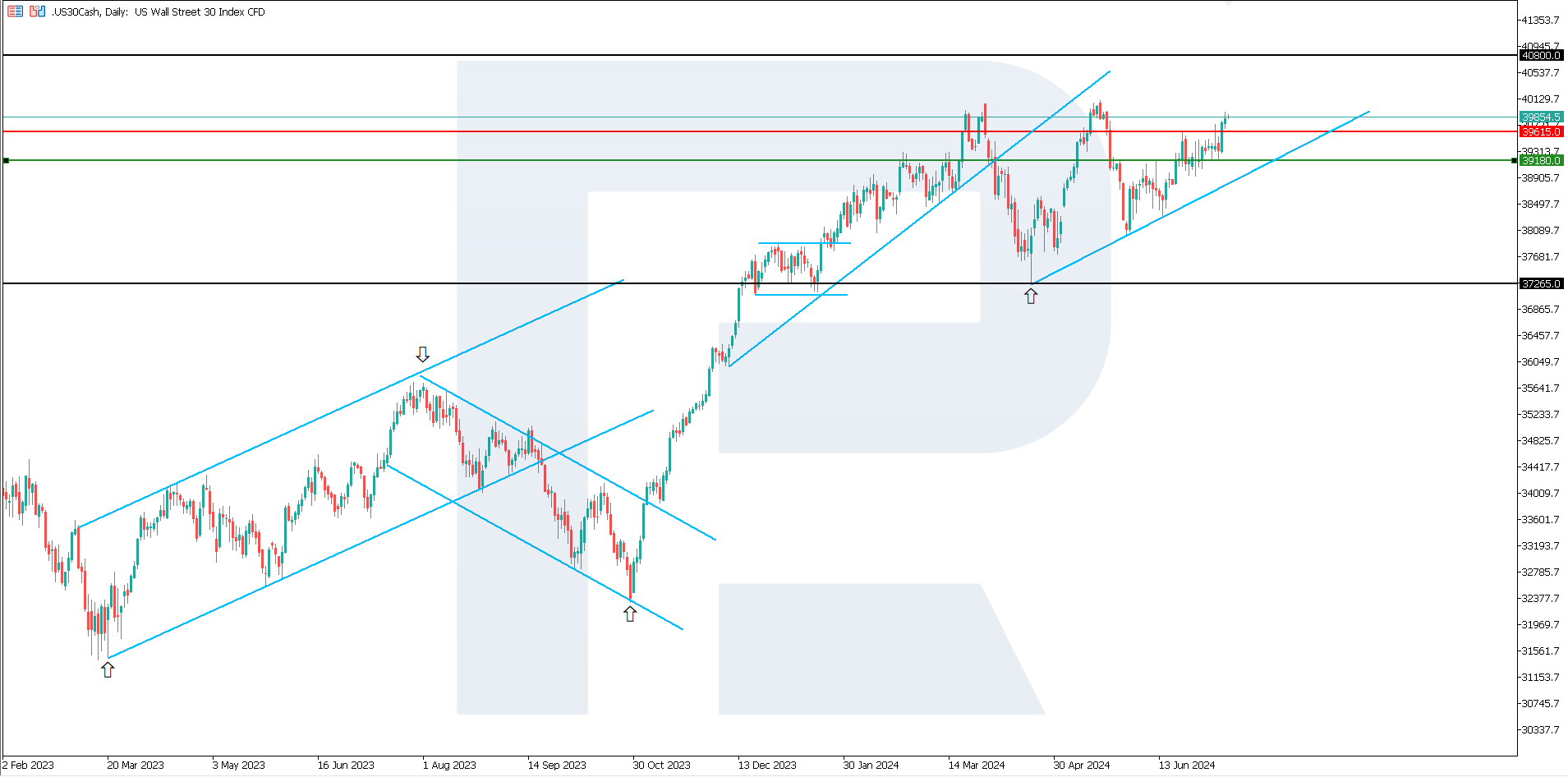

The US 30 stock index continues to rise within the uptrend, aiming to renew its historical high. Growth momentum was driven by US consumer inflation data, which fell short of expectations.

US 30 trading key points

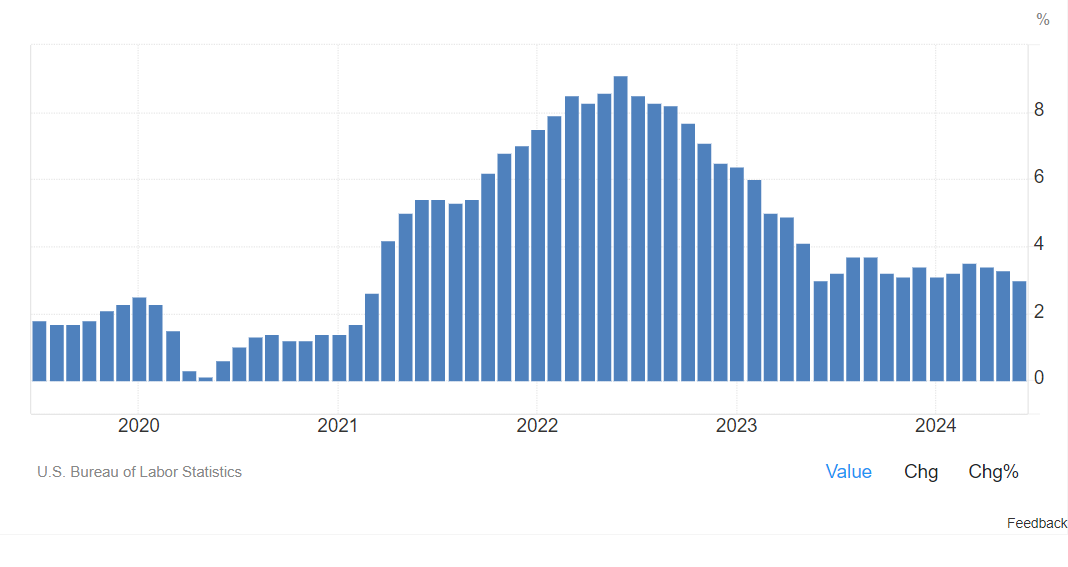

- Recent data: US consumer inflation reached 3.0% year-over-year in June

- Economic indicators: increasingly, more indicators meet the conditions stated by the US Federal Reserve for a key rate cut

- Market impact: a lower interest rate will enable companies to raise funds at a lower cost and increase their revenue

- Resistance: 39,615.0, Support: 39,180.0

- US 30 price target: 40,800.0

Fundamental analysis

The June US consumer price index (CPI) lagged behind the overall and core indicators, making arguments for a September cut more compelling. Inflation reached 3.0% year-over-year in June compared to the forecasted 3.1%. With such deflation, the Federal Reserve could lower interest rates as early as August.

Source: https://tradingeconomics.com

US 30 technical analysis

Within the uptrend, the US 30 stock index exited a sideways channel, where it had hovered for nearly two weeks. After breaking above the resistance level, it may reach a new all-time high. The potential for further growth remains.

Key US 30 levels to watch next week include:

- Resistance level: 39,615.0 – the price has already breached this level, aiming for 40,800.0 as the next target

- Support level: 39,180.0 – breaking below this level will indicate a trend reversal to the downtrend, with a target at 37,265.0

Summary

A substantial slowdown in inflation increases the likelihood of two Federal Reserve interest rate cuts in 2024, not just one as previously expected. CPI reached 3.0% y/y in June against the forecasted 3.1%. The US 30 stock index breached the upper boundary of the sideways channel with a target of 40,800.0 and still has the potential for growth and reaching another historical high.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.