JP 225 continues to rise despite a decline in fundamental data

The JP 225 index rose again after the close of trading on Monday – this time by 0.72%. Growth may continue amid the strengthening of the shipbuilding and financial sectors.

JP 225 forecast: key trading points

- Japan’s Corporate Services Price Index (CSPI), y/y: previously at 3.1, currently at 2.8%

- The Bank of Japan’s Core Consumer Price Index (CPI), y/y: previously at 2.1%, currently at 1.8%

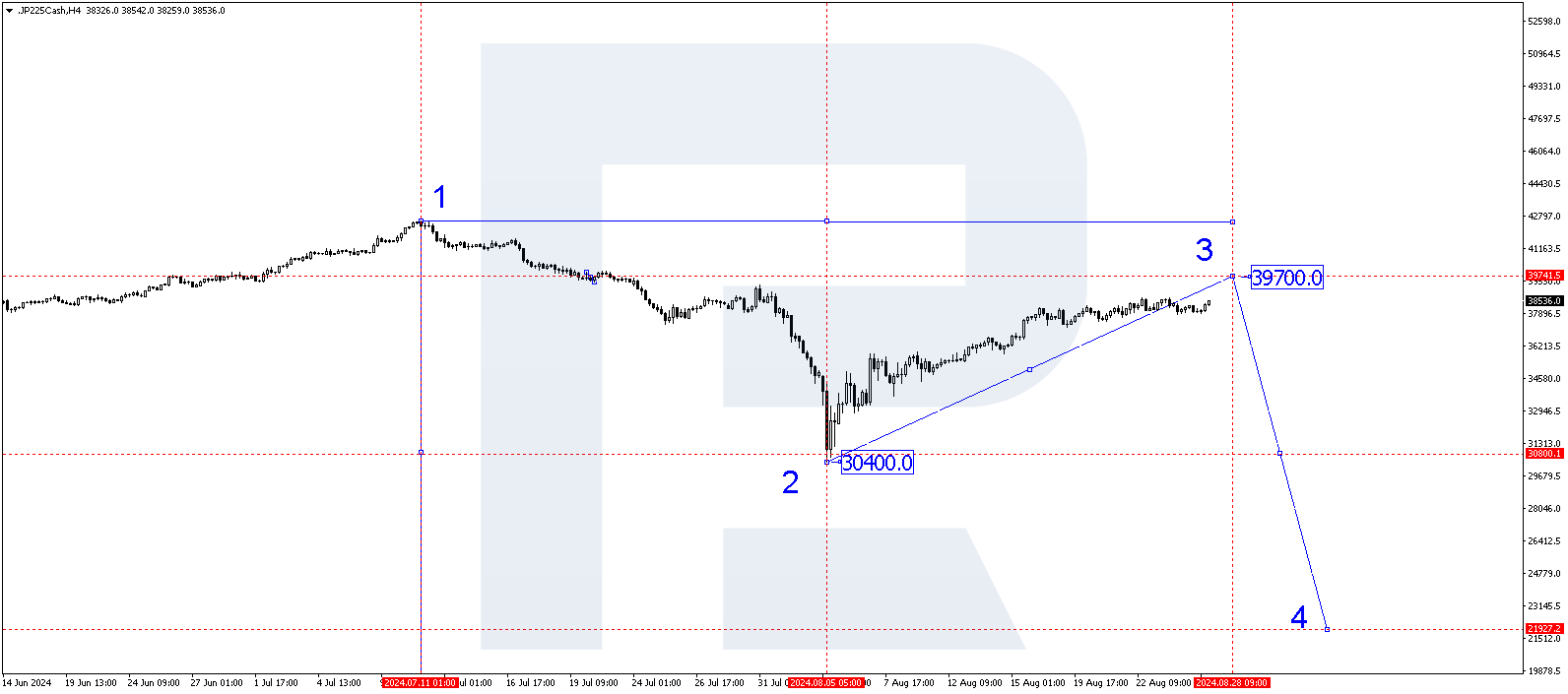

- Resistance: 39,700.0, Support: 30,400.0

- JP 225 price forecast: 22,000.0

Fundamental analysis

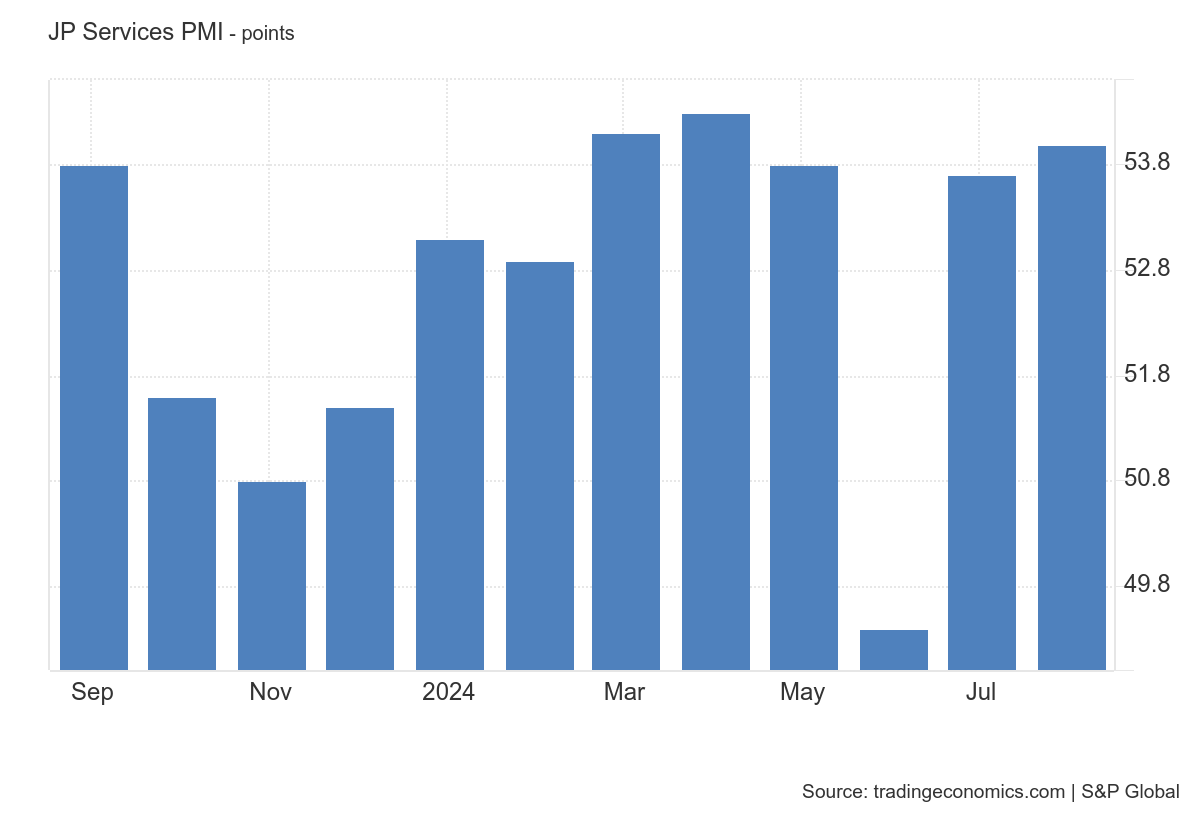

Monday’s trading session closed with a 0.72% rise in the index. The JP 225 analysis shows that fundamental data has favoured this month’s stock market. According to preliminary data, Japan’s services PMI increased to 54.0 in August 2024 from 53.7 points last month. This optimism was due to increased orders, which led to a rise in workforce numbers.

Source: https://tradingeconomics.com/japan/services-pmi

The Corporate Services Price Index measures the inflation rate that companies experience when purchasing various services. It reflects the balance between demand and supply in the services sector. The higher the index reading, the stronger its impact on consumer inflation. The data was worse than the previous reading, coming in at 2.8%.

The Bank of Japan’s Core Consumer Price Index (CPI) decreased to 1.8% from the previous period. Despite this primarily negative news for Japan, most securities closed the trading session with gains, positively impacting the JP 225 index price overall.

The JP 225 price forecast for next week appears somewhat optimistic, suggesting the price could maintain its upward momentum after a minor correction.

JP 225 technical analysis

The JP 225 H4 chart shows that the market has completed the first downward wave, reaching 30,400.0. A correction is currently underway, aiming for 39,700.0. The price could achieve this target level today, 27 August 2024. Subsequently, this correction is expected to be complete, followed by another downward wave towards 30,400.0. A breakout below this level will open the potential for a decline to 22,000.0, the local target.

Key JP 225 levels to watch include:

- Resistance level: 39,700.0 – if the price breaks above this level, it could reach 42,500.0

- Support level: 30,400.0 – a breakout below this level will signal a continuation of the trend towards 22,000.0

Summary

The decline in economic indicators could not significantly impact the JP 225 index price, which maintains its upward trajectory. Technical indicators suggest that the trend in the JP 225 index could continue to the 22,000.0 and 19,400.0 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.