JP 225 analysis: the most significant decline since 1987 may be followed by a correction, but the downtrend persists

The JP 225 stock index plunged by over 12%, marking its most significant daily decline since 1987. As the JP 225 index forecast suggests, this decline may continue until the end of the week.

JP 225 trading key points

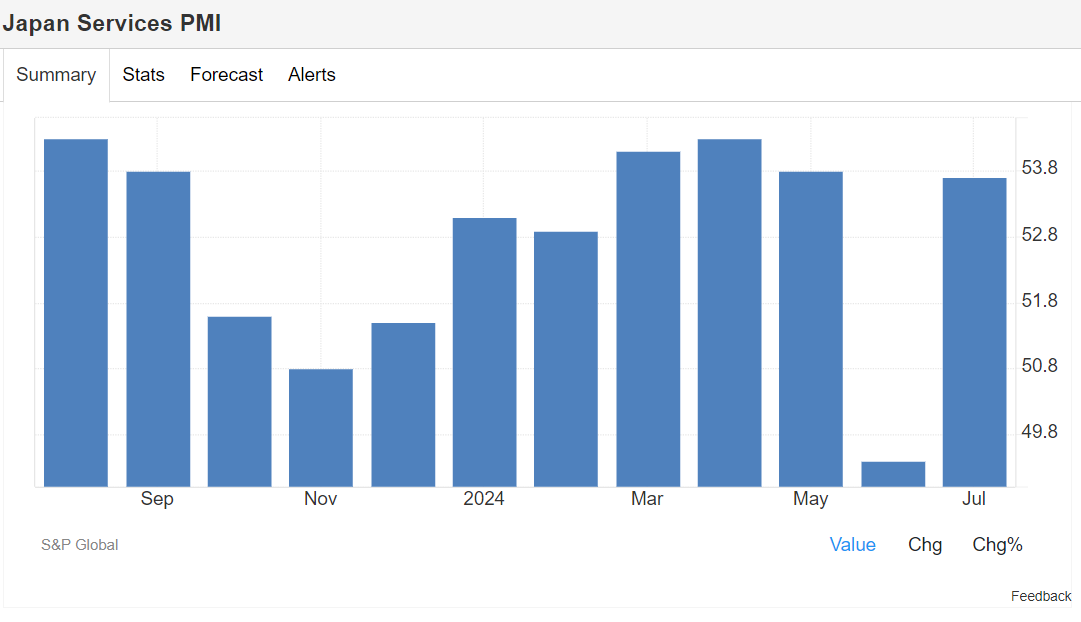

- Recent data: the services PMI reached 53.7 points, slightly missing the forecast of 53.9

- Economic indicators: the manufacturing sector dominates the Japanese economy, so services sector indicators are less critical

- Market impact: the most significant impact is from the US Federal Reserve’s monetary policy and the Japanese yen’s substantial appreciation, which is negatively affecting exporters’ revenues

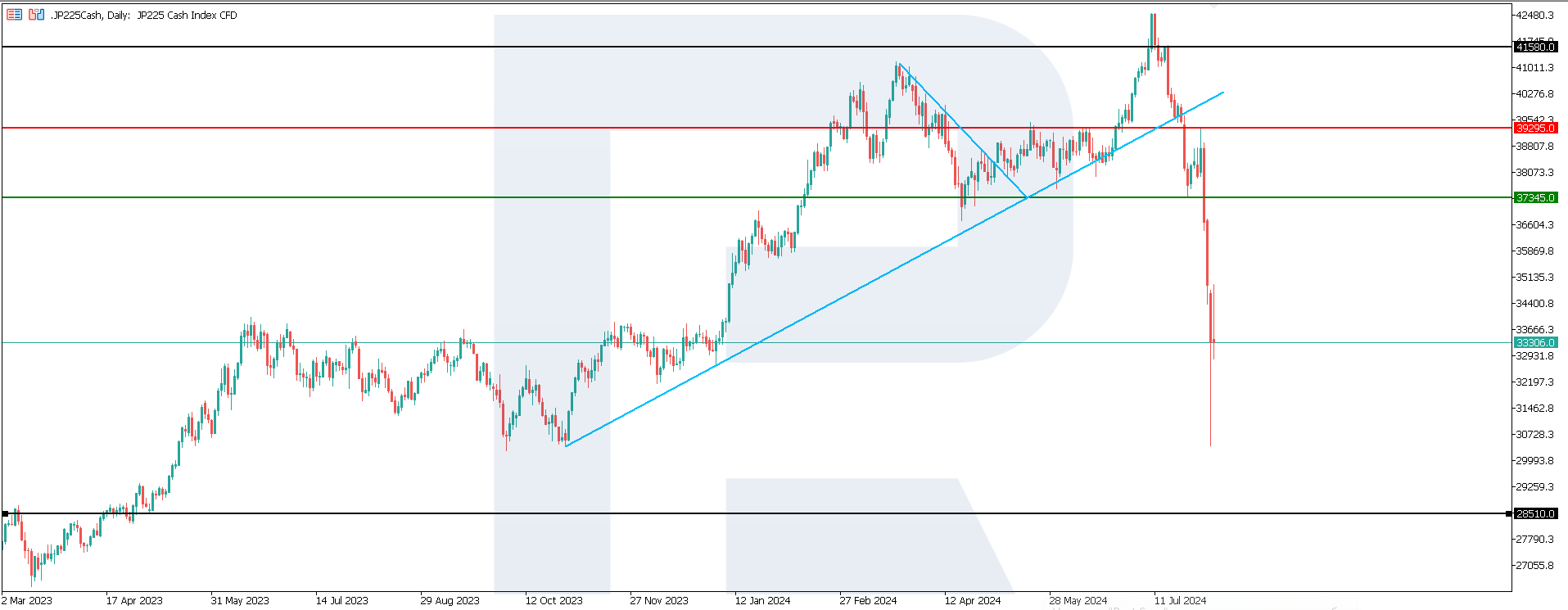

- Resistance: 39,295.0, Support: 37,345.0

- JP 225 price forecast: 28,510.0

Fundamental analysis

Japanese stocks tumbled, with the JP 225 index experiencing its most substantial fall since 1987. Massive sell-offs occurred as the yen’s sharp strengthening pressured exporters, and a Bank of Japan interest rate hike led to declines in the real estate sector.

Source: https://tradingeconomics.com/japan/services-pmi

The Japanese stock market faced a unique situation where both non-residents and residents began to reduce their investments simultaneously. Non-residents aimed to optimise their portfolios by buying US national debt at current yield rates, while residents wanted to dump exporters’ shares due to the yen’s strengthening.

As a result, the JP 225 stock index experienced its most substantial fall. Given that the primary drivers of sell-offs remain, the downtrend will persist in the medium term. The JP 225 forecast for next week will likely remain negative.

JP 225 technical analysis

The JP 225 stock index dropped by 12% before correcting by 10% from its minimum values at the opening of Tuesday’s trading. This development indicates high market volatility. A steady downtrend has formed in the JP 225 index. Following such a sharp decline, a sideways channel could now form, with the potential for a break below its lower boundary.

Key levels to watch in the JP 225 price forecast include:

- Resistance level: 39,295.0 – if the price breaks above this level, it could rise to 41,580.0

- Support level: 37,345.0 – the price has already breached this support level, allowing it to drop to 28,510.0

Summary

The JP 225 fundamental and technical analyses suggest that the asset has the potential to decline further to 28,510.0. Both domestic and foreign investors are reducing their positions in Japanese stocks. The decline is primarily driven by the yen’s strengthening and a potential US Federal Reserve interest rate cut. As a result, the JP 225 index is expected to fall further.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.