JP225 analysis: The Bank of Japan’s decision to maintain the interest rate had no impact on the market

JP225 is in a sideways channel with no clear trend

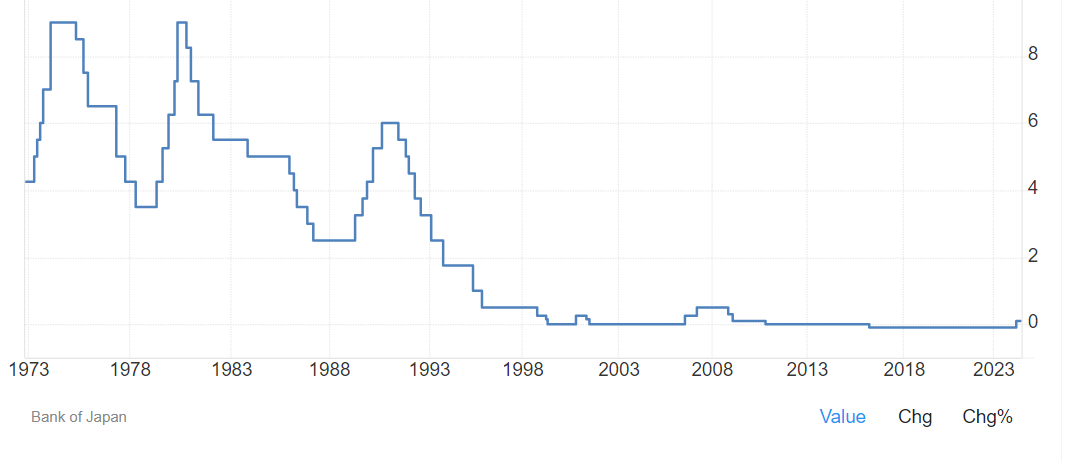

JP225 fundamental analysis

The JP225 stock index is flat after hitting a new all-time high in late March 2024. The current price is 38,397.0.

Following its two-day policy meeting last week, the Bank of Japan left short-term interest rates unchanged at levels varying from 0.00% to 0.10%, as widely expected. However, it is worth noting that the bank’s leadership did not rule out reducing Japanese government bond purchases after its next monetary policy meeting.

Source: https://tradingeconomics.com

In anticipation of the next meeting, the Bank of Japan stated that it would gather market participants’ opinions and decide on a detailed purchase reduction plan for the upcoming one or two years. Purchases of government bonds, commercial papers, and corporate bonds will also continue in line with the decision taken at the March monetary policy meeting.

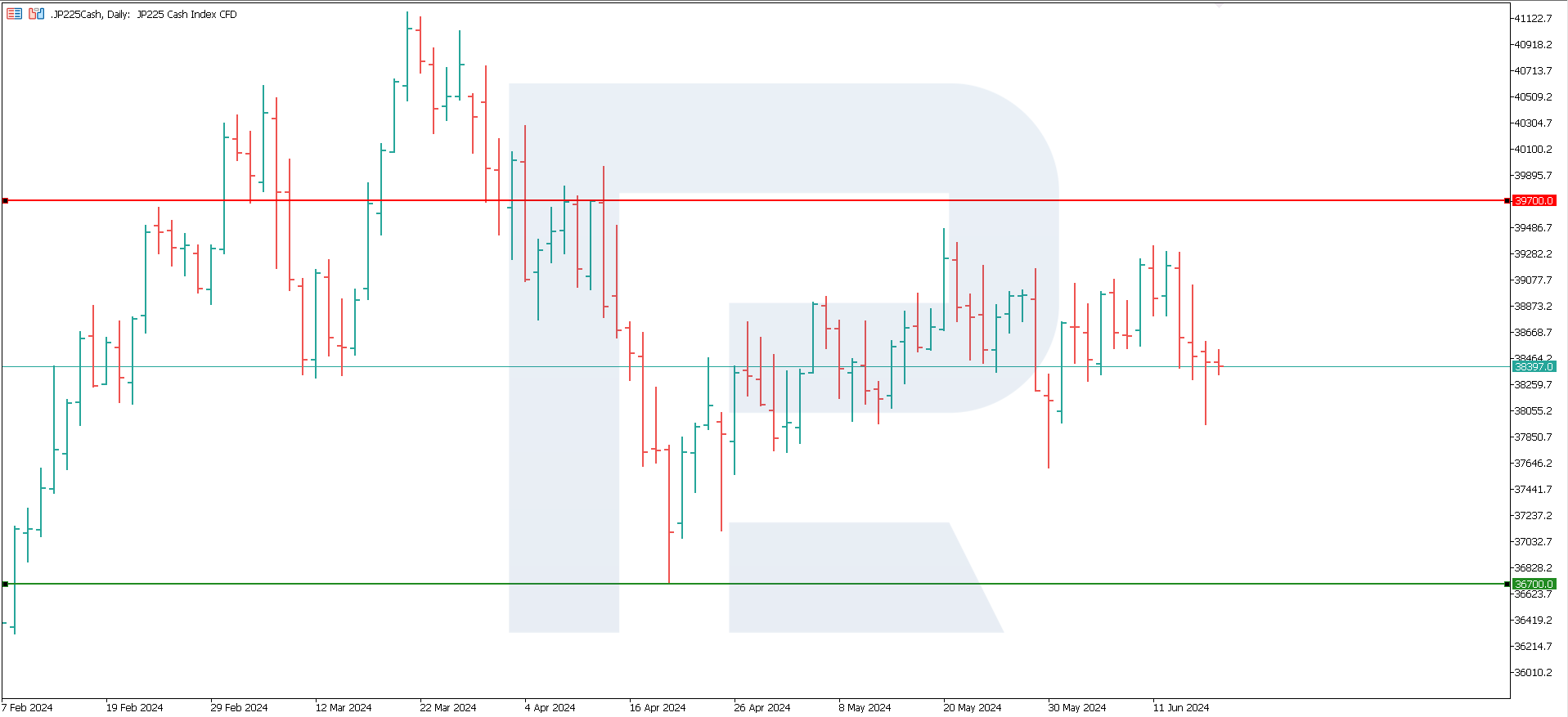

JP225 technical analysis

The JP225 stock index fell by 10.86% after reaching a new all-time high. It can be stated confidently that a downtrend has ended with a sideways channel. Given the Bank of Japan’s current monetary policy, the quotes will likely remain in this range for an extended period.

JP225 technical analysis 18.06.2024

A resistance level has formed at 39,700.0, with support at 36,700.0. This channel will likely exist for an extended period. If the resistance level breaks, the target might be the 40,230.0 mark. Alternatively, the price might surpass the support level in a move towards 35,680.0.

Summary

The Bank of Japan kept short-term interest rates unchanged at varying levels from 0.00% to 0.10%. However, it stated that it may reduce Japanese government bond purchases after its next monetary policy meeting. From a technical analysis perspective, the JP225 stock index price will hover around 36,700.0-39,700.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.