JP 225 analysis: potential for further growth persists after the price reaches an all-time high

The JP 225 stock index reached a new all-time high and corrected by 3.50%. However, the potential for further growth persists within a global uptrend.

JP 225 trading key points

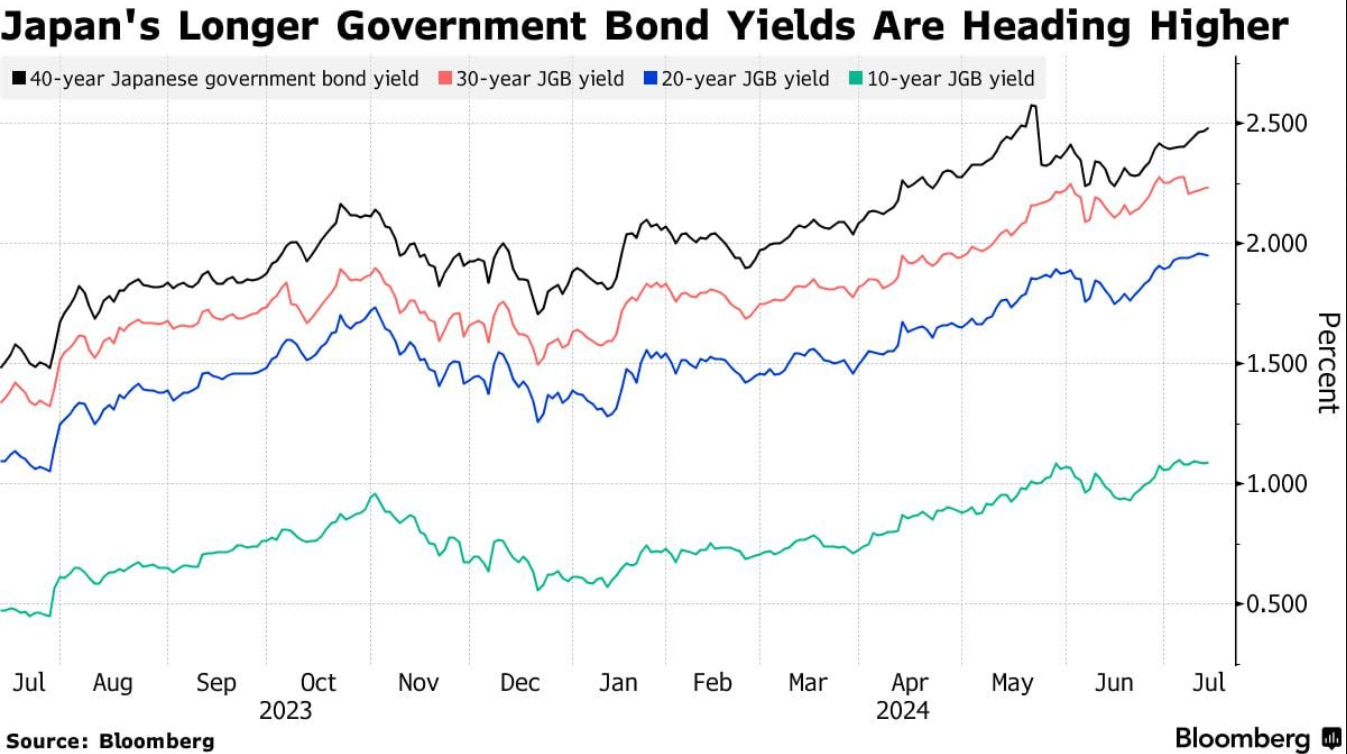

- Recent data: Japan’s 40-year government bond yield reached 3.00% for the first time

- Economic indicators: amid the weakening yen, investors expect a key rate hike and are divesting earlier government bond issues to reinvest in other bonds and stocks

- Market impact: the stock market experiences significant demand from domestic investors who are seeking to save their funds from the depreciation of the Japanese yen

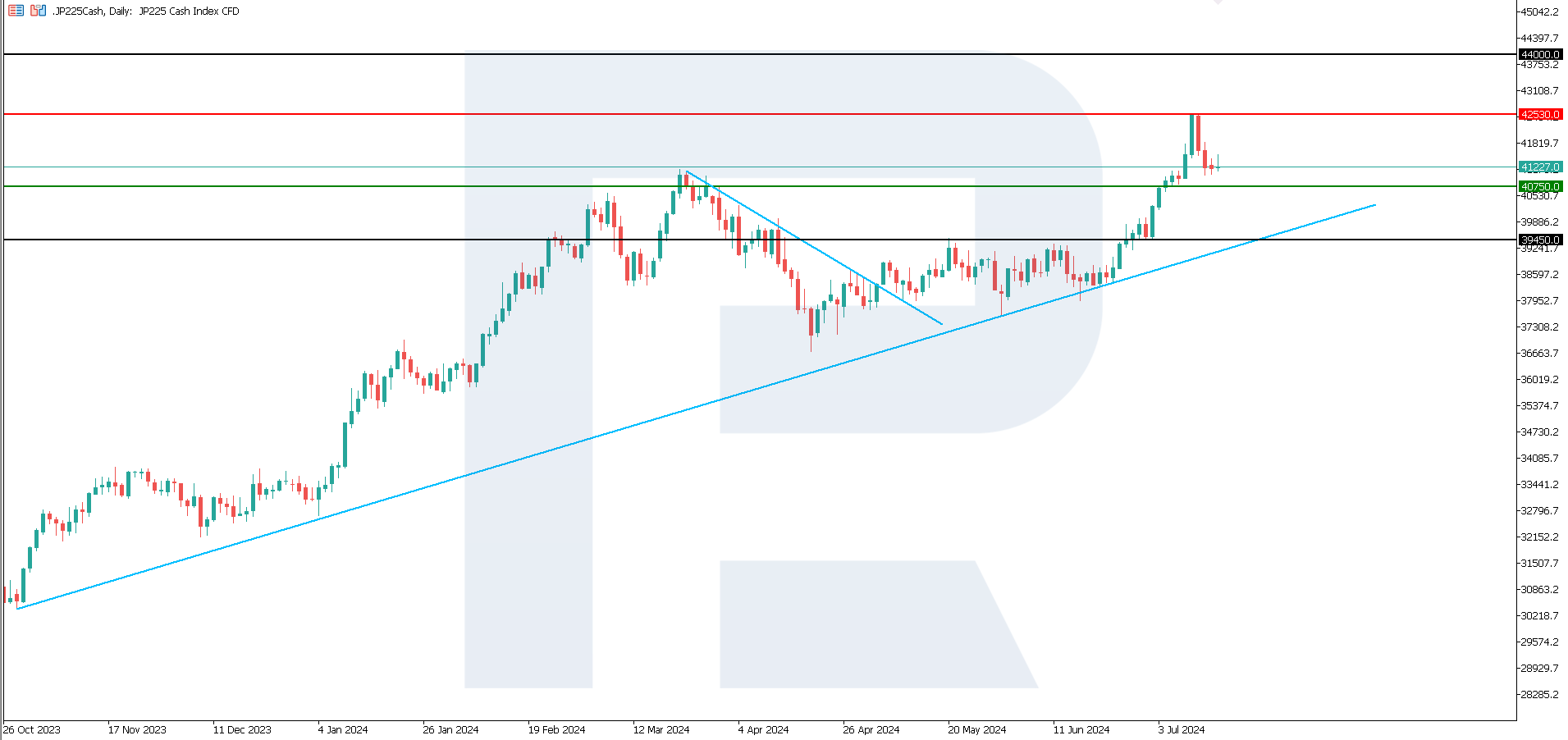

- Resistance: 42,530.0, Support: 40,750.0

- JP 225 price target: 44,000.0

Fundamental analysis

Japan’s 40-year government bond yield reached 3% for the first time since they were first issued in 2007. The steady weakening of the yen is fuelling speculation that the Bank of Japan will soon take further action to normalise monetary policy, with large investors, including insurance companies, reluctant to invest money in the debt.

The yen’s decline to new 38-year lows against the US dollar prompts some investors to bet that the Bank of Japan will reduce bond purchases while raising interest rates at the 30-31 July meeting to support the national currency.

The JP 225 stock index may receive additional growth incentives thanks to domestic investors. The latter will likely continue to reduce their foreign investments and return funds to the national market.

JP 225 technical analysis

The JP 225 stock index is in a strong uptrend despite a 3.50% correction at the end of last week. The price will highly likely attempt to reach a new all-time high again by the end of this week.

Key levels to watch this week include:

- Resistance level: 42,530.0 – if the price breaks above this level, it could target 44,000.0

- Support level: 40,750.0 – if the price breaks below this level, it could fall to 39,450.0

Summary

The JP 225 stock index continues to reach new all-time highs, driven by rising demand for Japanese stocks from domestic investors. If the price breaks above the current 42,530.0 resistance level, the next target could be 44,000. The Bank of Japan will likely raise the key rate at its 30-31 July meeting, prompting investors to return to the stock market from other jurisdictions.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.