JP 225 analysis: the index regains its 1989 historical high

Following a 10.78% correction and a prolonged sideways channel, the JP 225 stock index resumed growth, reaching its highest level since 1989. The primary driver is increased demand from Japan’s domestic investors, who have reduced their investments in US government bonds to protect themselves against the yen’s depreciation.

JP 225 trading key points

- Recent data: basic pay increased by 2.5% in May compared to last year

- Economic indicators: basic pay, excluding bonuses and overtime pay, rose by a record 2.7%

- Market impact: these employment market indicators suggest that the main trend in wages may support consumption and enable the Bank of Japan to raise interest rates again

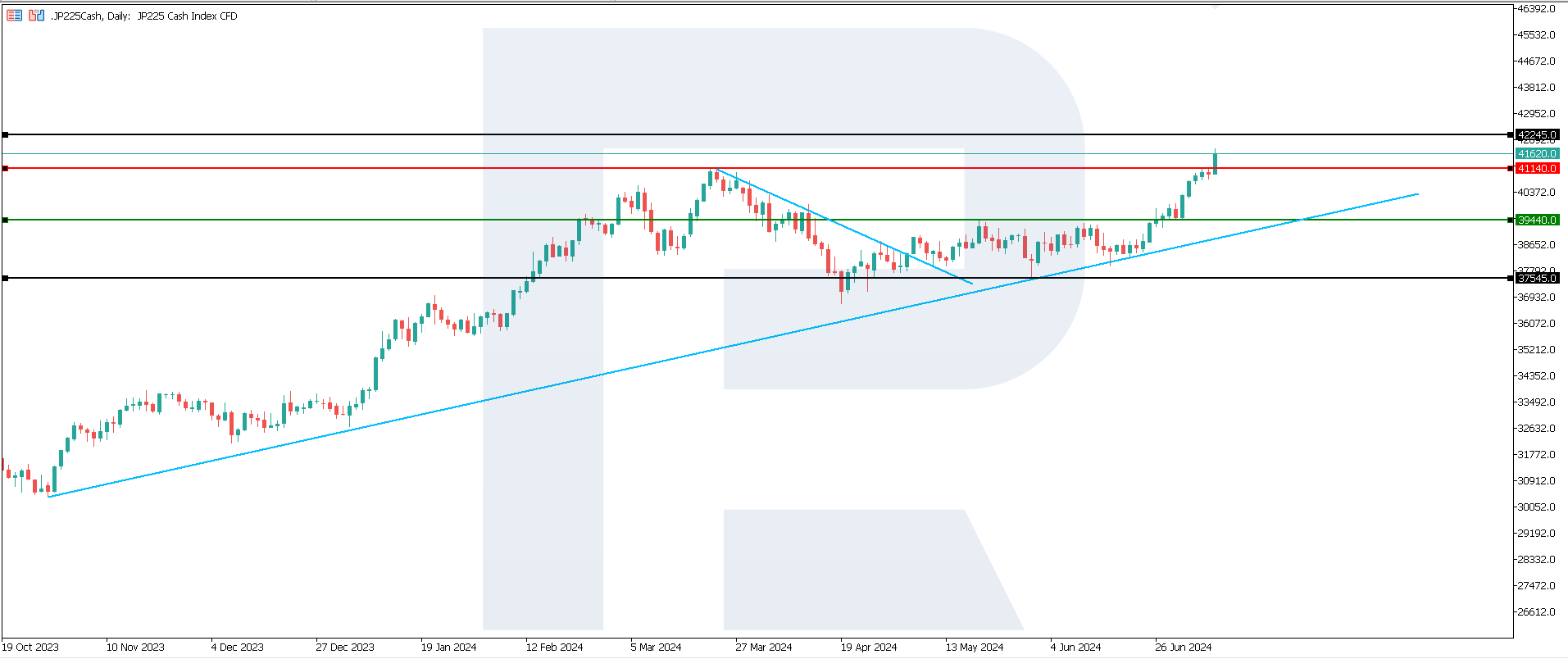

- Resistance: 41,140.0, Support: 39,440.0

- JP 225 price target: 42,245.0

Fundamental analysis

Japan’s Labour Ministry announced last Monday that basic pay increased by 2.5% in May compared to the previous year, marking the most rapid rise since 1993 and outperforming a 1.9% increase in the main gauge.

Basic pay, excluding bonuses and overtime pay, rose by 2.7%, indicating an improvement in the general wage trend.

As a result, the Bank of Japan may raise the interest rate as early as July, which could increase the activity of domestic investors and cause them to reduce their positions in US government bonds. At the same time, Japan remains one of the largest holders of the US national debt.

JP 225 technical analysis

The JP 225 stock index exited the sideways channel to embark on an upward trajectory, reaching its highest level since 1989. Growth potential remains amid a confident breakout above the 41,140.0 resistance level.

Key JP 225 levels to watch include:

- Resistance level: 41,140.0 – after breaking above this level, the price will likely target 42,245.0

- Support level: 39,440.0 – after breaking below this level, the price might decline to 37,545.0

Summary

The JP 225 stock index has reached its highest level since 1989, with a likely target for further rise at 42,245.0. Domestic investors are the primary drivers of this growth. With wages rising at the highest pace since 1993, the Bank of Japan will likely raise the key rate as early as July.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.