JP 225 analysis: the index exited the sideways channel, resuming growth

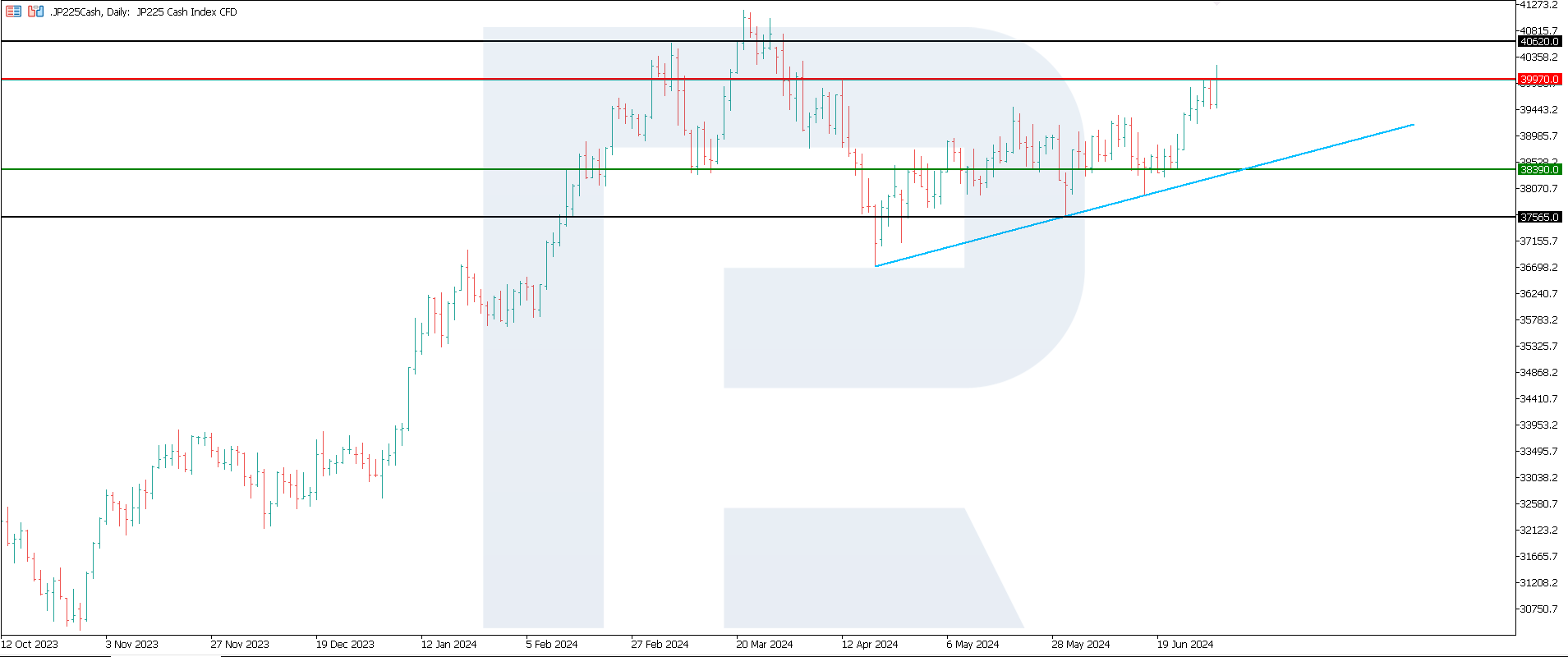

Within the uptrend that began in late April 2024, the JP 225 stock index has broken above the upper boundary of the sideways channel and is heading towards its all-time high.

JP 225 trading key points

- Recent data: the manufacturing PMI for June reached 50.0, down from 50.4 in May

- Economic indicators: the decrease in the manufacturing PMI is due to increased bankruptcies caused by the Bank of Japan’s current monetary policy

- Market impact: foreign investors have been reducing their investments in Japan’s stock market since late May, with domestic players driving demand

- Resistance: 39,970.0 Support: 38,390.0

- JP 225 price target: 40,620.0

JP 225 fundamental analysis

Since last May, foreign investors have reduced their investments in Japan’s stock market at sell-off rates not seen since September 2023. Major buyers are domestic investors seeking to safeguard their assets against yen depreciation by investing in export-oriented companies.

The Bank of Japan’s current policy has raised corporate borrowing costs. Consequently, the manufacturing PMI dropped to 50.0 in June. A reading below this level signals a potential threat of economic recession, which could exert future pressure on the JP 225 stock index.

JP 225 technical analysis

On the daily timeframe, the JP 225 stock index exited the sideways range within the uptrend. It will likely attempt to rise to an all-time high and achieve it. This scenario has potential as the price has hovered within a sideways channel for over a month. Key levels to watch include:

- Resistance level: 39,970.0 – if the price breaks above this level, it will target 40,620.0

- Support level: 38,390.0 – if the price breaks below this level, it will dip to 37,565.0

Summary

The JP 225 stock index has broken out of the sideways channel where it has hovered for over a month. This signals the beginning of a strong uptrend, aiming for a new all-time high. The nearest growth target could be 40,620.0. Major buyers in Japan’s stock market are domestic players, while foreign investors have reduced their investments since late May 2024 at record sell-off rates unseen since September 2023.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.