DE 40 analysis: the index steadily rises following a downward correction

The DE 40 stock index is actively rising after a downward correction, supported by a consistent increase in leading US stock indices.

DE 40 forecast: key trading points

- Economic indicators: the German economy largely depends on the manufacturing sector, as the services sector holds a smaller share

- Market impact: the revival of the automotive industry may increase investor interest in German stocks

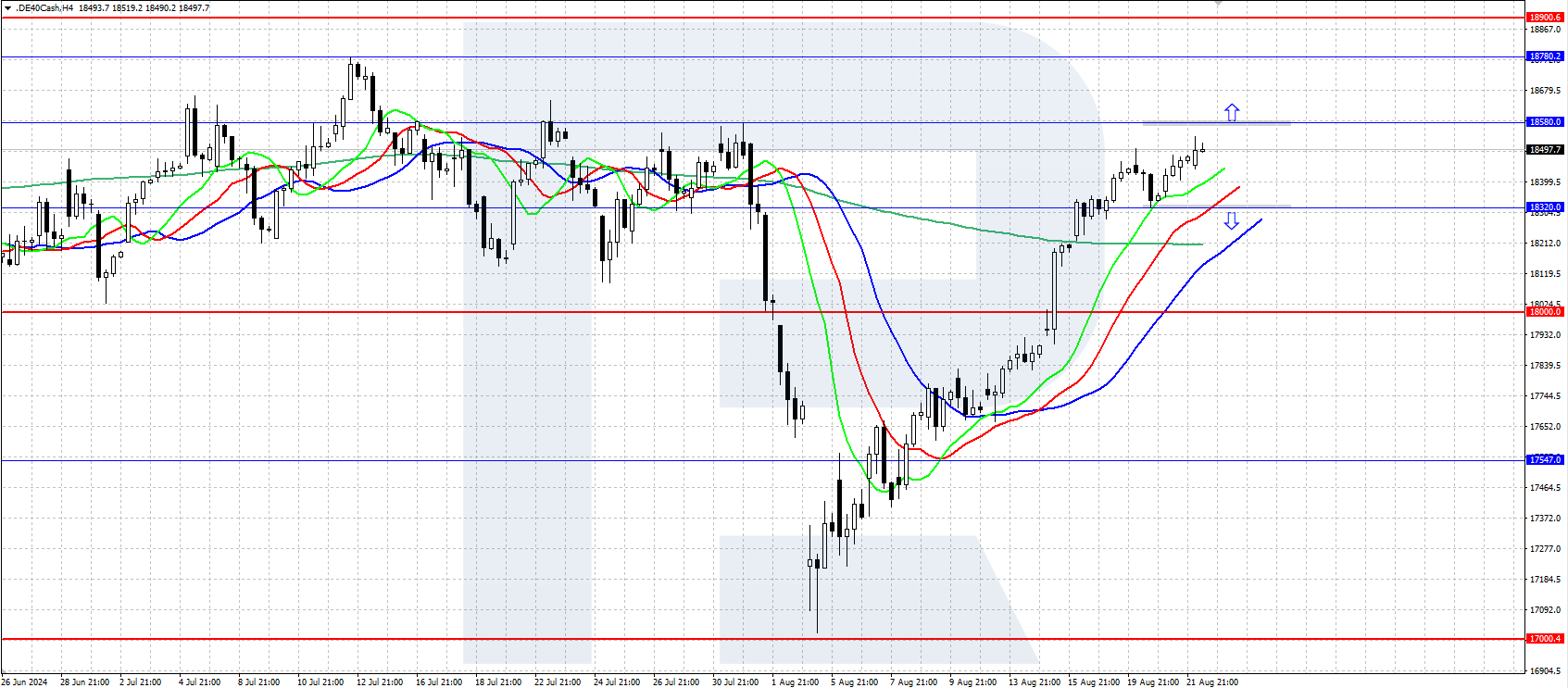

- Resistance: 18,580.0, Support: 18,320.0

- DE 40 price forecast: 18,580.0

Fundamental analysis

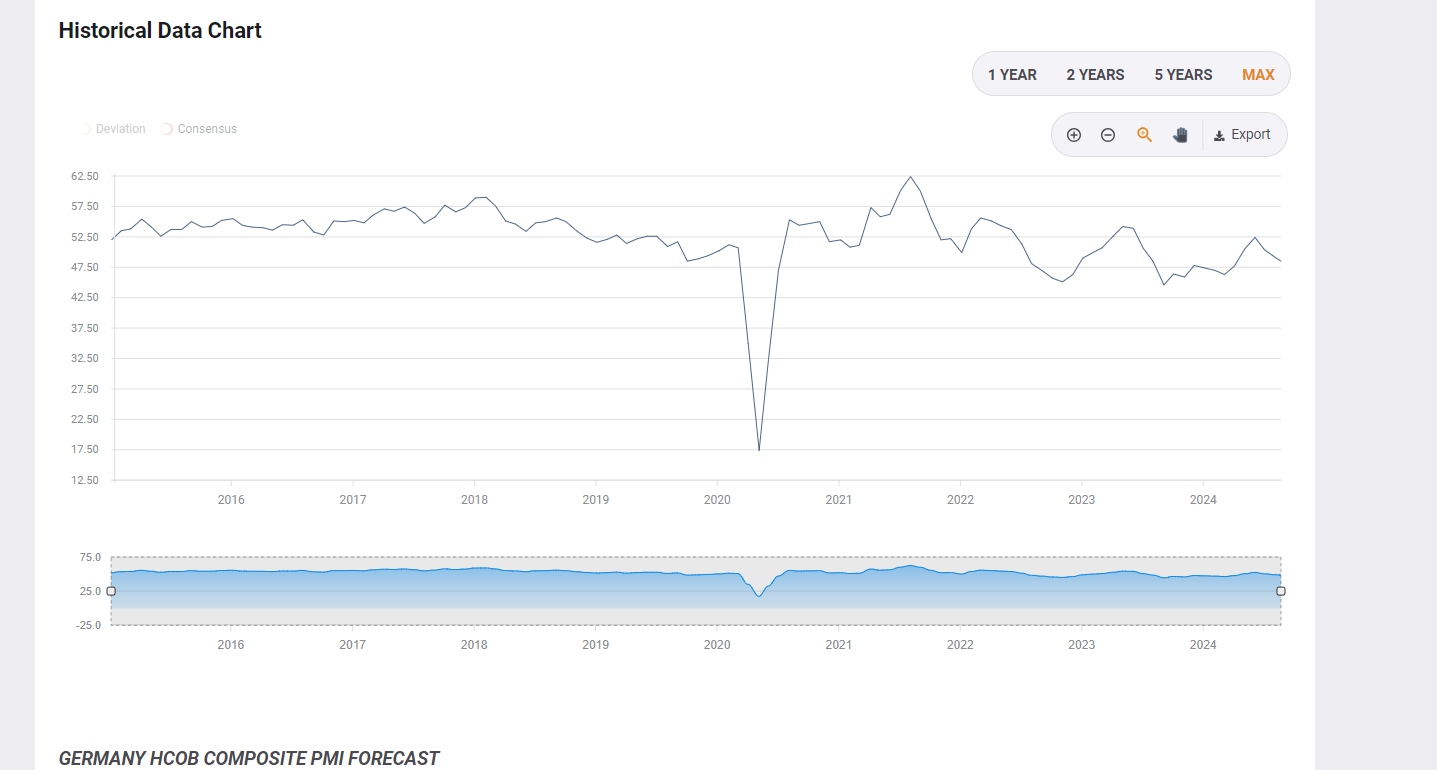

According to recently released statistics, Germany’s composite PMI dropped to 48.5 points in August, with the manufacturing PMI declining to 42.1. As a result, the country’s private sector economy continued to contract in August. However, the services PMI remained above the 50.0 threshold value (51.4 in August).

The German DE 40 index strengthened significantly on Wednesday, with the automotive sector leading the gains: Porsche, BMW, Mercedes, and Volkswagen stocks increased by 0.5% to 2.5%. Adidas and BASF shares also contributed to the index’s rise, each gaining about 2.0%. Airbus and Allianz also saw slight increases.

Despite a slight decrease in Germany’s PMI indices, the DE 40 index appears relatively stable, bolstered by US stock market growth. The latest Federal Reserve meeting minutes, released yesterday, indicate an intention to lower interest rates in September, with another cut likely by the end of the year.

DE 40 technical analysis

The DE 40 technical analysis shows a strong uptrend, with the price steadily recovering to annual highs after a downward correction. The DE 40 price forecast is somewhat optimistic, with the price likely reaching an all-time high of 18,900.0 in the near term.

Key levels for the DE 40 analysis:

- Resistance level: 18,580.0 – if the price breaks above this level, it could rise to an all-time high of 18,900.0

- Support level: 18,320.0 – if the price breaks below the support level, it could decline to 18,000.0

Summary

Strong growth in the DE 40 index persists, with the target for further upward movement being the annual and all-time high of 18,900.0. Despite weak statistics on Germany’s PMI indices, market sentiment remains somewhat optimistic, with expectations that the Fed and the ECB will ease monetary policy.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.