DE 40 analysis: the price exited a sideways channel, forming an uptrend

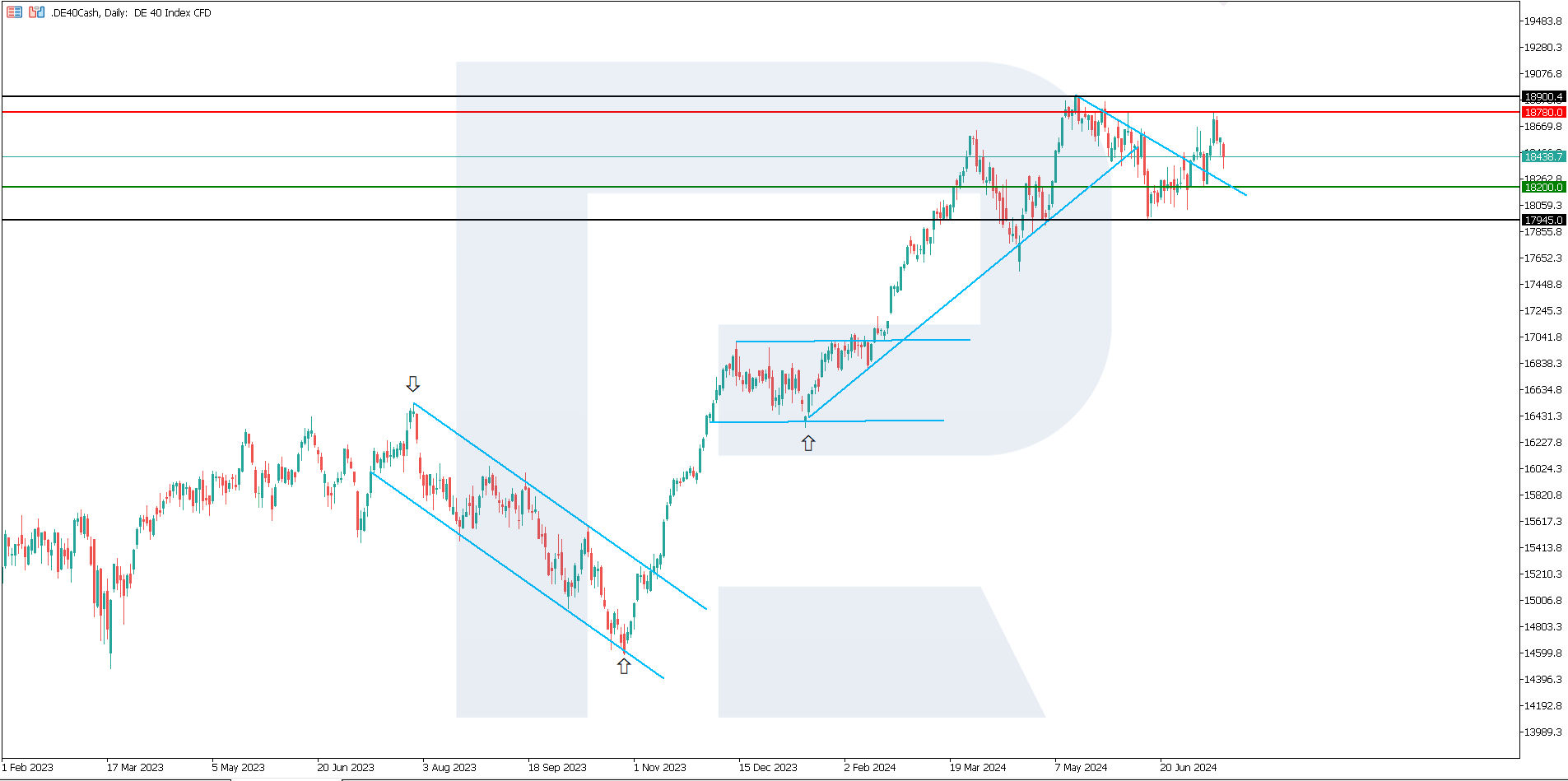

The DE 40 stock index has remained in a sideways range for an extended period. The price breached its upper boundary at the end of last week, indicating a reversal to an uptrend.

DE 40 trading key points

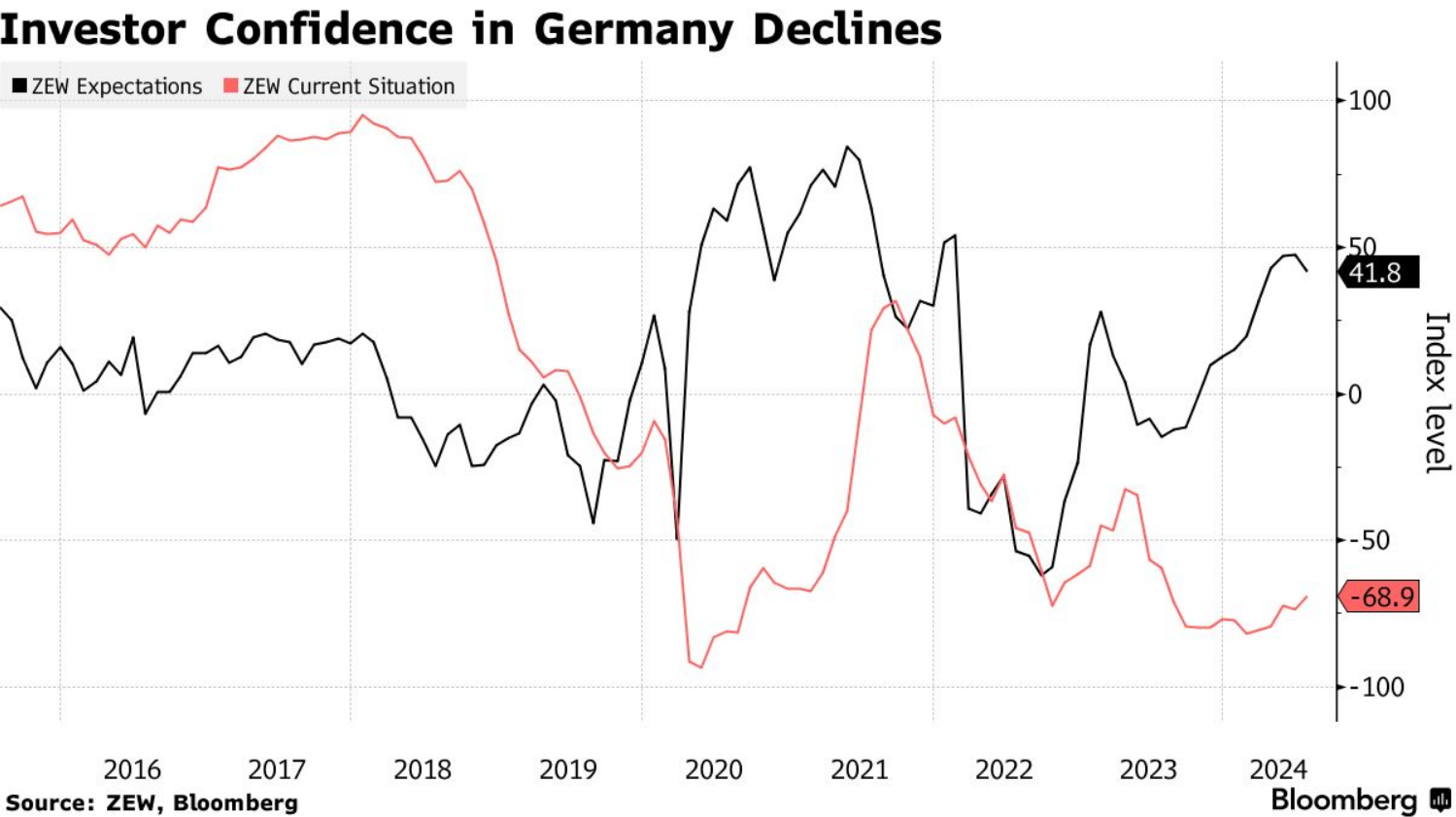

- Recent data: the ZEW indicator of economic sentiment fell to 41.8 in July from 47.5 in June

- Economic indicators: investor confidence in the German economy has deteriorated as the manufacturing industry lags behind the gradual recovery of other sectors

- Market impact: if the situation does not improve, demand for German stocks is unlikely to rise

- Resistance: 18780.0, Support: 18200.0

- DE 40 price target: 18900.0

Fundamental analysis

Investor confidence in the German economy deteriorated for the first time in a year as the manufacturing industry lags behind the recovery of related industries. According to data released by the ZEW institute on Tuesday, an expectations gauge decreased to 41.8 points in July from 47.5 in June, slightly exceeding the forecast of 41.0 points.

Additionally, Germany may face new challenges if Donald Trump wins the US presidential elections. Germany would suffer from the economic policy he plans.

As for the GDP, Germany has the highest share of industrial production, which, in turn, would be particularly impacted by trade uncertainty. According to Goldman Sachs Group estimates, rising uncertainty may lead to a nearly 0.5% decline in international trade.

DE 40 technical analysis

The DE 40 stock index has broken above the upper boundary of a sideways channel within an emerging uptrend, providing a stronger confirmation of the uptrend beginning. A correction is underway, limiting expectations of the price reaching a new all-time high. It could, however, be tested.

Key DE 40 levels to watch next week include:

- Resistance level: 18,780.0 – if the price breaks above this level within an uptrend, it could reach 18,900.0

- Support level: 18,200.0 – if the price breaks below this support level, the trend will reverse again to a downtrend, with the target at 17,945.0

Summary

The DE 40 stock index has broken above the upper boundary of a sideways channel and is heading towards 18,900.0. The price is unlikely to reach a new all-time high. The ZEW indicator of economic sentiment fell to 41.8 points in July from 47.5 in June. Investors are wary of Donald Trump coming to power in the US as his economic program is unbeneficial for the German manufacturing sector.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.