DE 40 analysis: decreasing German exports hinder demand for German stocks

The DE 40 stock index has been moving sideways for an extended period. The future trend will depend on the ECB’s decision regarding monetary policy and the key interest rate.

DE 40 trading key points

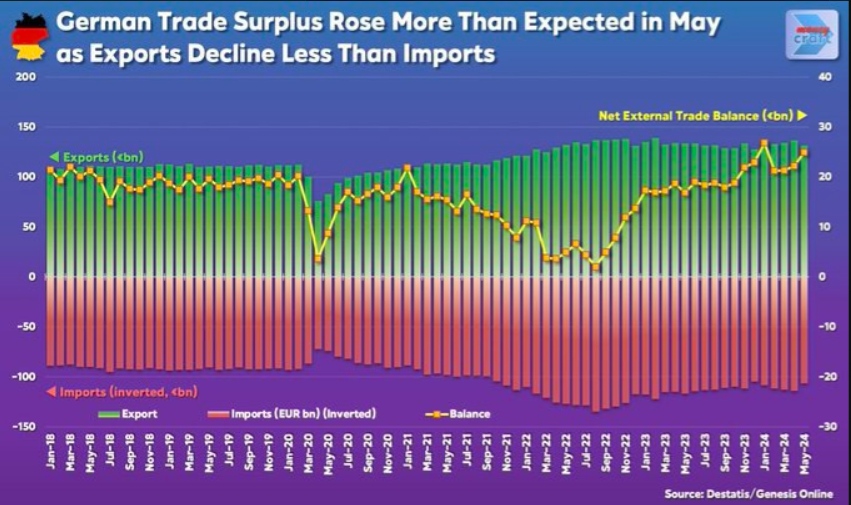

- Recent data: German exports fell by 3.6% in May 2024, and imports decreased by 6.6% compared to April 2024 (adjusted for calendar and seasonal factors)

- Economic indicators: Germany is an export-oriented country, so declining exports negatively impact companies’ earnings

- Market impact: with issuers’ financial results declining, investor demand for their securities will drop significantly

- Resistance: 18,645.0, Support: 17,935.0

- DE 40 price target: 18,795.0

Fundamental analysis

German exports deteriorated markedly in May due to sluggish demand from China, the US, and European countries.

Compared to the previous month, exports and imports in May declined by 3.6% and 6.6%, respectively (adjusted for calendar and seasonal factors). Germany’s foreign trade balance showed a surplus of 24.9 billion EUR in May 2024.

Source: https://x.com/libertniko/status/1777249122145206400

Goldman Sachs Group Inc. recommends selling those European shares whose profit depends on China due to slowing consumption growth rates and increasing trade tensions. Strategists prefer companies with US exposure as the US dollar might strengthen.

DE 40 technical analysis

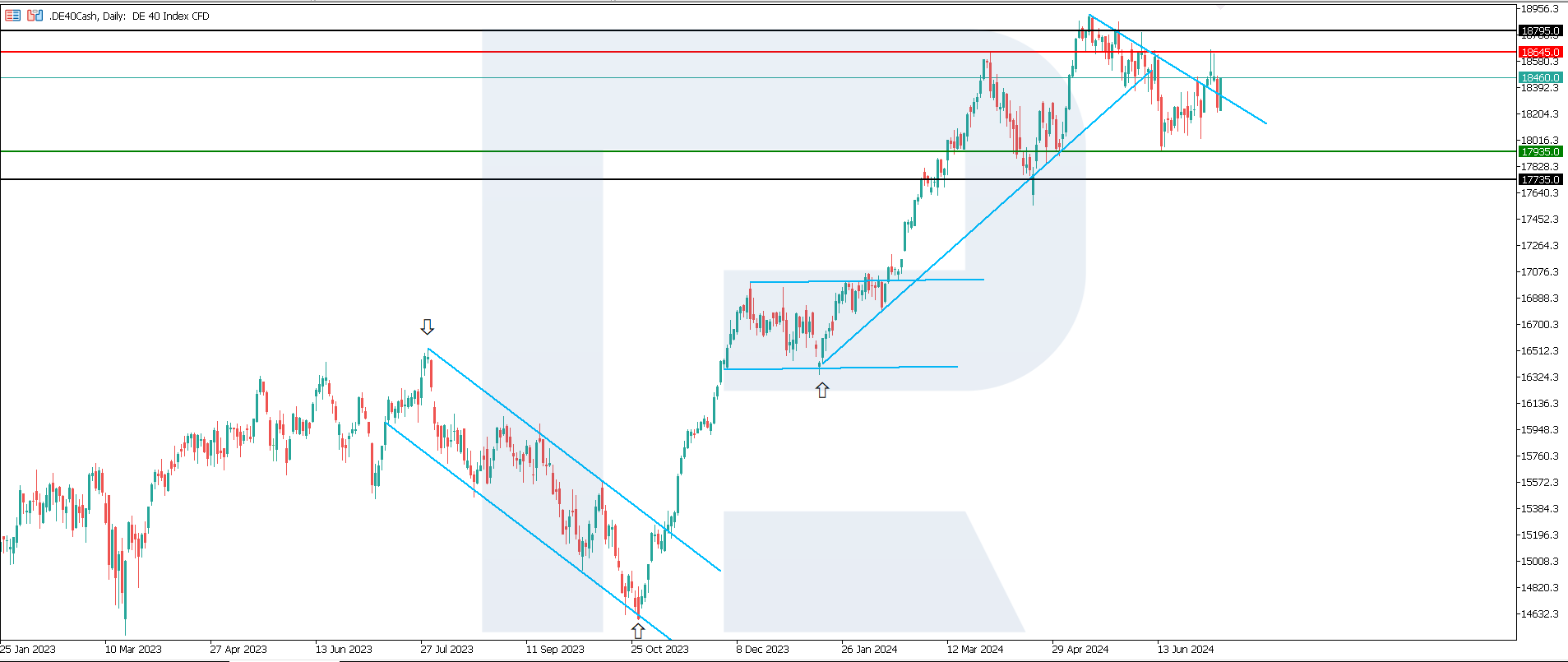

The DE 40 stock index is in a sideways channel on the daily timeframe. After breaking above the downtrend’s resistance, the price failed to surpass another resistance level. Growth potential remains.

Key DE 40 levels to watch this and the next week include:

- Resistance level: 18,645.0 – if the price breaks above this level, it might rise to 18,795.0

- Support level: 17,935.0 – if the price breaks below this level, a downtrend could continue to the 17,735.0 target

Summary

The DE 40 stock index remains within the same sideways channel boundaries. There is potential for breaking above the upper boundary, targeting 18,795.0. Exports fell 3.6% in May 2024, and imports decreased 6.6% compared to April (adjusted for calendar and seasonal factors). Due to slowing consumption growth rates and increasing trade tensions, Goldman Sachs Group Inc. recommends selling European shares (including German ones) whose profits depend on China.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.