DE 40 analysis: weak German data does not prevent the index from reaching all-time highs

Despite Germany’s economic downturn, the DE 40 stock index continues rising, reaching historical highs. This anomaly is unlikely to last long, so the forecast for the DE 40 for next week is negative.

DE 40 forecast: key trading points

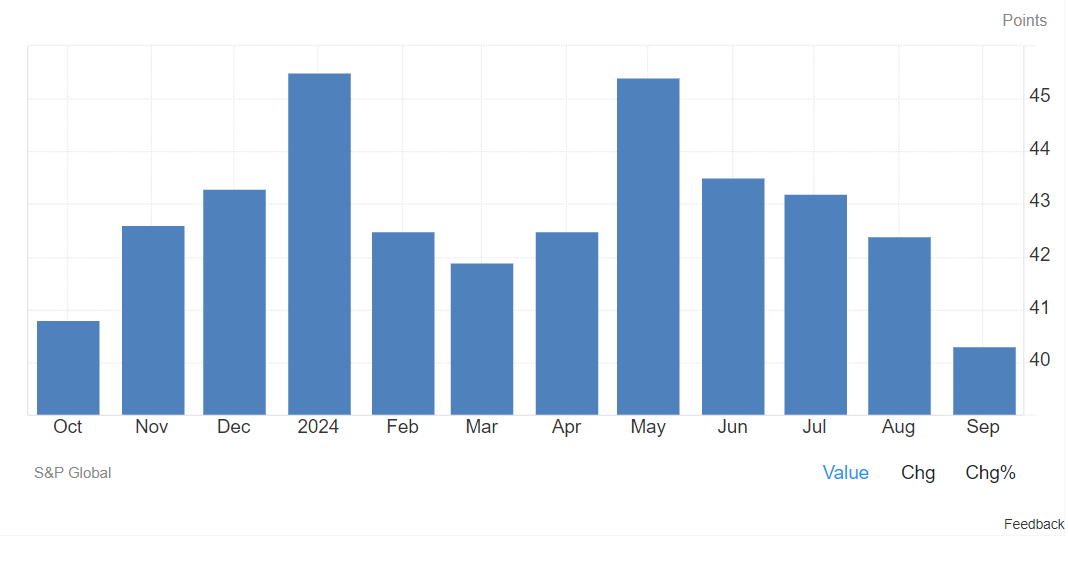

- Recent data: Manufacturing PMI was 40.3 points in September

- Economic indicators: Manufacturing PMI reflects current economic conditions and expectations

- Market impact: a PMI reading below 50.0 indicates a downturn in the manufacturing sector, while a reading above 50.0 indicates growth, which influences demand from stock market investors

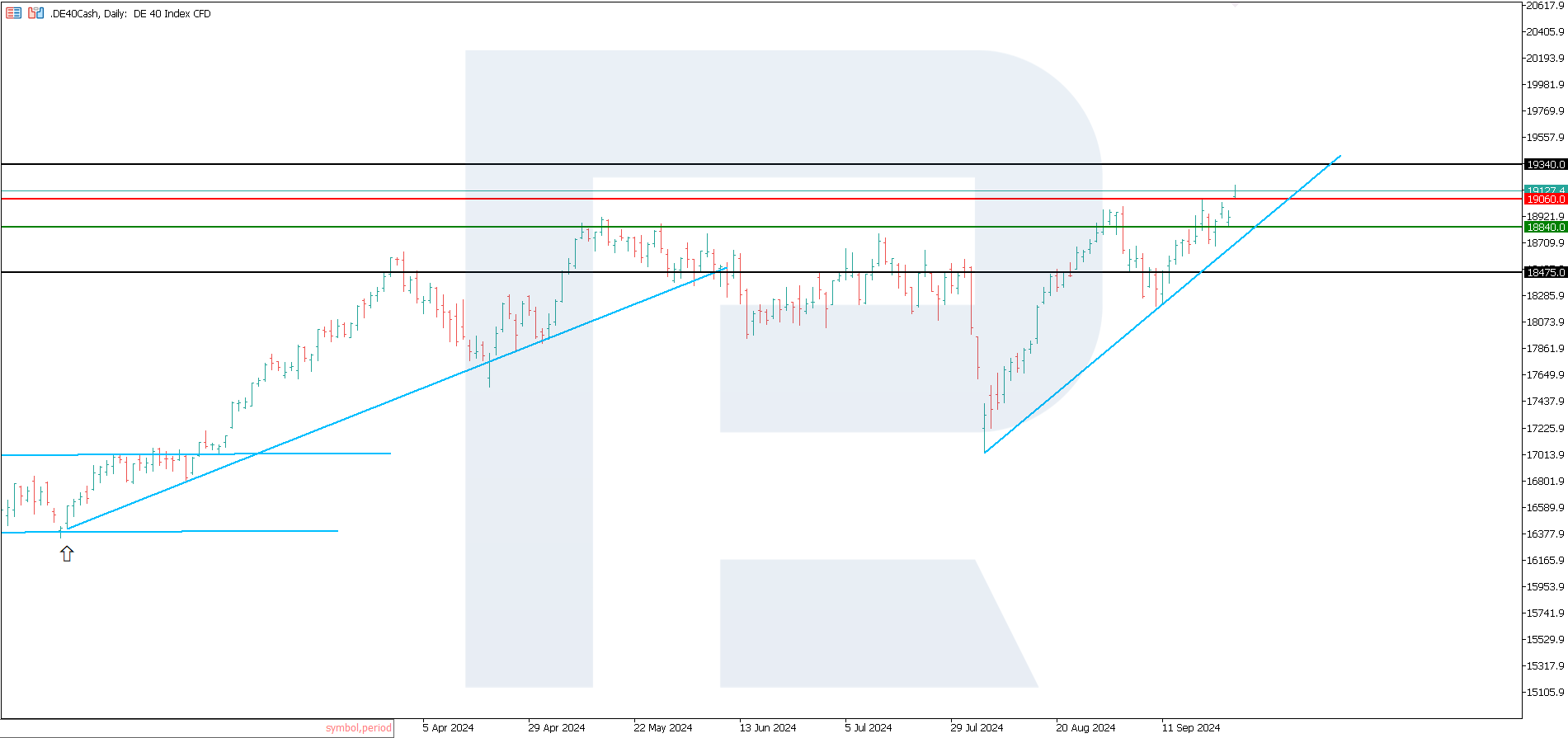

- Resistance: 19,060.0, Support: 18,840.0

- DE 40 price forecast: 19,340.0

Fundamental analysis

The 40.3 Manufacturing PMI indicator is well below the 50.0 mark, indicating a decline in activity in the manufacturing sector. The dynamics reflect a worsening situation, as the current value is lower than the previous one (42.4), indicating a stronger contraction in output.

Source: https://tradingeconomics.com/germany/manufacturing-pmi

Such a decline may signal weak domestic and foreign demand, negative economic expectations, and a deeper recession in the manufacturing segment, which is the backbone of the German economy. This data could push the German authorities and the European Central Bank towards further stimulus measures to support industry and avoid more significant economic consequences.

Labour leaders threatened strikes and warned Volkswagen against a historic mistake. Both sides have begun wage negotiations that are likely to determine how aggressively Europe’s largest carmaker will pursue layoffs and potential plant closures in Germany. The long-term outlook for the DE 40 index is negative.

DE 40 technical analysis

The DE 40 stock index is in an uptrend, but its growth dynamics are relatively weak. From the technical analysis perspective, DE 40 will likely enter a downward trend in the short term. However, before that, the index may update the historical maximum before a more substantial decline and stagnation. The forecast for the DE 40 index is negative.

The following scenarios are identified for the DE 40 index:

- Pessimistic forecast for DE 40: if the support level of 18,840.0 is breached, prices may fall to 18,475.0

- Optimistic forecast DE 40: if the price consolidates above the previously breached resistance level at 19,060.0, it may reach 19,340.0

Summary

The September manufacturing PMI is at 40.3 points, well below the 50.0 level, indicating a decline in activity in the manufacturing sector. The dynamics reflect the deterioration of the situation, as the current value is lower than the previous one (42.4). Nevertheless, the DE 40 index continues to rise speculatively with a potential target of 19,340.0. However, unfavourable economic indicators are highly likely to affect stock market dynamics in the short term.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.