DE 40 analysis: a correction in the downtrend is underway

The DE 40 index is in a downtrend after reaching an all-time high amid the crisis in the German automotive industry. The DE 40 forecast for next week is negative.

DE 40 forecast: key trading points

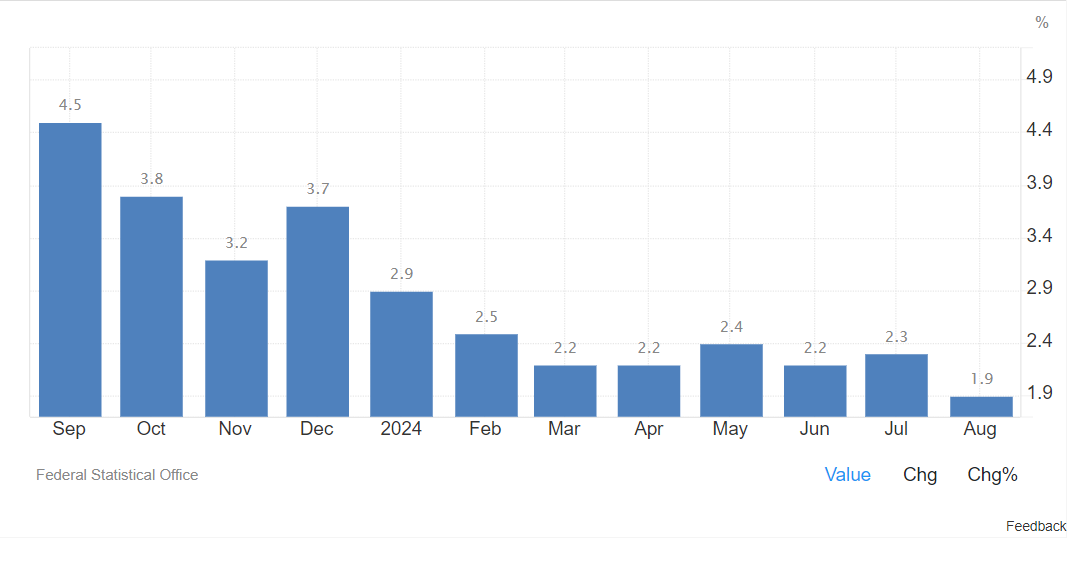

- Recent data: consumer inflation in Germany is 1.9%

- Economic indicators: inflation in the leading EU economy directly affects the ECB’s interest rate decision

- Market impact: slowing inflation has a positive impact on the stock market

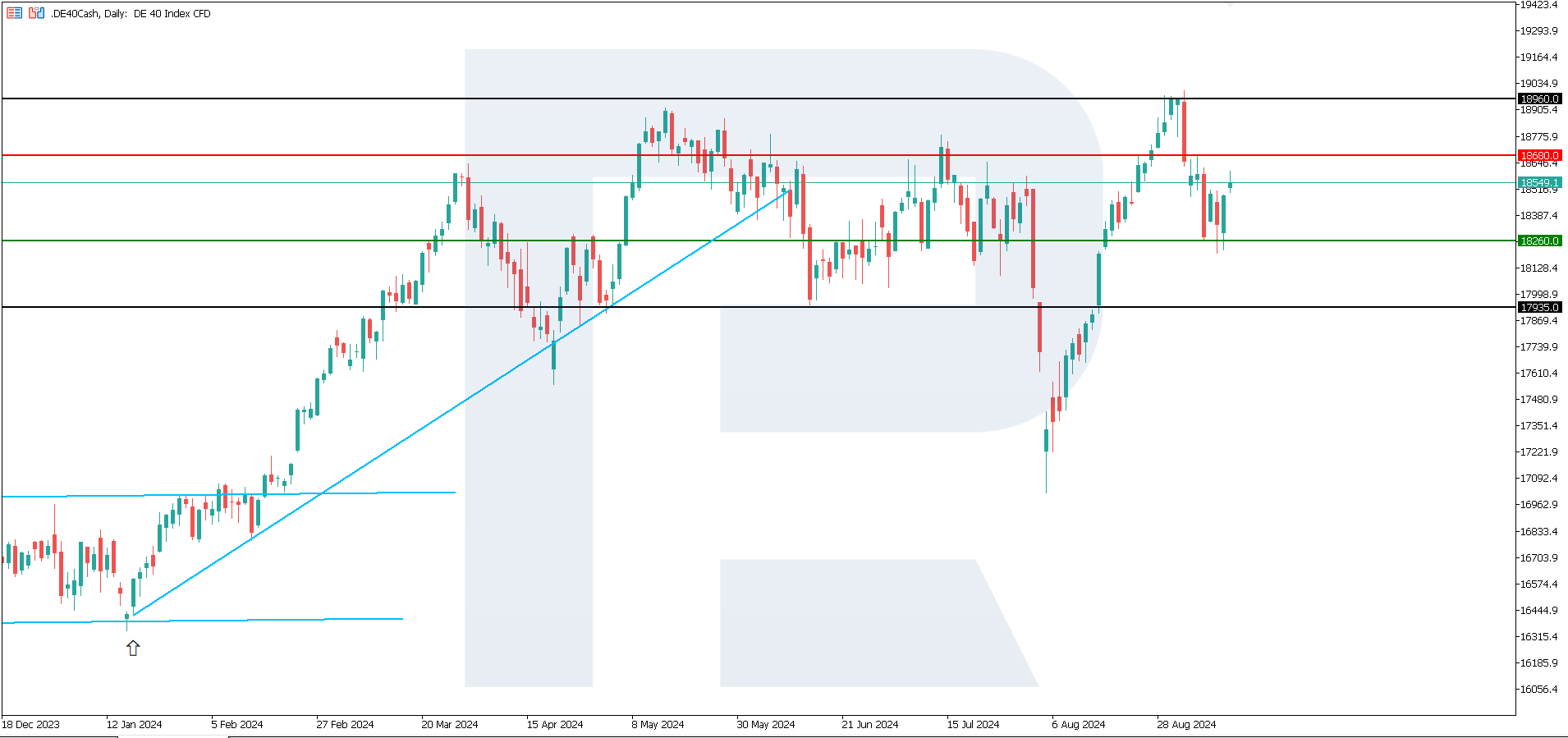

- Resistance: 18,680.0, Support: 18,260.0

- DE 40 price forecast: 17,935.0

Fundamental analysis

Consumer inflation in Germany reached 1.9% year-over-year, fully aligning with analysts’ expectations. Price growth rates in the leading EU economy are slowing and standing below the ECB target of 2.0%.

Source: https://tradingeconomics.com/germany/inflation-cpi

Investors had priced in a gloomy outlook for European automakers, and the reality gradually appears to be even worse than expected. Germany as the leading EU automaker is suffering the most.

The five major automakers (BMW, Mercedes-Benz, Renault, Stellantis, and VW) had nearly a third of large European car factories underutilised last year, producing less than half the cars they can produce, as analysed by Bloomberg News based on the Just Auto data. The plant closures could fuel concerns that the region is in for a long-term downturn after falling behind its competitors. Therefore, the medium-term DE 40 index forecast is negative.

DE 40 technical analysis

In terms of the DE 40 technical analysis, the index is in a downtrend. After reaching an all-time high, the quotes consistently break below each newly formed support level. The nearest target for the decline is currently at the 17,935.0 level. If the price falls further, the downtrend may last for several more weeks.

Key levels to watch in the DE 40 price forecast include:

- Resistance level: 18,680.0 – a breakout above this level may drive the index to 18,960.0

- Support level: 18,260.0 – a breakout below the support level may send the price down to 17,935.0

Summary

Consumer inflation in Germany eased to 1.9% in August from 2.3% in July. This is a positive signal for the stock market as the ECB may lower the key rate more decisively. However, the real sector data is disappointing for investors – in particular, the crisis in the automotive industry may cause a recession both in the EU and Germany itself. For this reason, the medium-term DE 40 forecast is negative.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.