EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD technical analysis and forecast for 9-13 December 2024

Here is a detailed weekly technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD for 9-13 December 2024.

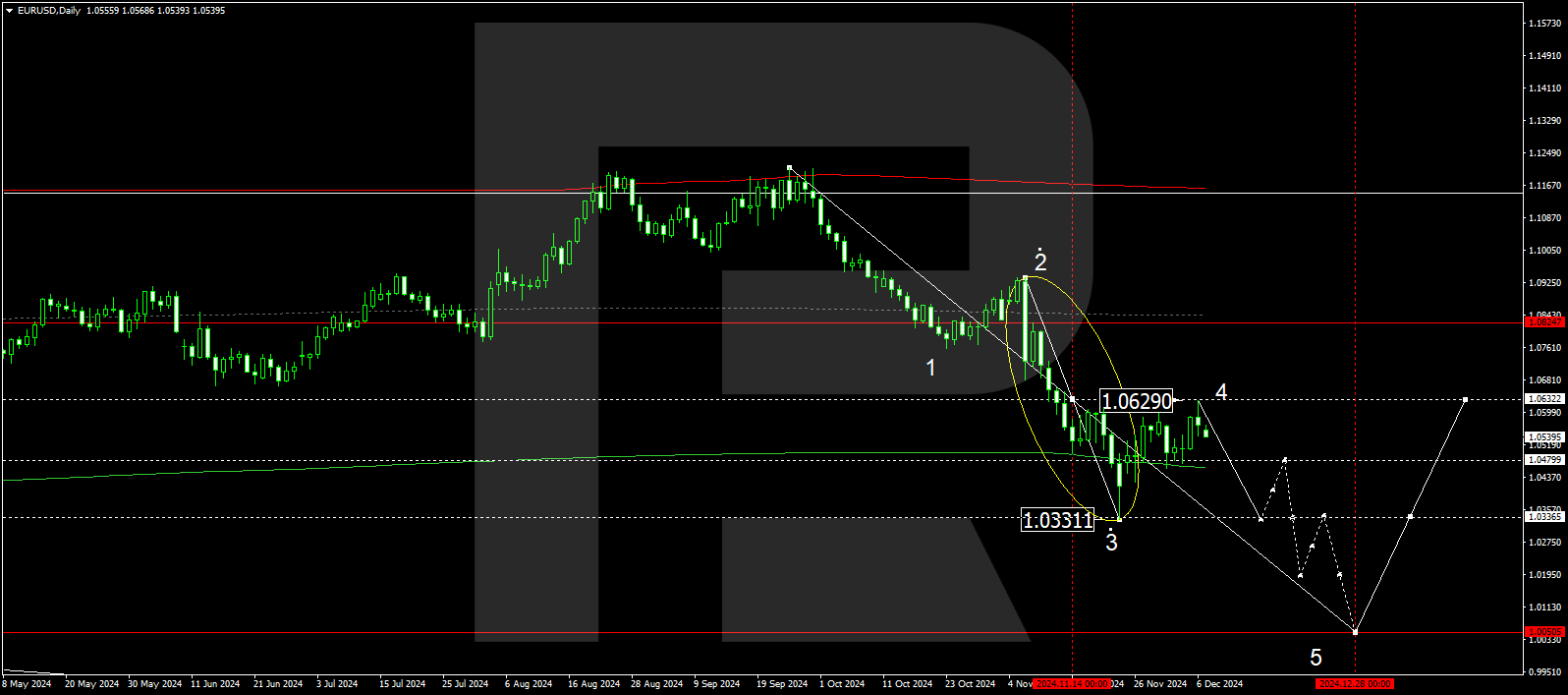

EURUSD forecast

The EURUSD pair has completed a growth wave, reaching 1.0629. This growth structure is considered a correction of the previous downward wave, with a new descending wave expected to start, aiming for 1.0480. A breakout below this level will open the potential for a decline towards 1.0330, the first target. After reaching this level, the price could rise to 1.0480 (testing from below). Subsequently, the downward wave in the EURUSD pair might extend to 1.0200 and potentially further to 1.0050.

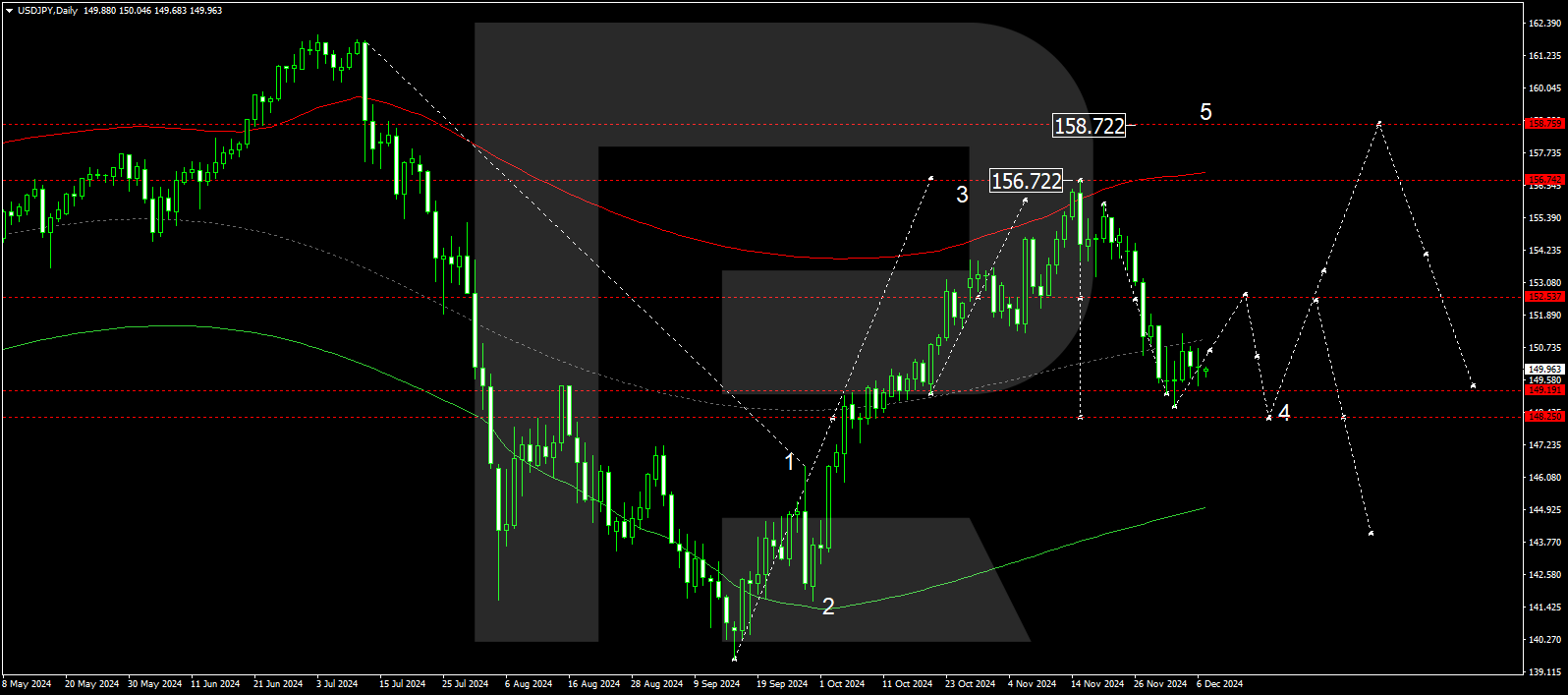

USDJPY forecast

The USDJPY pair has reached the local target of a downward wave at 148.64. After hitting this level, the price could rise to 152.50 before tumbling to 148.25. A correction is practically developing further. Once it is complete, a new growth wave in the USDJPY pair might start, targeting 154.00 and potentially continuing the trend to the 158.70 level.

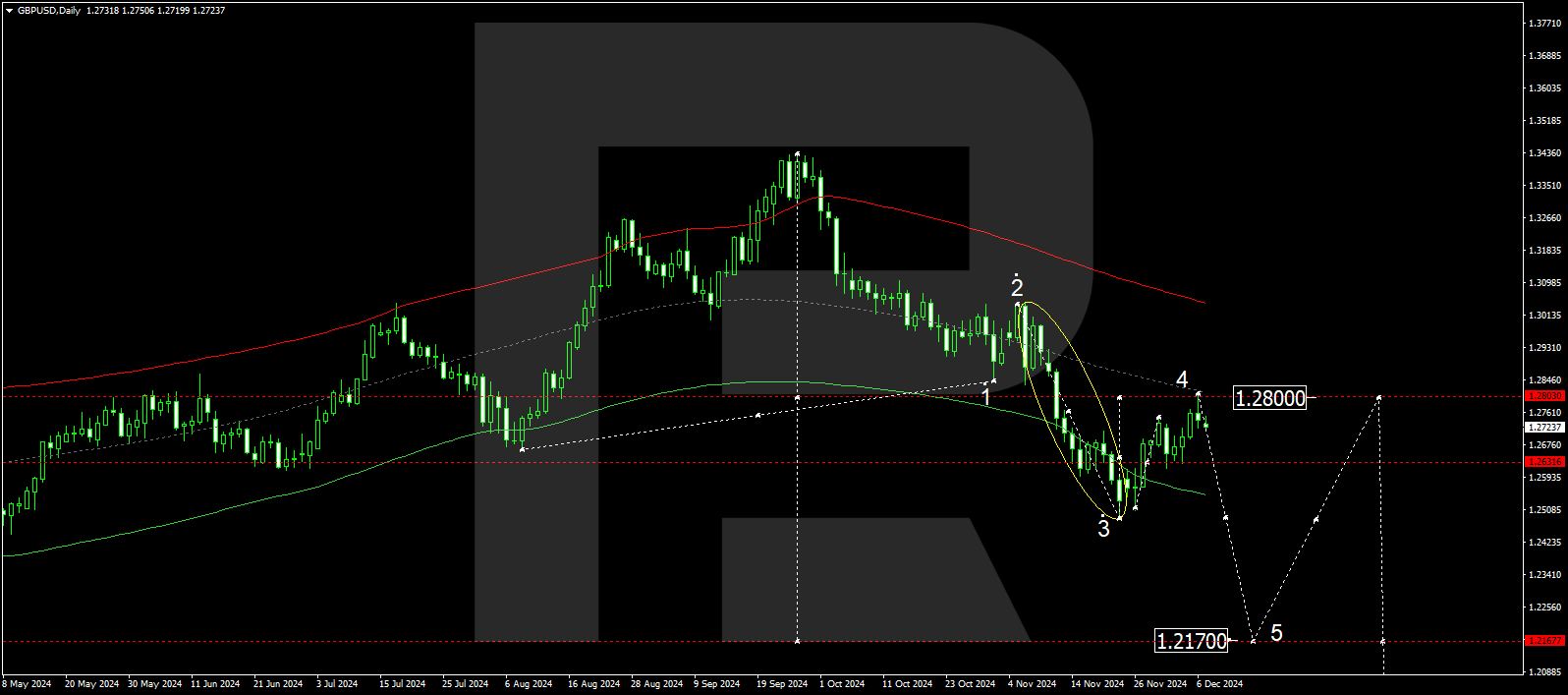

GBPUSD forecast

The GBPUSD pair has completed a growth wave towards 1.2800, marking a correction of the previous downward wave. After reaching this level, the market rebounded downwards, forming a downward wave towards 1.2630. The price is expected to break below this level, with the decline target at 1.2480, potentially continuing the trend to 1.2170. Once the price hits this level, a growth wave in the GBPUSD pair could start, targeting 1.2800.

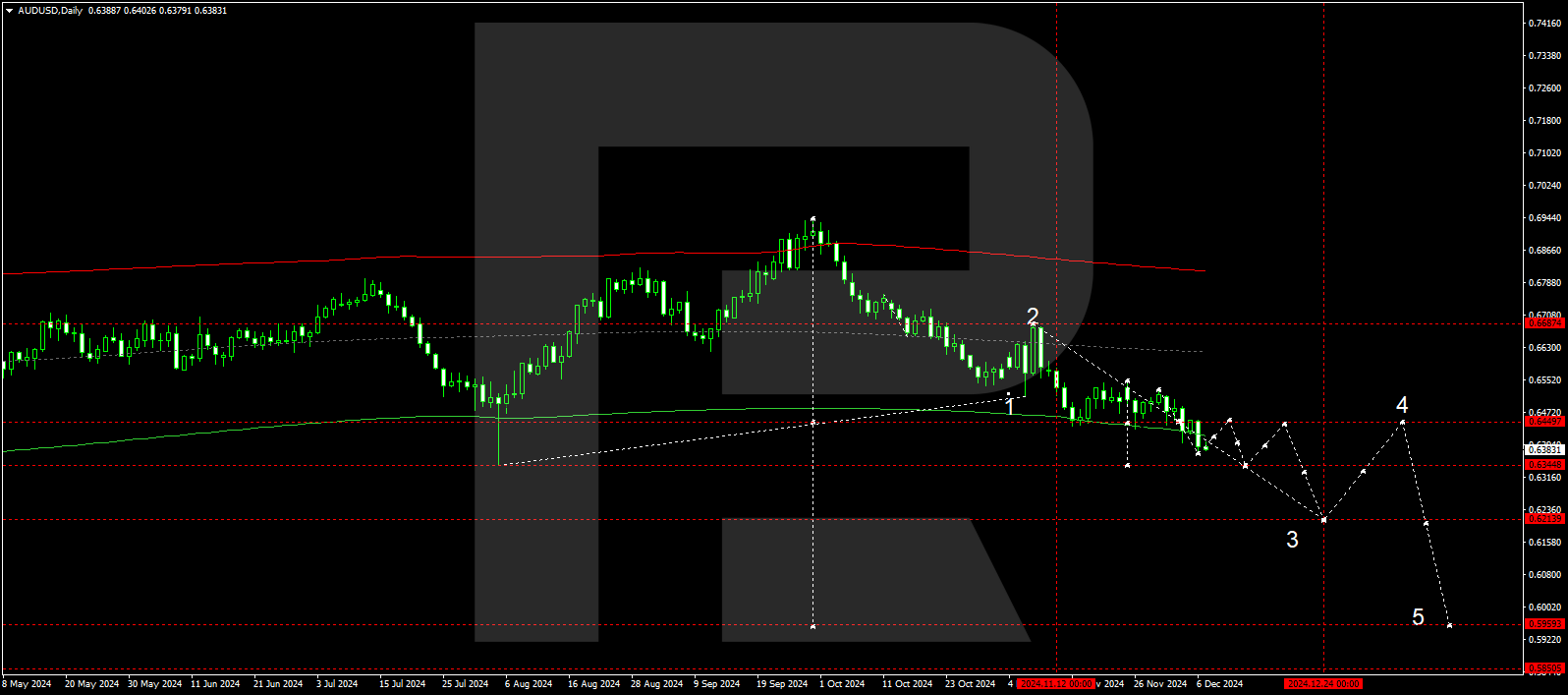

AUDUSD forecast

The AUDUSD pair has breached the 0.6450 level and maintains its momentum towards 0.6344. After reaching this level, the price could rise to 0.6444. Subsequently, the downward wave in the AUDUSD pair could continue towards the local target of 0.6220.

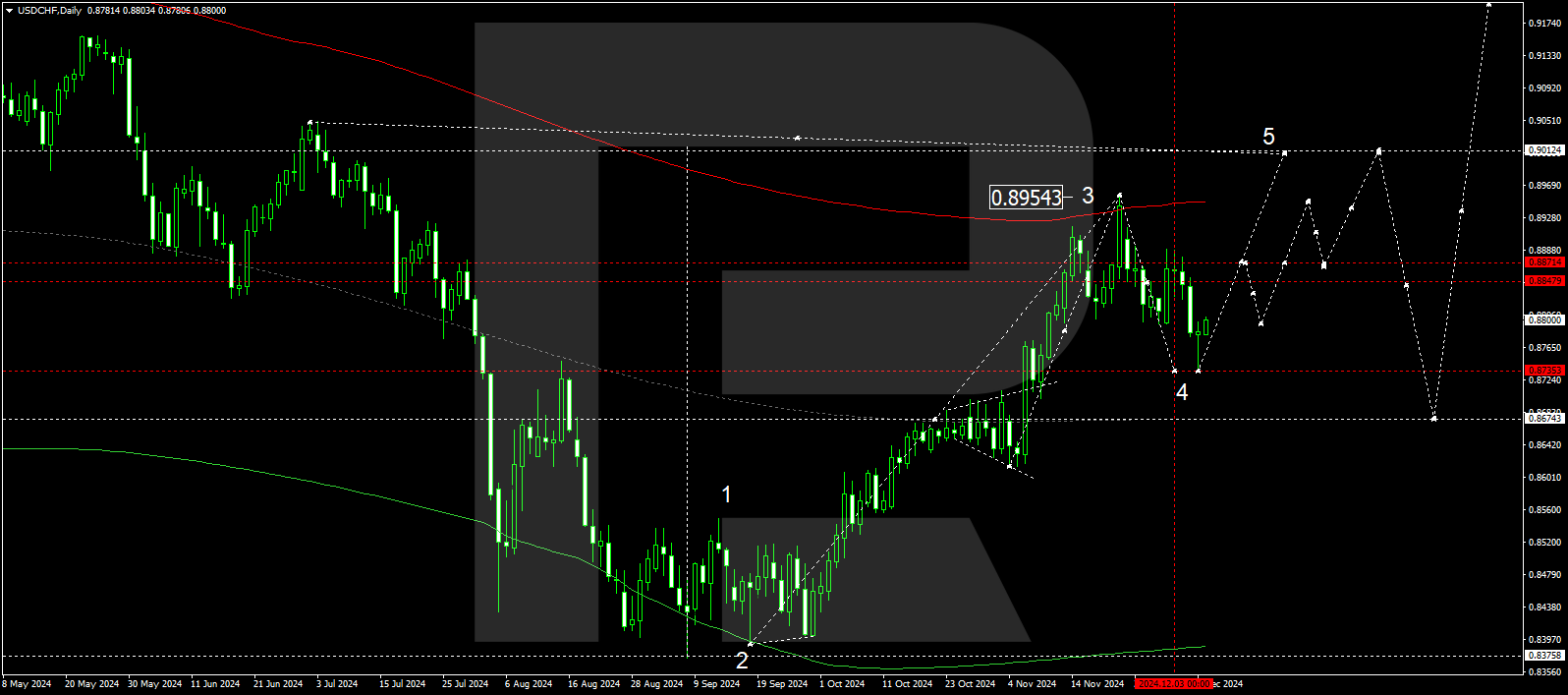

USDCHF forecast

The USDCHF pair has completed a downward wave, reaching 0.8735, and could rise to 0.8874 today. Once the price hits this level, it might tumble to 0.8797. Subsequently, a growth wave could start, aiming for 0.8949 and potentially further for 0.9010, the main target.

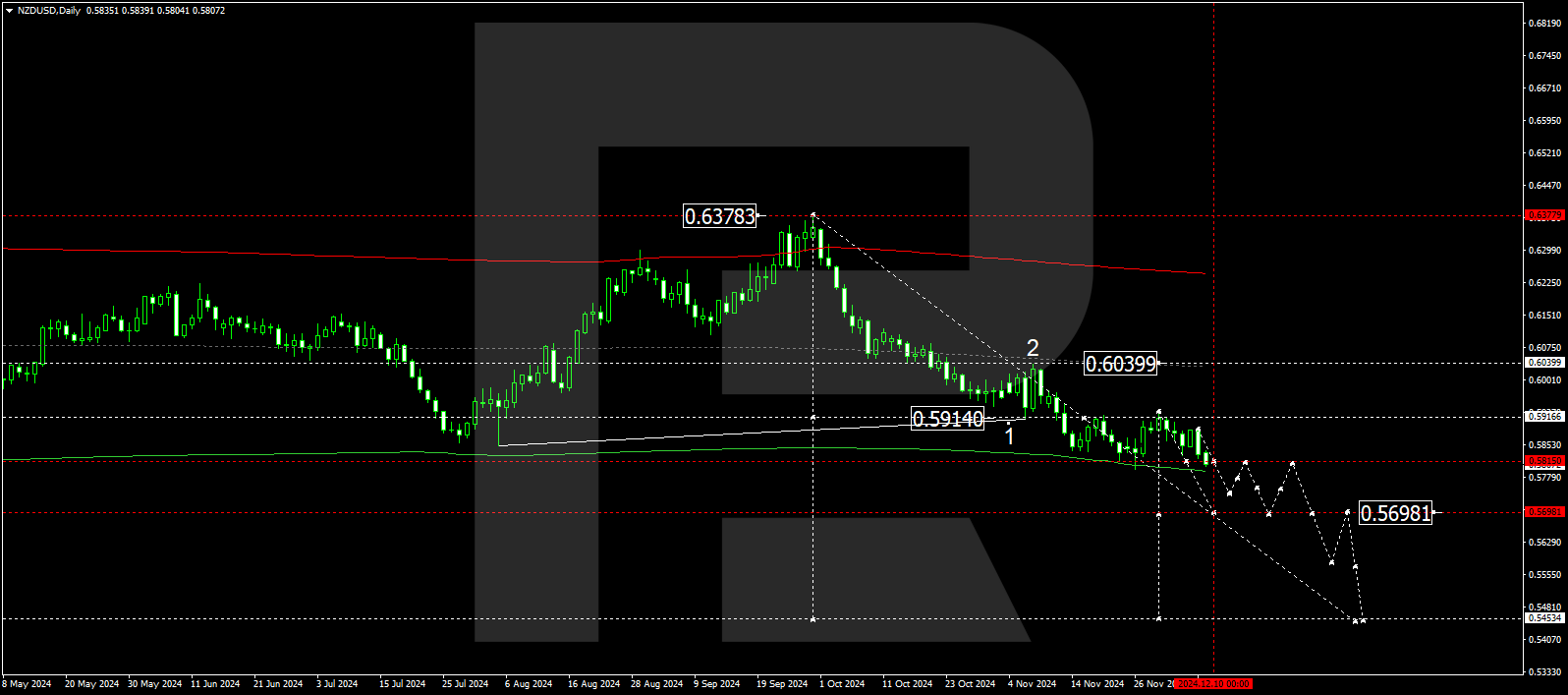

NZDUSD forecast

The NZDUSD pair has completed a corrective wave, reaching 0.5922. The market continues developing a downward wave, targeting 0.5700. After hitting this level, the price could rise to 0.5800 (testing from below). Subsequently, a downward wave in the NZDUSD pair could continue, aiming for 0.5454 as the main target.

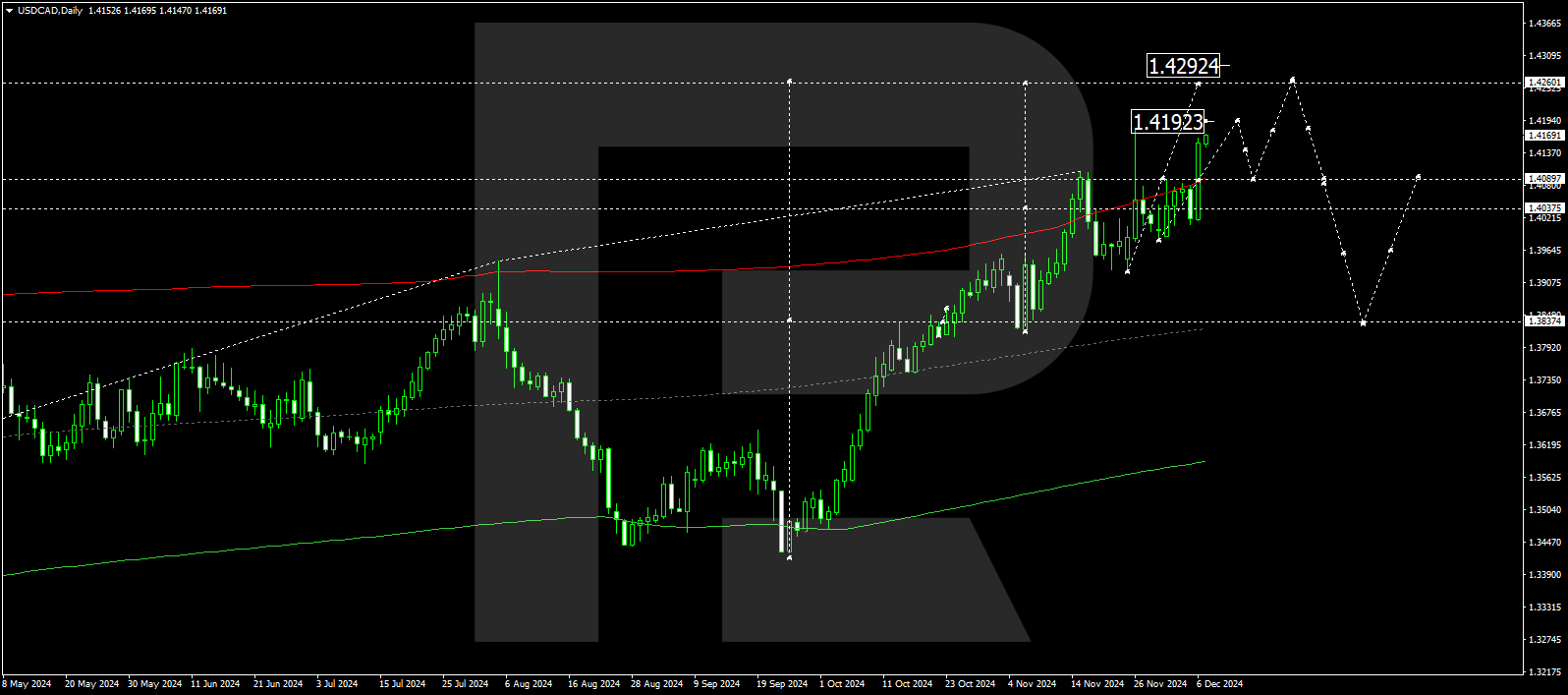

USDCAD forecast

The USDCAD pair has broken above the 1.4090 level and maintains its upward trajectory, aiming for 1.4200. Once the price reaches this level, it could plunge to 1.4090 (testing from above). Subsequently, a growth wave is expected to target 1.4260, followed by a corrective wave in the USDCAD pair towards the 1.4090 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.