USDJPY: the yen has a strong chance of strengthening

Stable bank lending and the Bank of Japan’s summary of opinions may support the yen’s strengthening against the US dollar. Discover more in our analysis for 11 November 2024.

USDJPY forecast: key trading points

- Japan’s Bank Lending Rate (y/y): previously at 2.7%, currently at 2.7%

- The Bank of Japan summary of opinions

- Japan’s Economy Watchers Survey: previously at 49.0%, currently at 47.5

- USDJPY forecast for 11 November 2024: 150.55

Fundamental analysis

Japan’s Bank Lending Rate shows the total funds Japanese banks provide to borrowers, including businesses and individuals. The indicator is an important gauge for understanding economic activity, as growth in lending indicates increased spending and investment. The Japanese central bank closely monitors bank lending to regulate monetary policy effectively and stimulate economic growth.

An increase in bank lending volume signals economic recovery, as rising demand for loans reflects confidence in economic prospects.

Fundamental analysis for 11 November 2024 indicates that the lending rate remained at the previous level of 2.7%, which may suggest a stabilisation in Japan’s economy and inflation.

The Bank of Japan’s summary of opinions is a report released after BoJ monetary policy meetings. This document outlines the principal opinions and discussions of the Policy Board members concerning the current economic situation, inflation, and financial conditions in Japan. It provides insight into the Bank of Japan’s assessment of economic risks and potential measures it may implement to stabilise inflation and promote sustainable economic growth.

The summary of opinions is valuable to analysts and investors as it indicates potential changes in Japanese monetary policy.

Japan’s Economy Watchers Survey is a monthly indicator measuring economic sentiment and expectations among representatives from various Japanese business sectors, including retail, transport, and services.

The index is based on surveys of professionals directly involved with consumers, enabling timely observations of changes in demand and public sentiment.

The index consists of two parts: current economic conditions and expectations for the coming months. An increase in the index indicates economic improvement, while a decline signals potential economic challenges. The indicator is widely used to forecast short-term trends in the Japanese economy.

Although the forecast for 11 November 2024 suggested the index could fall to 47.2, the actual reading was 47.5. While this exceeded the forecast, it was below the previous level. Nevertheless, the actual result may be viewed positively for the Japanese yen.

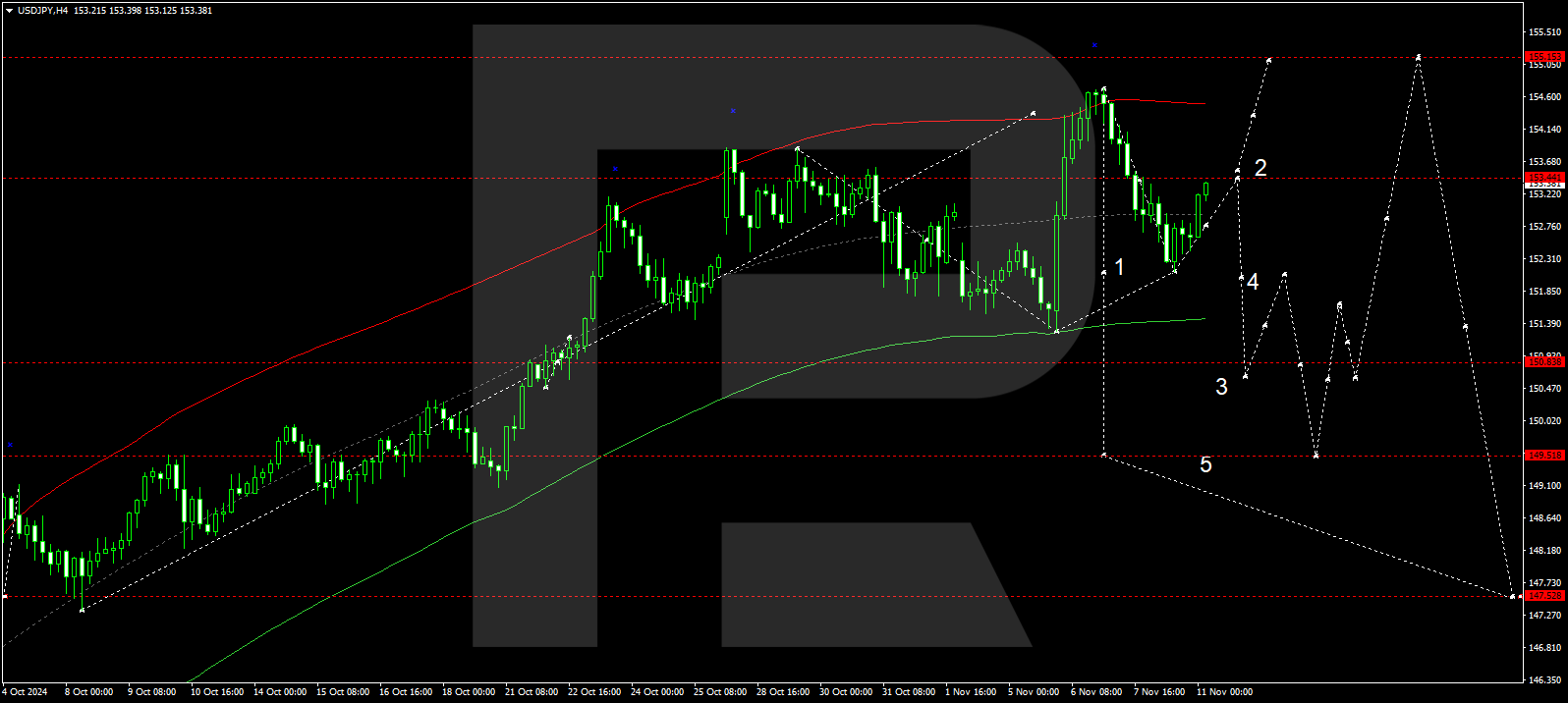

USDJPY technical analysis

The USDJPY H4 chart shows that the market has completed a wave, reaching 152.20. The price is expected to rise to 153.44 today, 11 November 2024. After the USDJPY rate hits this level, a consolidation range may develop between these levels. A downward breakout from the range would open the potential for a further corrective wave towards 150.55, with the trend likely to move towards the 149.50 level. Conversely, an upward breakout could propel the price to 155.15, potentially followed by a more substantial corrective wave targeting 147.47.

The Elliott Wave structure and corrective wave matrix, with a pivot point at 153.44, technically confirm this scenario for the USDJPY rate. The market is currently at the midpoint of a price envelope, where a consolidation range is likely to develop. A breakout below this range is worth considering, with the USDJPY rate targeting the envelope’s lower boundary at 150.55.

Summary

The Bank of Japan summary and technical analysis for today’s USDJPY forecast suggests a potential decline to 150.55.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.