USDJPY is on hold: investors prefer to wait for further news

The USDJPY pair remains in a consolidation phase. The market is preserving its strength ahead of the BoJ meeting. Find out more in our analysis for 30 October 2024.

USDJPY forecast: key trading points

- The USDJPY pair paused ahead of the Bank of Japan meeting

- The market expects the interest rate to remain unchanged at the meeting but to be raised at the end of the year

- USDJPY forecast for 30 October 2024: 150.83

Fundamental analysis

The USDJPY rate is consolidating around 153.34 on Wednesday.

The market is holding steady ahead of Thursday’s Bank of Japan meeting. Investors’ core expectations suggest that the BoJ will keep its monetary policy unchanged this time. However, it is widely believed that the regulator will increase the interest rate before the end of the year.

The economy’s problematic areas include summer export weakness and shrinking household spending. The Bank of Japan needs compelling arguments in the form of higher inflation figures to tighten monetary conditions. Inflation is expected to remain around the 2.0% target.

The latest data showed that inflationary pressures have moderately eased. However, prices for domestic and imported goods are rising, indicating that any decline in inflation below the 2.0% level will likely be temporary.

The USDJPY forecast suggests a continued consolidation at the moment.

USDJPY technical analysis

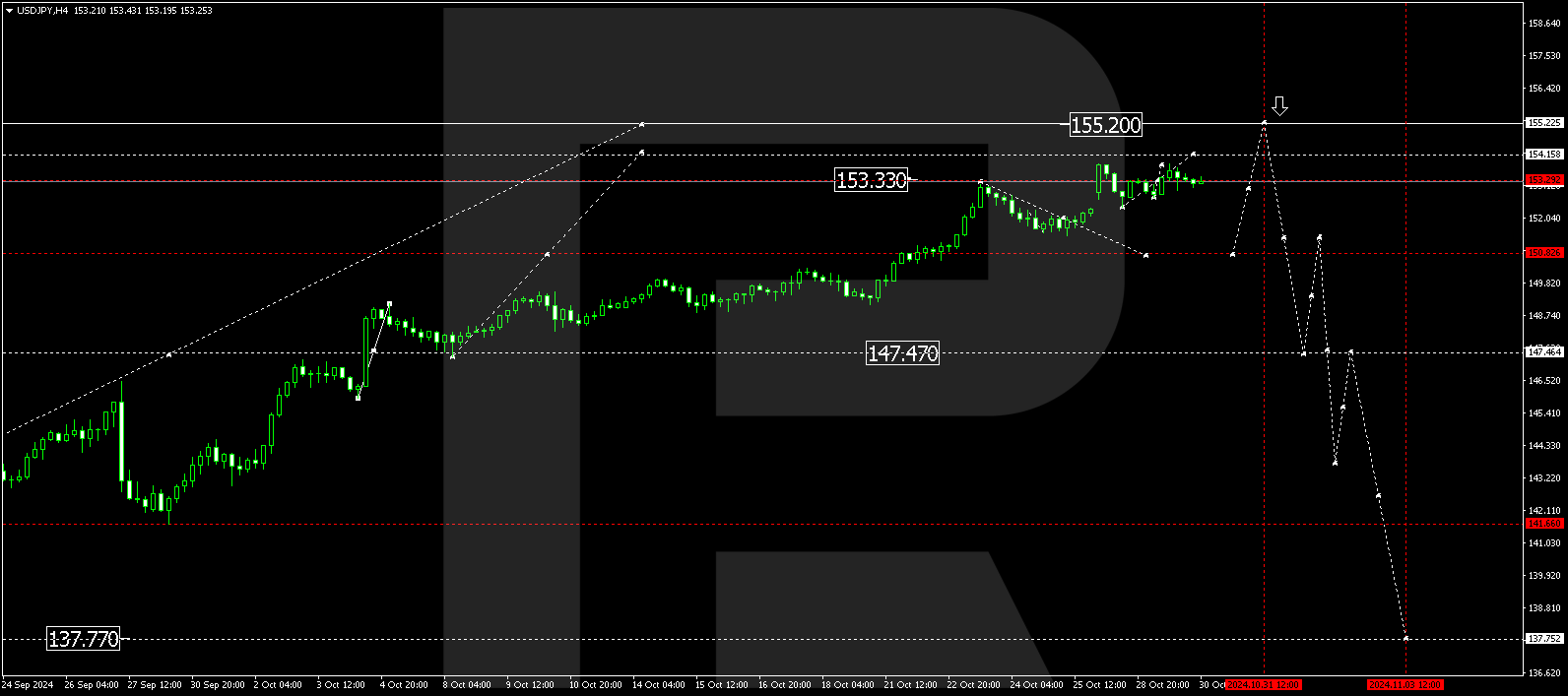

The USDJPY H4 chart shows that the market continues to develop a narrow consolidation range around 153.30 without a clear trend. The range could extend to 154.15, with a decline to 153.30 today, 30 October 2024. A breakout below the range would open the potential for a decline to 150.83, signalling a possible correction. If the USDJPY rate breaks above the range, the upward wave could continue to 155.22. Once the price reaches this level, a more substantial correction might begin, aiming for 147.47, with the initial correction target at 150.83.

Summary

The USDJPY pair conserves strength before the Bank of Japan decides on its next interest rate. Technical indicators in today’s USDJPY forecast suggest a potential corrective wave towards the 150.83 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.