USDJPY continues its ascent, reaching a three-month high

The USDJPY pair has reached a new three-month peak. The market does not rule out currency interventions from the Bank of Japan. Find out more in our analysis for 22 October 2024.

USDJPY forecast: key trading points

- The USDJPY pair has surpassed a three-month high

- The yen has weakened, increasing the likelihood of new currency interventions from the Bank of Japan

- USDJPY forecast for 22 October 2024: 151.25 and 153.20

Fundamental analysis

The USDJPY rate rose by 150.95 on Tuesday, the highest level in the last three months.

Investors believe the odds of new currency interventions from the Bank of Japan increased after the USDJPY tested the 151.00 level. However, Japan’s Deputy Chief Cabinet Secretary Kazuhiko Aoki did not comment on a news media question about currency fluctuations. Last week, one of the top currency diplomats, Atsushi Mimura, noted that the authorities are closely monitoring all market movements. He also added that excessive volatility was undesirable. These remarks can be interpreted differently, but the market typically views them as a signal of readiness to influence the situation.

Currency interventions occurred in early 2024 when the yen breached the 160.00 level.

This time, the JPY began to weaken in mid-September due to rising uncertainty about the trajectory of BoJ interest rate hikes.

The USDJPY forecast does not rule out further growth.

USDJPY technical analysis

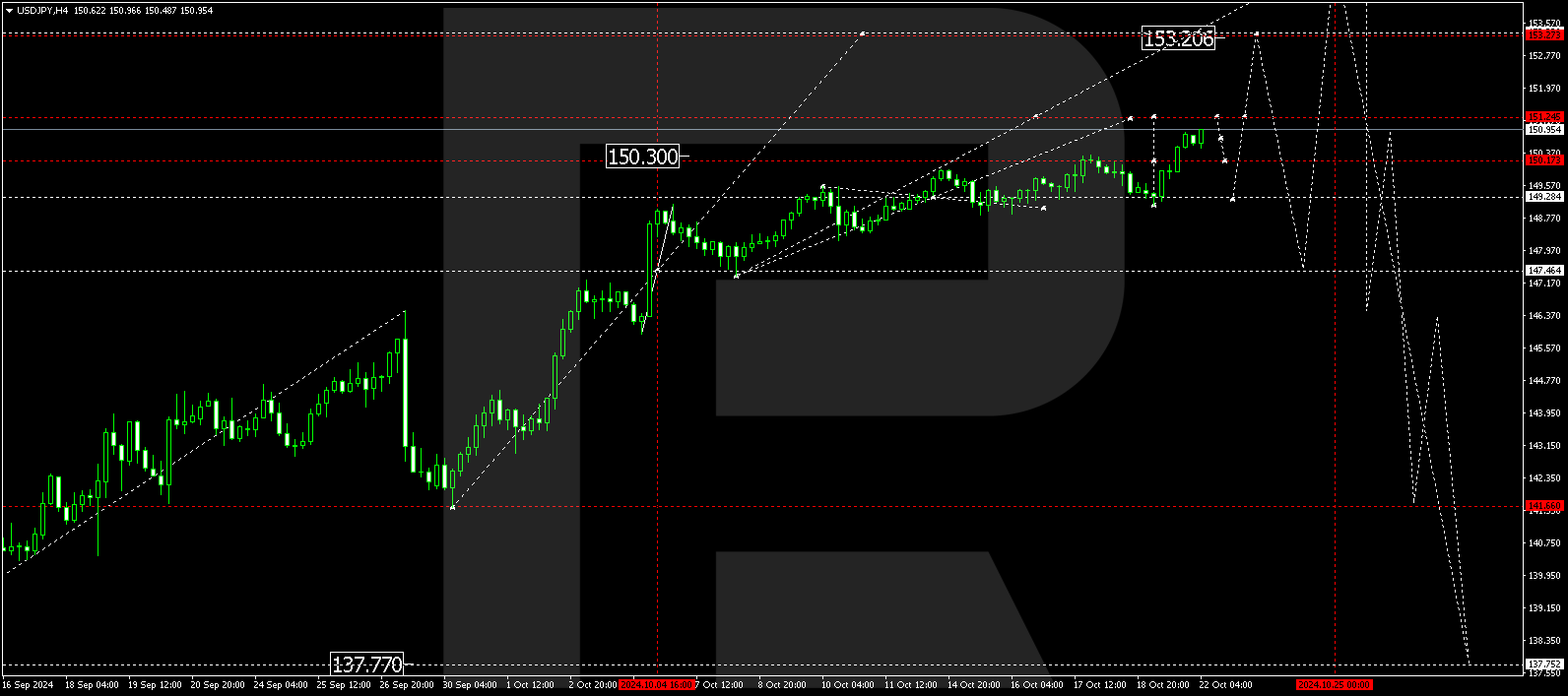

The USDJPY H4 chart shows that the market has broken above the 150.30 level and maintains its upward momentum, targeting 151.25. The price is expected to reach this target level today, 22 October 2024. Subsequently, a downward wave could develop, aiming for at least 150.30, followed by another growth wave towards the local target of 153.20. Once the price reaches this level, a more substantial correction in the USDJPY rate is possible, aiming for 149.29.

Summary

The USDJPY pair may maintain its upward trajectory. Technical indicators in today’s USDJPY forecast suggest that the upward move could continue towards 151.25 and potentially further to 153.20.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.