USDJPY: Japan’s inflation eases but remains above the BoJ’s target

The USDJPY rate is hovering around an 11-week high. Find out more in our analysis for 18 October 2024.

USDJPY forecast: key trading points

- Japan’s consumer prices rose by 2.5% year-on-year in September, the lowest level since April

- Tokyo’s core inflation index increased by 2.4% in September, remaining above the BoJ’s 2.0% target

- Japan’s top currency diplomat, Atsushi Mimura, warned against excessive yen volatility

- USDJPY forecast for 18 October 2024: 151.15

Fundamental analysis

The USDJPY rate is undergoing a correction after rising for two days. The yen remains under pressure due to easing inflation in the country, which weakens the national currency despite expectations that the BoJ will tighten its monetary policy. According to today’s USDJPY forecast, the currency pair will likely continue its upward trend.

Japan’s consumer prices rose by 2.5% year-on-year in September, down from 3.0% in August. This is the first time inflation has slowed since March and the lowest since April 2024. The core inflation index, closely monitored by the BoJ, rose by 2.4%, marking the lowest reading since April after a 2.8% increase in August. The figure has remained above the regulator’s 2.0% target for 30 months. Inflation, excluding food and energy, was 2.1% in September, up from 2.0% in August.

Bank of Japan Policy Board member Seiji Adachi recently noted that the pace of interest rate hikes should be moderate, warning against abrupt policy changes due to uncertainty in the global economy and the country’s wage growth rate. At the same time, the yen’s weakness prompted Japan’s top currency diplomat, Atsushi Mimura, to remind the Japanese government that it is closely watching foreign exchange movements and to emphasise that excessive volatility is undesirable.

USDJPY technical analysis

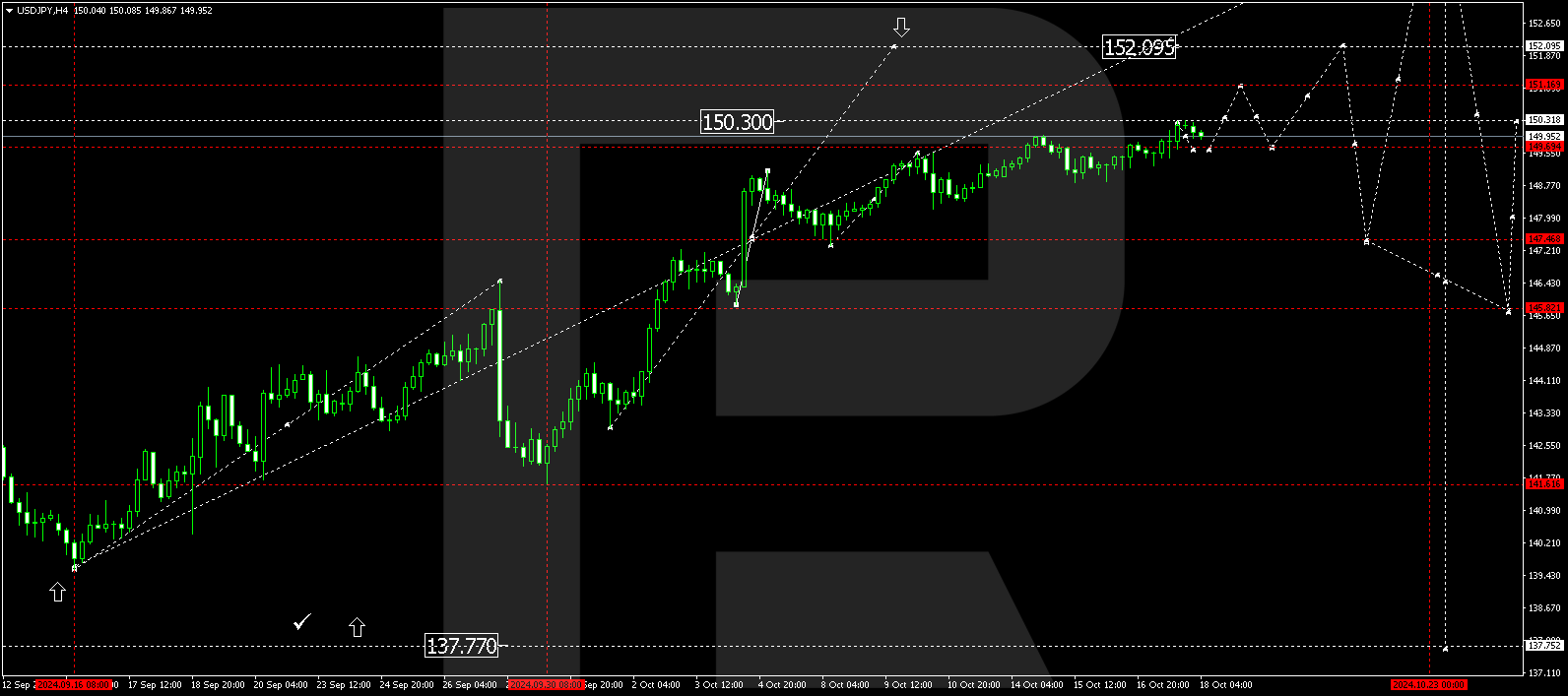

The USDJPY H4 chart shows that the market has completed a growth wave, reaching 150.30. A correction towards 149.70 (testing from above) is possible today, 18 October 2024. Subsequently, a growth wave might develop, aiming for 151.15 and potentially continuing the trend towards 152.10. After the price reaches this local target, a corrective structure in the USDJPY rate will start, targeting 147.50. The first correction target is 149.70.

Summary

Easing inflation in Japan increases pressure on the yen, creating conditions for further growth in the USDJPY pair. However, the BoJ plans to maintain a cautious approach to monetary policy changes, which may contribute to weakening the yen. Technical indicators in today’s USDJPY forecast suggest further potential for growth towards 151.15.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.