USDJPY: the pair moderately rises, aiming for 150.00

The USDJPY rate gradually strengthened on Thursday, approaching the psychologically important resistance level of 150.00. More details in our analysis for 17 October 2024.

USDJPY forecast: key trading points

- Japan’s trade balance decreased by 293.3 billion yen in September

- Japan will release inflation data on Friday, notably the National Consumer Price Index (CPI)

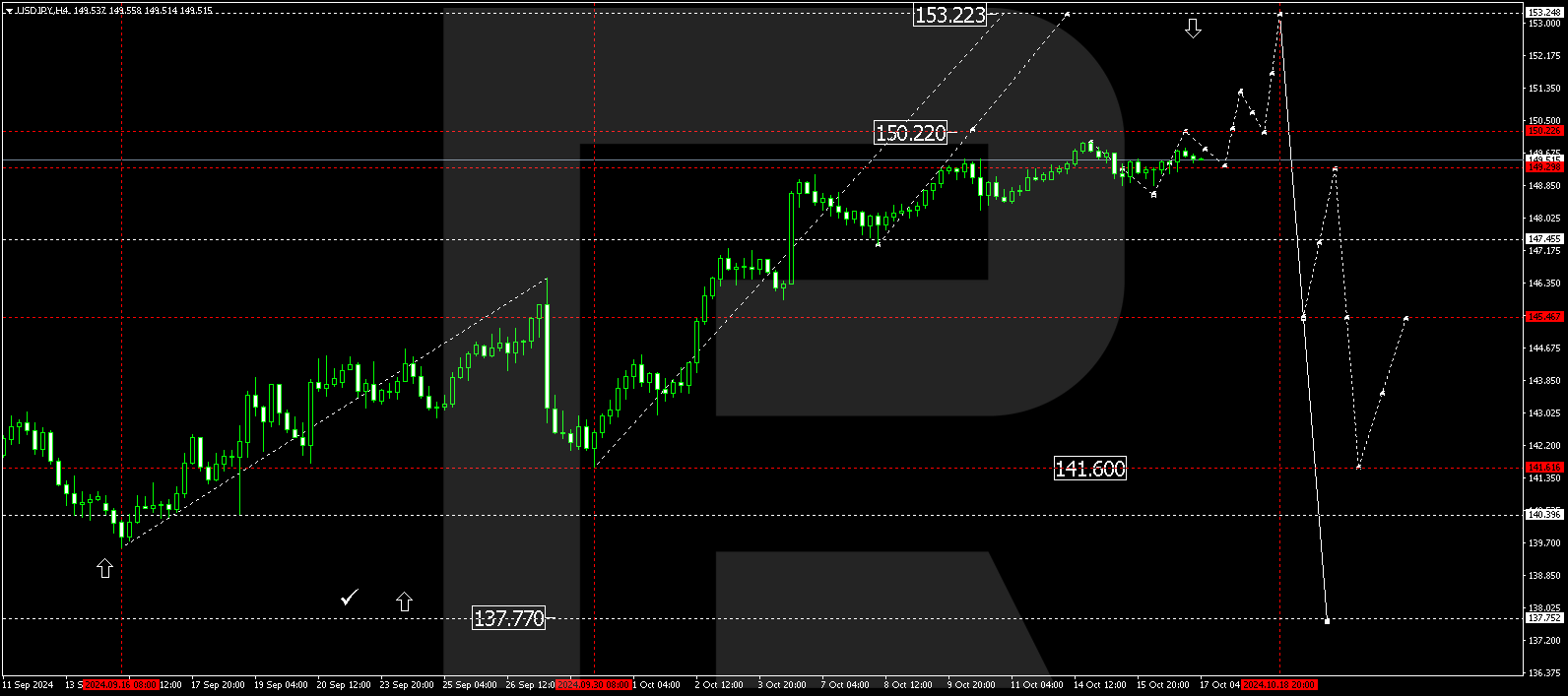

- USDJPY forecast for 17 October 2024: 150.22, 151.30, and 153.22

Fundamental analysis

The USDJPY pair gradually strengthened on Thursday, approaching the crucial resistance level at 150.00. Japan’s declining exports in September, which resulted in a trade balance decrease of 293.3 billion yen, raise concerns about weak global demand.

With Japan’s Prime Minister Shigeru Ishiba opposing further rate hikes, the negative trade balance data may complicate the Bank of Japan’s plans to exit its multi-year ultra-loose monetary policy, putting pressure on the JPY.

Additionally, the generally positive tone in global stock markets is another factor contributing to the yen’s decline against the US dollar. The USD has hovered steadily around its highest level over the past two months amid expectations that the Federal Reserve will slow the pace of interest rate cuts.

USDJPY technical analysis

The USDJPY H4 chart shows that the market continues to develop a narrow consolidation range around 149.30 with no defined trend. The range could extend down to 148.61 today, 17 October 2024. If the USDJPY rate breaks above the range, this will open the potential for a growth wave towards 150.22 and potentially further towards 151.30. With a downward breakout, the USDJPY rate could undergo a correction towards 147.50 (testing from above). Subsequently, a growth wave could follow, aiming for 151.30 and potentially continuing the trend towards 153.22, the local target.

Summary

The yen is weakening against the US dollar amid Japan’s negative trade balance data in September. Technical indicators in today’s USDJPY forecast suggest that growth could continue towards the 150.22, 151.30, and 153.22 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.