USDJPY may undergo a correction: the market remains stable

The USDJPY pair is starting to undergo a correction as the US dollar appears overvalued. Find out more in our analysis for 8 October 2024.

USDJPY forecast: key trading points

- The USDJPY pair is poised for a correction

- The yen is recovering after plunging to a seven-week low

- USDJPY forecast for 8 October 2024: 146.60, 145.88, and 144.00

Fundamental analysis

The USDJPY rate declines to 148.05 on Tuesday.

The Japanese yen had previously plummeted to a seven-week low against the US dollar. The market continued to assess the Bank of Japan’s monetary policy prospects.

The BoJ previously released a quarterly report indicating that wages and prices across Japan were rising. At the same time, it highlighted a decrease in margins for small and medium-sized businesses.

Previous statistics revealed that real wages in Japan decreased by 0.6% in August following two months of growth. Household spending fell by 1.9%, a negative signal for Japanese inflation.

The JPY has come under pressure recently following comments by new Prime Minister Shigeru Ishiba, emphasising the need for caution when easing monetary conditions.

The USDJPY forecast suggests that the yen may strengthen.

USDJPY technical analysis

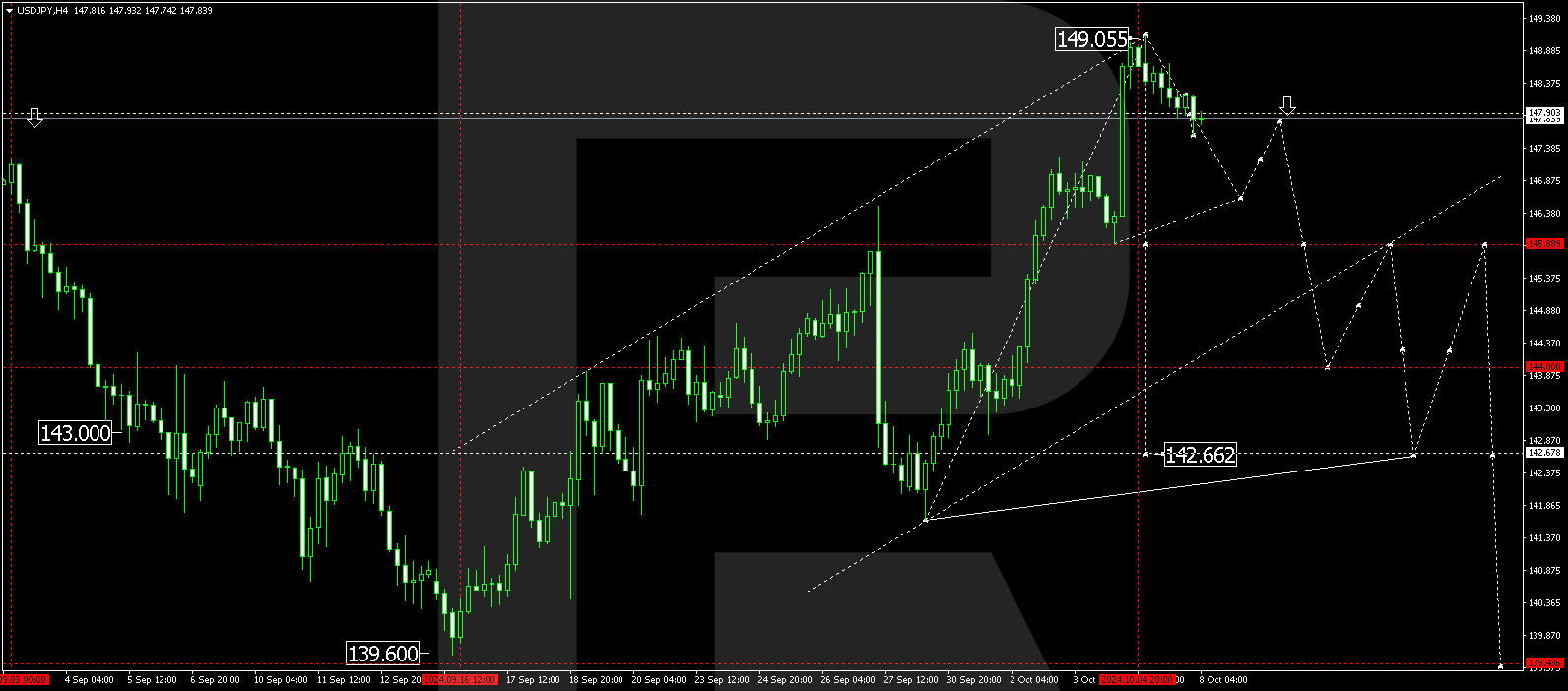

The USDJPY H4 chart shows the market forming a downward wave towards 146.60. The price is expected to reach this target level today, 8 October 2024, and then correct towards 147.90 (testing from below). Once the correction is complete, a new downward wave in the USDJPY rate could begin, targeting 145.88. A breakout below this level may signal a continuation of the trend towards 144.00, the local target.

Summary

The USDJPY pair has paused its rally, allowing the yen to stabilise. Technical indicators in today’s USDJPY forecast suggest a potential downward wave towards the 146.60, 145.88, and 144.00 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.