USDJPY rises: investors are uncertain about the Bank of Japan's position

The USDJPY pair is continuing to rise. The yen lost more than 2% last week. Read more in our analysis for 23 September 2024.

USDJPY forecast: key trading points

- USDJPY is steadily rising

- The yen is under pressure from the Bank of Japan's indecision

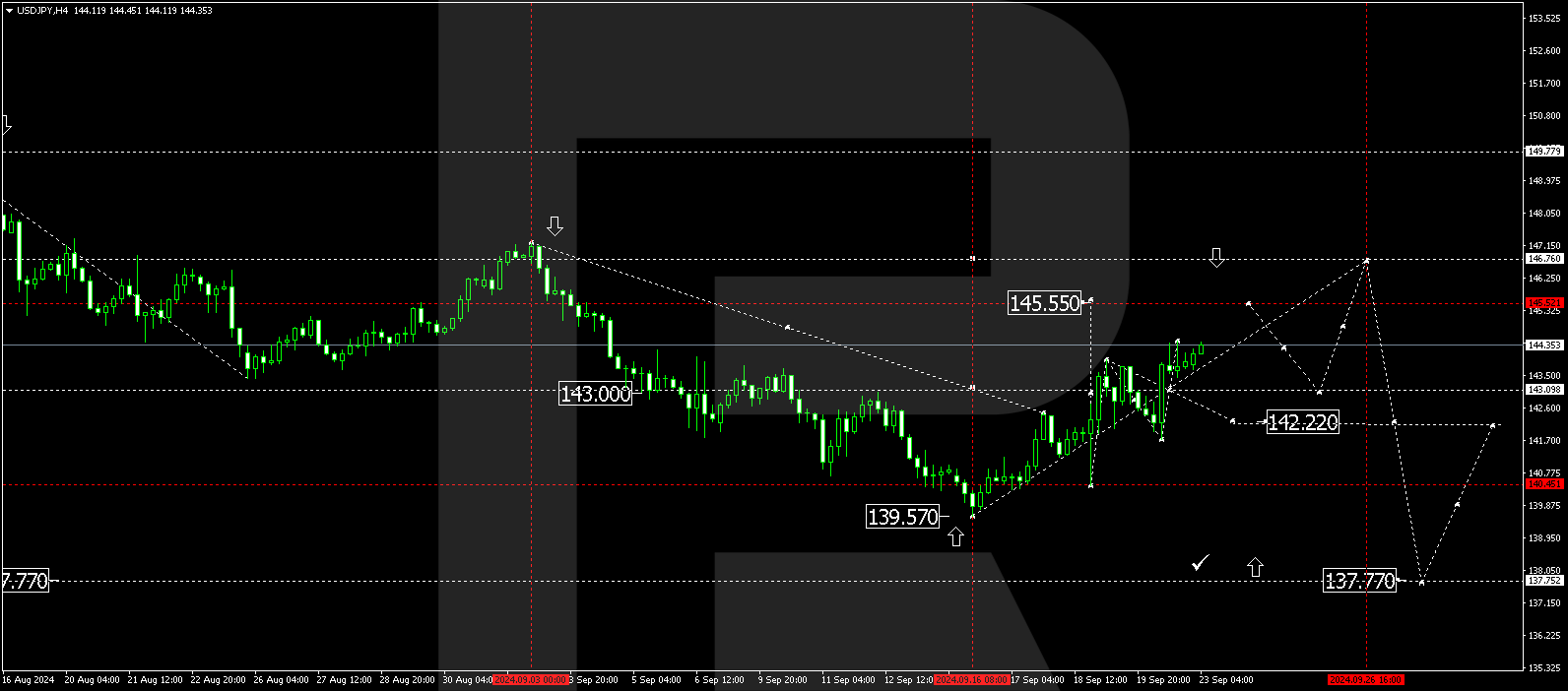

- USDJPY forecast for 23 September 2024: 145.55 and 146.76

Fundamental analysis

USDJPY rose to 144.35 on Monday.

Thus, the yen is extending last week's losses amid market confidence that the BoJ will not be too quick to raise the interest rate. An earlier BoJ meeting ended with the BoJ keeping borrowing costs unchanged at 0.25% p.a.

At the same time, BoJ Governor Kazuo Ueda acknowledged some weakness in the economy. His tone was softer than at previous meetings, undermining the prospect of a rate hike at the October meeting. That said, investors still expect to see a rate hike at the December meeting.

The yen also faced external pressure. After the US Fed reduced its rate, risk appetite increased. The forecast for USDJPY looks positive.

Today is a holiday in Japan – Autumn Equinox Day. The country's markets are closed.

USDJPY technical analysis

On the H4 chart of USDJPY, the market is forming a consolidation range around 143.00. Currently, the range is extended downwards to 141.73 and upwards to 144.44. Today, on 23 September 2024, we consider the probability of breaking the upper boundary and the USDJPY rate continuing to 145.55. This is a local target. After reaching this level, a decline in correction to the level of 143.00 (test from above) is not excluded. In the future, we expect another wave of growth to 146.76.

Summary

The USDJPY pair has returned to a strong position. The yen is suffering due to BoJ's softness and external pressure. Technical indicators for today's USDJPY forecast suggest considering the probability of continuing the growth wave to the 145.55 and 146.76 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.