USDJPY forecast: Japanese yen regains strength

The USDJPY rate has seen significant movement as the Japanese yen strengthens due to critical economic factors. The yen experienced a boost following the Bank of Japan’s decision to keep interest rates unchanged. This article provides a comprehensive analysis, focusing on the USDJPY forecast, key signals, and the market outlook for 20 September 2024.

USDJPY forecast: key trading points

- Japan’s CPI data: previous reading: -0.2%, actual reading: 0.5%

- The Bank of Japan interest rate decision: previous and actual: 0.25%

- Patrick T. Harker FOMC speech: with the Federal Reserve’s monetary policy outlook being a crucial driver for the USDJPY, traders will look to signals from Harker’s speech for insights into the future direction of US interest rates

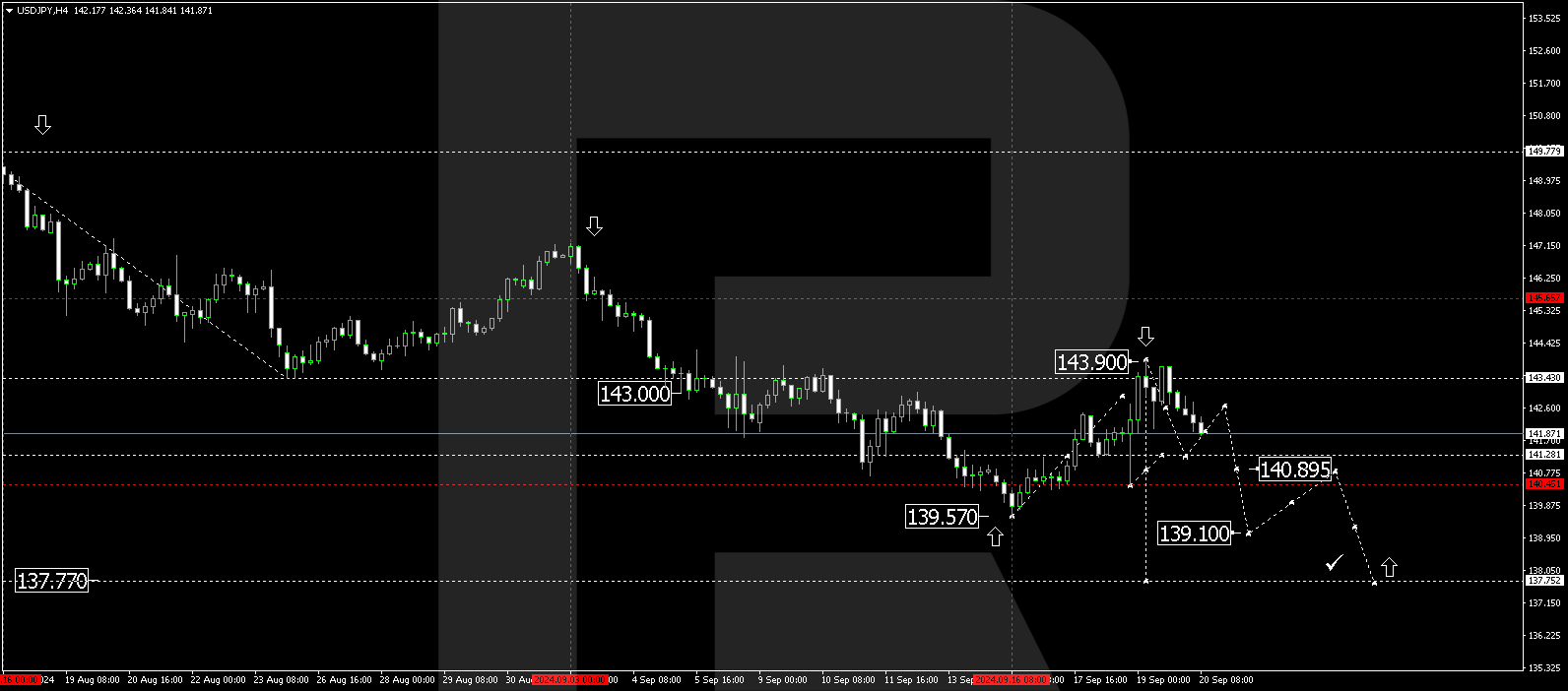

- USDJPY forecast for 20 September 2024: 141.30, 139.10, and 137.77, suggesting the yen may continue its bullish momentum

Fundamental analysis

The Consumer Price Index (CPI) is crucial in evaluating currency performance. Japan’s recent CPI report for 20 September 2024 showed a significant increase from -0.2% to 0.5%. This upward movement in inflation reflects growing economic pressures, strengthening the yen, and weakening the USDJPY. When CPI rises, it often leads to higher interest rates, which supports the yen.

The Bank of Japan left its interest rate unchanged at 0.25%. The BoJ Interest Rate Decision is made eight times a year. This rate directly influences the yen’s exchange rate as part of its monetary policy management. By stabilising the rate, the BoJ signals a steady economic environment, which has bolstered the yen.

The US Federal Open Market Committee (FOMC) also significantly shapes the USDJPY’s trajectory. Today’s speech from FOMC Member Patrick Harker could provide clues on US monetary policy, possibly impacting USDJPY prediction trends. Any indication of future rate hikes could support the dollar, while dovish commentary may pressure the pair.

USDJPY technical analysis

On the H4 chart, USDJPY is showing signs of consolidation around 142.55. Continuing the current bearish trend could bring the price down to 141.28 before testing 142.55 from below. Should the price break below 141.00, it could indicate a more profound decline, with potential targets at 139.10 and 137.77. This technical setup offers clear signals for traders, supporting the outlook for further yen strength and a USDJPY decline.

Summary

Based on the combination of technical and fundamental factors, today’s USDJPY forecast suggests a high probability of further downside movement. Traders should watch for a potential break below 141.00, which could signal a decline toward the key levels of 139.10 and 137.77.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.