USDJPY remains flat: the market is awaiting signals

The USDJPY pair has halted its rise and is consolidating. Investors have a busy week ahead. Find out more in our analysis for 10 September 2024.

USDJPY forecast: key trading points

- The USDJPY halted its ascent

- The market is still betting on a decisive monetary policy tightening by the Bank of Japan

- USDJPY forecast for 10 September 2024: 139.70

Fundamental analysis

The USDJPY rate is hovering around 143.25 on Tuesday. Last week’s gains for the yen appear to be offset, with the US dollar regaining ground ahead of the release of crucial inflation statistics this week.

The JPY rate rose by more than 3.00% over the past week, with the USDJPY pair falling to annual lows. This became possible due to expectations of future decisive steps by the Bank of Japan. In making a decision to raise interest rates before the end of the year, the BoJ could be supported by the continued growth of wages in the country and persistent inflationary pressure.

It became known a little earlier that the Japanese economic growth rate slowed in Q2. The country’s GDP grew by 2.90% year-over-year, falling short of the preliminary estimate of 3.10%. The USDJPY forecast is still neutral.

USDJPY technical analysis

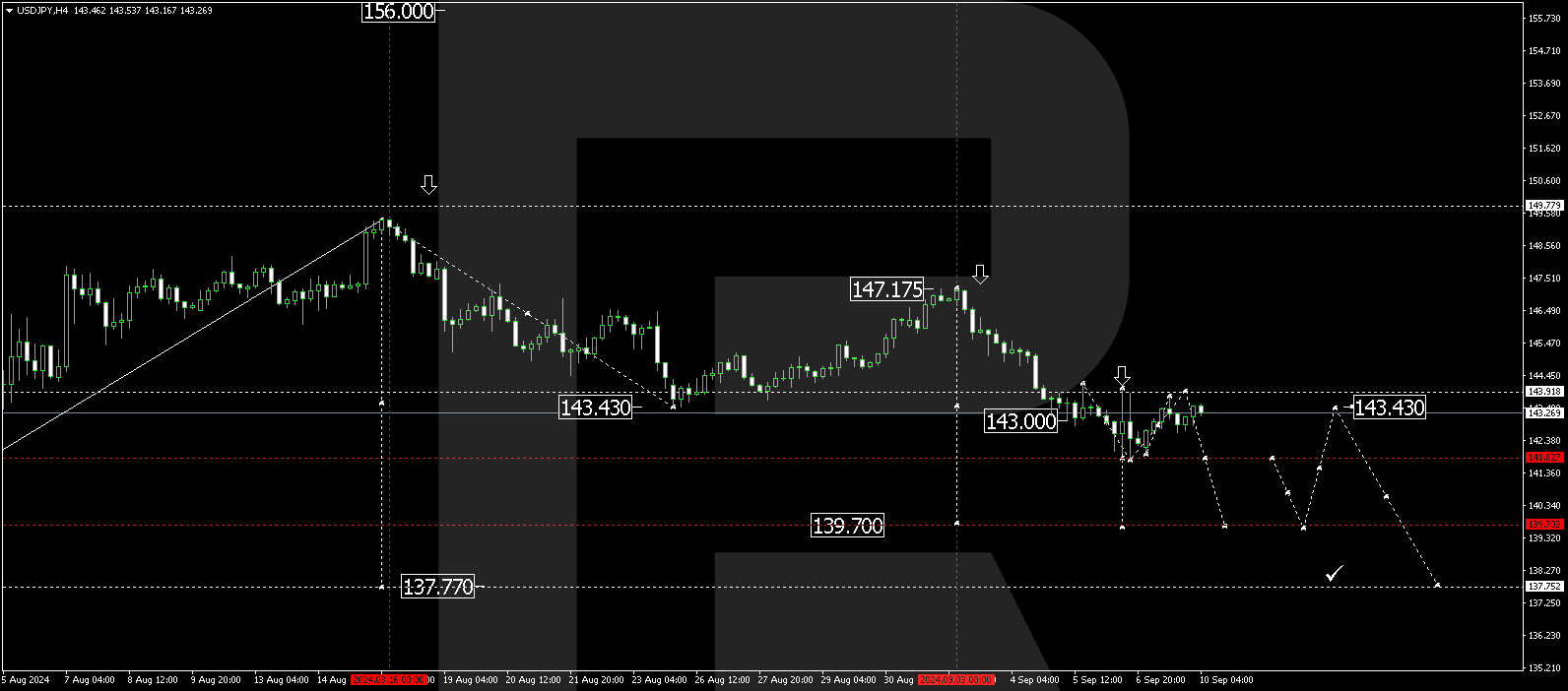

On the USDJPY H4 chart, the market continues to develop a consolidation range around 143.00. The price could rise to 143.90 (testing from below) today, 10 September 2024. Subsequently, it might break below the lower boundary of the range. A breakout below the 141.80 level may signal a further decline in the USDJPY rate to the local target of 139.70. After reaching this level, the price could correct to 143.40 (testing from below). Subsequently, a downward wave is expected to develop, aiming for 137.77.

Summary

The USDJPY pair halted its rise as the market took a pause. The current developments do not affect the yen’s strong position. Technical indicators in today’s USDJPY forecast suggest a potential decline to 139.70.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.