USDJPY: the yen continues to strengthen in anticipation of an interest rate decision

With Japan’s Q2 GDP slightly rising and consumer spending moving into positive territory, all fundamental data supports the Japanese yen. Find out more in our analysis for 9 September 2024.

USDJPY forecast: key trading points

- Japan’s Q2 GDP: previously at -0.6%, currently at 0.7%

- Japan’s GDP deflator (y/y): previously at 3.4%, currently at 3.1%

- Japan’s Q2 consumer spending: previously at -0.6%, currently at 0.9%

- USDJPY forecast for 9 September 2024:139.70

Fundamental analysis

GDP is the aggregate value of all goods and services produced in a country over a particular period. Only end products are considered, excluding the raw materials used.

The previous reading was below zero, at -0.6%, while the current Q2 reading is 0.7%. Although the figure was 0.1% lower than forecasted, it still supported the Japanese yen.

Japan’s GDP deflator, published by the Japanese Cabinet, reflects price movements for end goods and services. This indicator is a crucial gauge of inflation trends, which makes it significant in forecasting future monetary policy. A stronger-than-expected reading is considered a positive signal for the JPY rate, while a weaker-than-expected value is a negative factor. The Q2 figure was 0.1% higher than forecasted; data below the previous reading (but combined with other fundamental data) may help strengthen the yen.

Japan’s consumer spending reflects Japanese households’ spending on goods and services, including food, transport, housing, education, healthcare, and entertainment. The indicator is one of the country’s significant GDP components, reflecting the population’s economic activity.

High consumer spending typically indicates economic growth as it shows consumer confidence in their financial position and market stability. Low spending may signal an economic downturn and uncertainty. Consumer spending was projected to reach 1.0% but came in at 0.9%. The change was not critical and did not significantly affect the pair, as the USDJPY analysis shows.

Expectations of changes in the Federal Reserve and the Bank of Japan interest rates continue to influence the USDJPY forecast.

USDJPY technical analysis

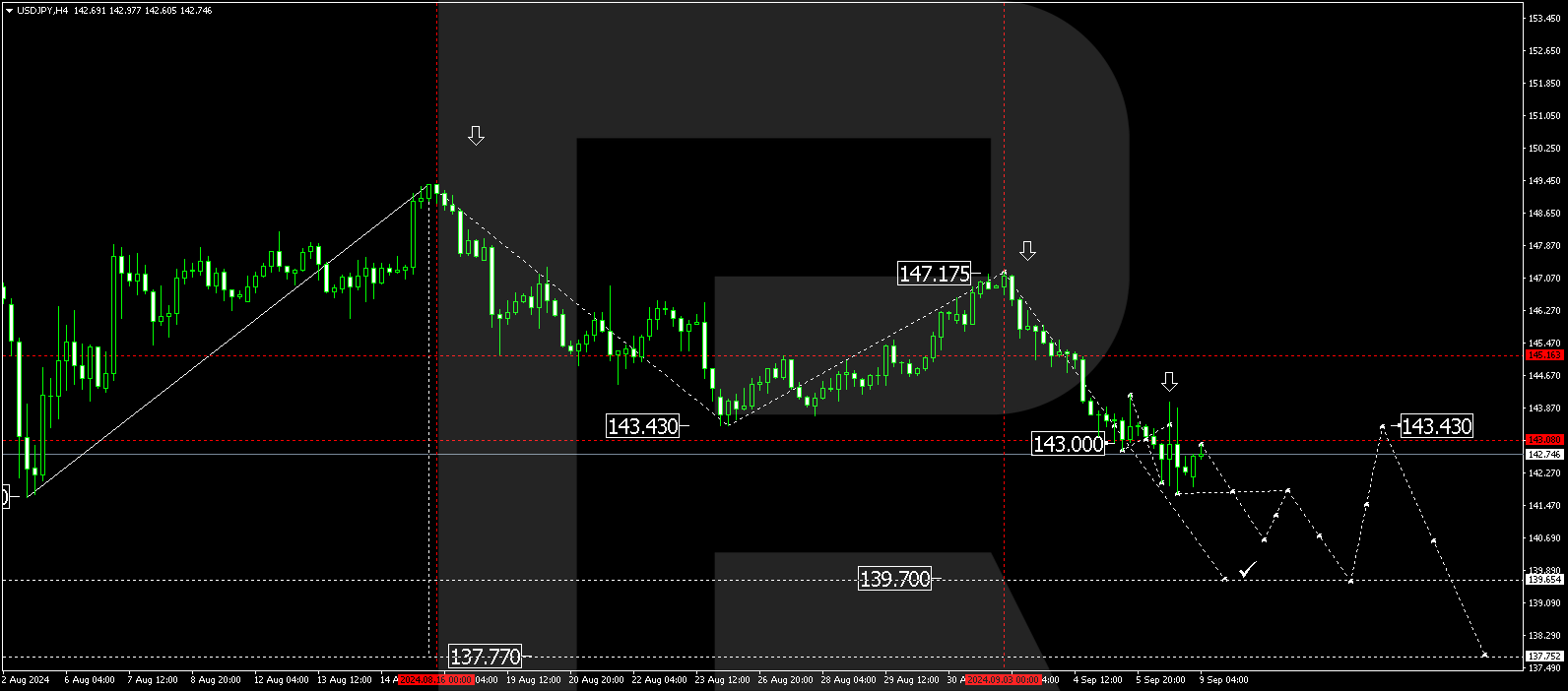

The USDJPY H4 chart shows that the market is forming a consolidation range around 143.00 without a clear trend. The range was extended up to 144.00 and down to 141.76. The price could rise to 143.00 (testing from below) today, 9 September 2024, before potentially breaking below the lower boundary of the range. A breakout below the 141.76 level may signal further movement towards the local target of 139.70. After reaching this level, the price could correct towards 143.40 (testing from below). Subsequently, the USDJPY rate is expected to decline to 137.77.

Summary

An increase in Japan’s fundamental indicators and the USDJPY technical analysis in today’s USDJPY forecast suggest a potential decline in the pair to the 139.70 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.