USDJPY heads down: demand for the yen has risen significantly

The USDJPY pair is losing ground. The market favours the yen as a safe-haven asset. Discover more in our analysis for 5 September 2024.

USDJPY forecast: key trading points

- The USDJPY pair fell to a two-month low

- Japan’s robust domestic statistics and weak US reports are supporting the yen

- USDJPY forecast for 5 September 2024: 141.46

Fundamental analysis

The USDJPY rate halted its decline near the 143.69 level.

The pair is hovering near a two-month low after an active two-day sell-off. The yen’s strength is now based on the latest statistics from Japan. Data showed that real wages in the country rose in July for the second consecutive month, adding 0.4% y/y. Overall cash earnings increased by 3.6%.

This aligns with the Bank of Japan’s forecast for moderate economic growth rates. Additionally, such data supports expectations of wage increases, which will lead to higher overall inflation.

In addition to domestic statistics, the yen benefitted from growing market demand for safe-haven assets following the release of relatively weak US statistics. The figures reminded investors of a potential recession in the US economy, which boosted demand for safe-haven assets. The USDJPY forecast suggests local growth in the yen.

USDJPY technical analysis

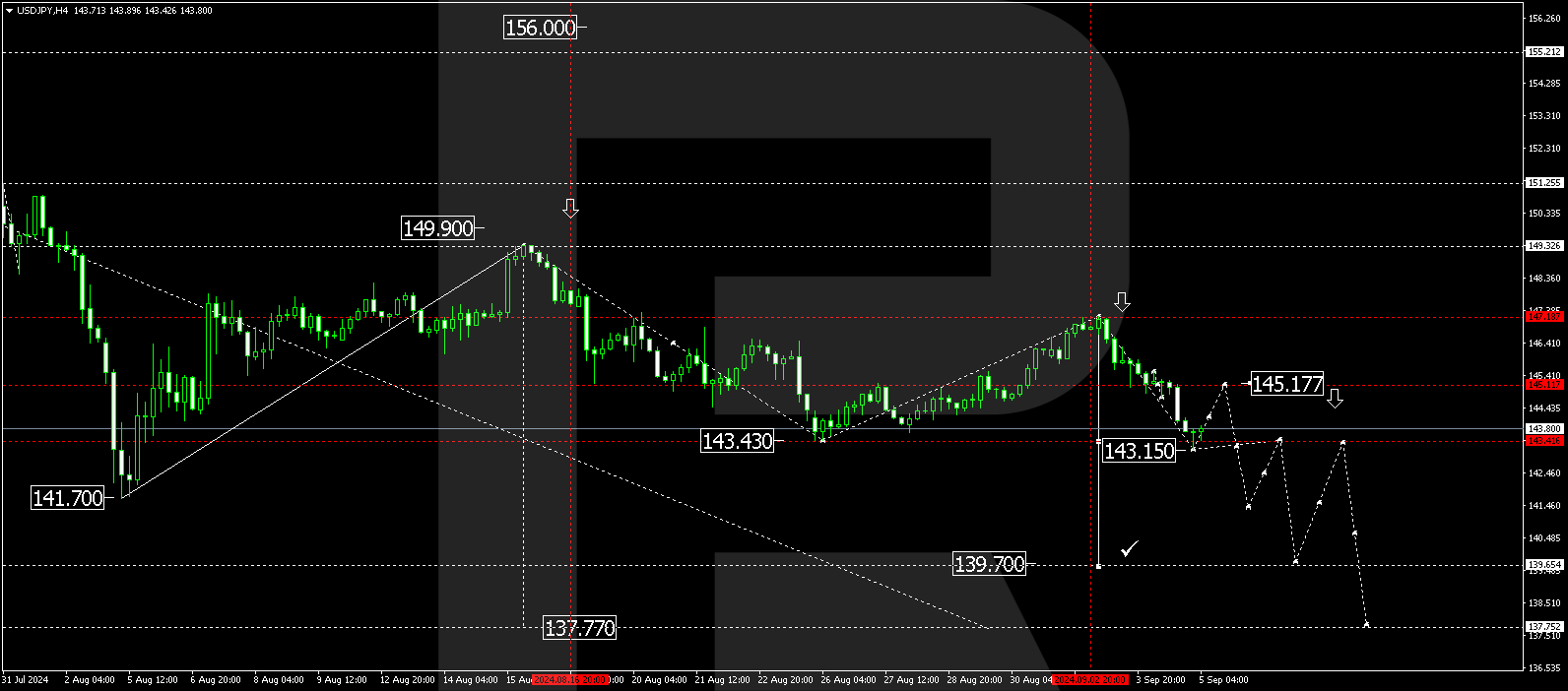

The USDJPY H4 chart shows that the market has formed a consolidation range around 145.17 and, after breaking below it, reached the downward wave’s target of 143.15. A correction towards 145.17 (testing from below) could develop today, 5 September 2024. Once the correction is complete, the USDJPY rate will decline to 143.10. A breakout below this level may signal a further movement towards 141.46, potentially continuing to the local target of 139.70.

Summary

The USDJPY pair dipped near two-month lows, with the yen’s strength supported by pro-inflation statistics. Technical indicators in today’s USDJPY forecast suggest a decline to 141.46.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.